Can Pi Network (PI) Crash to $0 in 2026? 4 AI Predictions Raise Serious Concerns

Pi Network’s native token recently plummeted to a new all-time low below $0.17, a decline of almost 95% from its historical peak of $3 registered approximately one year ago.

Amid persistent bearish conditions, some market participants may now fear that the valuation could literally hit $0 sometime this year. We asked four of the most popular AI-powered chatbots whether such a scenario is in the cards.

The Risk is Real

According to ChatGPT, PI could theoretically crash to $0 sometime this year, citing strong selling pressure, weak fundamentals (for now), poor market conditions, and investor loss of confidence as the main hurdles.

However, it noted that such a catastrophic scenario can only occur if exchanges delist en masse the asset and the trust in the project collapses completely. In the aftermath, ChatGPT claimed the chances of a plunge to $0 before the end of 2026 are less than 20%.

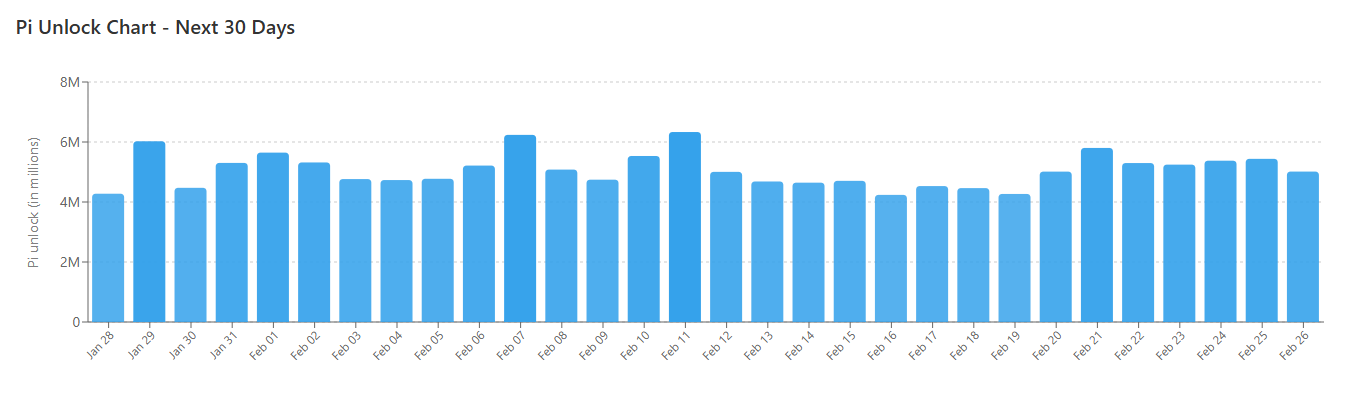

Grok – the AI integrated within the social media X – estimated that the chance of such a slump is around 5%-10%. It warned that the constant token unlocks remain a significant obstacle that could further increase selling pressure. Data shows that over 150 million coins are scheduled for release in the next 30 days, meaning the average daily unlock is about 5 million.

PI Token Unlocks, Source: piscan.io

PI Token Unlocks, Source: piscan.io

More Bullish Theories

Google’s Gemini argued that such a crash is possible, although extremely rare for a project with millions of users. “PI is unlikely to hit literally $0.00 as long as there is one person willing ot buy, but it is currently in a ‘make or break’ year,” it stated.

For its part, Perplexity noted that the asset’s Relative Strength Index (RSI) has fallen to oversold levels, suggesting it could be gearing up for a resurgence. The technical indicator measures the speed and magnitude of recent price changes and provides traders with a possible idea where the next pivotal moment might occur. It ranges from 0 to 100, and ratios below 30 hint that the coin is oversold and due for a rebound. Currently, the RSI stands at around 23.

PI RSI, Source: TradingView

PI RSI, Source: TradingView

The post Can Pi Network (PI) Crash to $0 in 2026? 4 AI Predictions Raise Serious Concerns appeared first on CryptoPotato.

You May Also Like

YZi Labs Binance Deposit: A $6.63M Signal That Could Shake the ID Token Market

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more