Can Ethereum (ETH) Still Deliver a 20x to 50x Move, or Is That Era Gone?

Ethereum price currently trades around $3,000, giving ETH a market cap close to $356 billion. That size alone causes many observers to assume the days of massive upside are already behind it. Large assets, the thinking goes, simply do not move like small ones anymore. Still, one analyst is challenging that assumption with a framework that focuses less on hype and more on structural demand that could build over time.

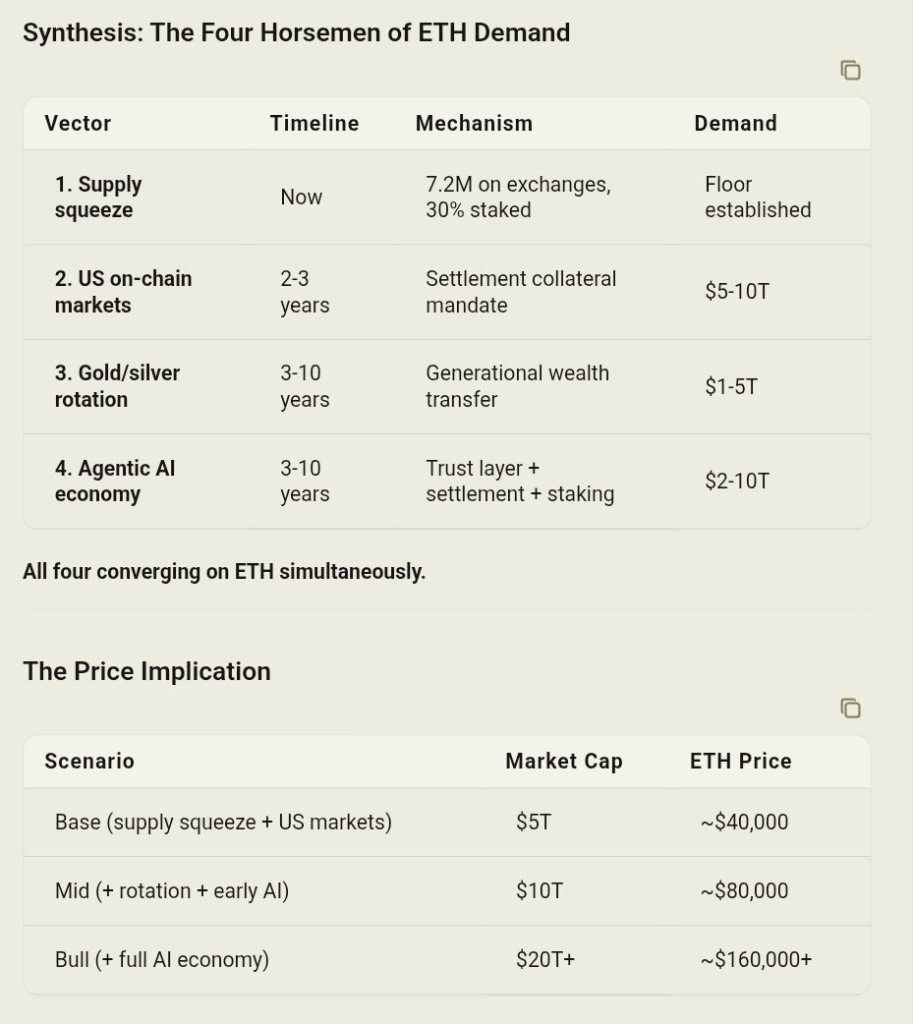

Nomad, @JourneyMacro on X, lays out a case that does not rely on short term excitement. His view centers on how ETH demand could grow from multiple directions at once, creating pressure that compounds rather than fades. The argument starts with supply and then moves into regulation, capital rotation, and even artificial intelligence driven activity.

Ethereum Supply Conditions Are Quietly Tightening Around ETH Price

Ethereum supply sits in a very different place compared to past cycles. Roughly 30 percent of ETH is staked, while only about 7.2 million ETH remain on exchanges. That combination matters because staked ETH is effectively removed from active circulation, while low exchange balances reduce immediate sell pressure.

This setup does not guarantee upside, though it creates a floor effect that limits how much ETH price can drift without new supply coming online. Nomad views this as the foundation of the entire thesis, because strong demand rarely leads anywhere if supply stays loose. From this base alone, the framework points toward ETH eventually sustaining higher valuation levels rather than collapsing back into deep drawdowns.

@JourneyMacro / X

@JourneyMacro / X

US On Chain Markets Could Redefine Ethereum Role In Finance

The next layer in the thesis focuses on regulation and infrastructure. Nomad argues that the SEC and White House are gradually steering US financial markets toward on-chain settlement over the next 2 to 3 years. That shift would require neutral collateral that can operate across decentralized systems.

Ethereum fits that role in his view. ETH functions across Layer 1 and Layer 2 networks, making it usable as settlement collateral for tokenized assets. If US markets move on chain at scale, ETH demand could reach $5 trillion to $10 trillion in value. From the current $3,000 level, a $40,000 ETH price represents roughly a 13x move and aligns with this base case scenario.

Gold And Silver Rotation Could Push Ethereum Price Higher

Beyond regulation, the framework looks at long term capital behavior. Nomad highlights a potential rotation from gold and silver into digital assets as generational wealth changes hands. This shift would not happen overnight, though it could unfold across 3 to 10 years.

Even partial rotation could matter. Estimates in the framework suggest $1 trillion to $5 trillion could migrate toward ETH over time. At the upper end, Ethereum price could approach $80,000, representing about a 26x increase from today’s $3,000 level. This mid scenario builds directly on the base case rather than replacing it.

Agentic AI Activity Could Create A New ETH Demand Layer

The most forward looking element of the analysis involves agentic AI systems executing transactions autonomously. These systems require trust, settlement, and reliability, areas where Ethereum already operates at scale. Nomad describes ETH as the trust layer for this emerging activity.

Read Also: Silver Price Hits $120 While Gold Reaches $5,600 in Historic Dual Rally – What’s Behind the Pump?

If AI driven economic activity grows into a multi trillion dollar market, ETH staking and settlement demand could increase sharply. Under a full adoption scenario, ETH market cap could exceed $20 trillion. That outcome places Ethereum price above $160,000, which equals more than a 53x move from current levels.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Can Ethereum (ETH) Still Deliver a 20x to 50x Move, or Is That Era Gone? appeared first on CaptainAltcoin.

You May Also Like

Where is the Bottom for Bitcoin?

Mysterious whales are accumulating these cryptocurrencies after market crash