Crypto Market Dips Below $3 Trillion: Is It a Buy-the-Dip Opportunity?

The broader cryptocurrency market is facing renewed selling pressure, with total market capitalization falling below $3 trillion.

The rise in the Japanese yen has reignited fears of a yen carry trade unwind, pushing risk-on assets like cryptocurrencies lower while safe-haven assets such as gold and silver rally.

On-chain data, however, suggests the crypto market may be undervalued.

Crypto Market Undervaluation Signals Appear

In the last 24 hours, the crypto market has faced additional selling pressure, losing the $3 trillion support levels.

As per Coinglass data, the liquidations have topped over $670 million, with over 85% share of long liquidations.

Blockchain analytics firm Santiment showed that the 30-day Market Value to Realized Value (MVRV) metric highlights a more favourable risk profile.

A negative 30-day MVRV suggests the average trader is currently holding at a loss, which can create potential entry opportunities as profits remain below typical “zero-sum” equilibrium levels.

A positive 30-day MVRV indicates that traders are in profit, increasing the likelihood of profit-taking.

According to Santiment, the 30-day MVRV for major altcoins such as Ethereum ETH $2 893 24h volatility: 1.6% Market cap: $349.36 B Vol. 24h: $33.06 B , XRP XRP $1.89 24h volatility: 1.1% Market cap: $114.82 B Vol. 24h: $3.32 B , Chainlink LINK $11.80 24h volatility: 2.5% Market cap: $8.36 B Vol. 24h: $493.85 M , and Cardano ADA $0.35 24h volatility: 3.3% Market cap: $12.76 B Vol. 24h: $569.29 M currently sits in negative territory, ranging from -5% to -10%.

Data from 10x Research shows that Bitcoin’s BTC $87 772 24h volatility: 0.7% Market cap: $1.75 T Vol. 24h: $53.30 B daily stochastic indicators are at very low levels of 15-16%, suggesting that the asset is currently in extremely oversold territory.

Despite the oversold reading, Bitcoin has been trending lower since reaching peaks above $125,000 in mid-2025, with the white price line (left-hand scale) showing a consistent downward bias over recent months.

Is a Gold-to-Bitcoin Shift on the Horizon?

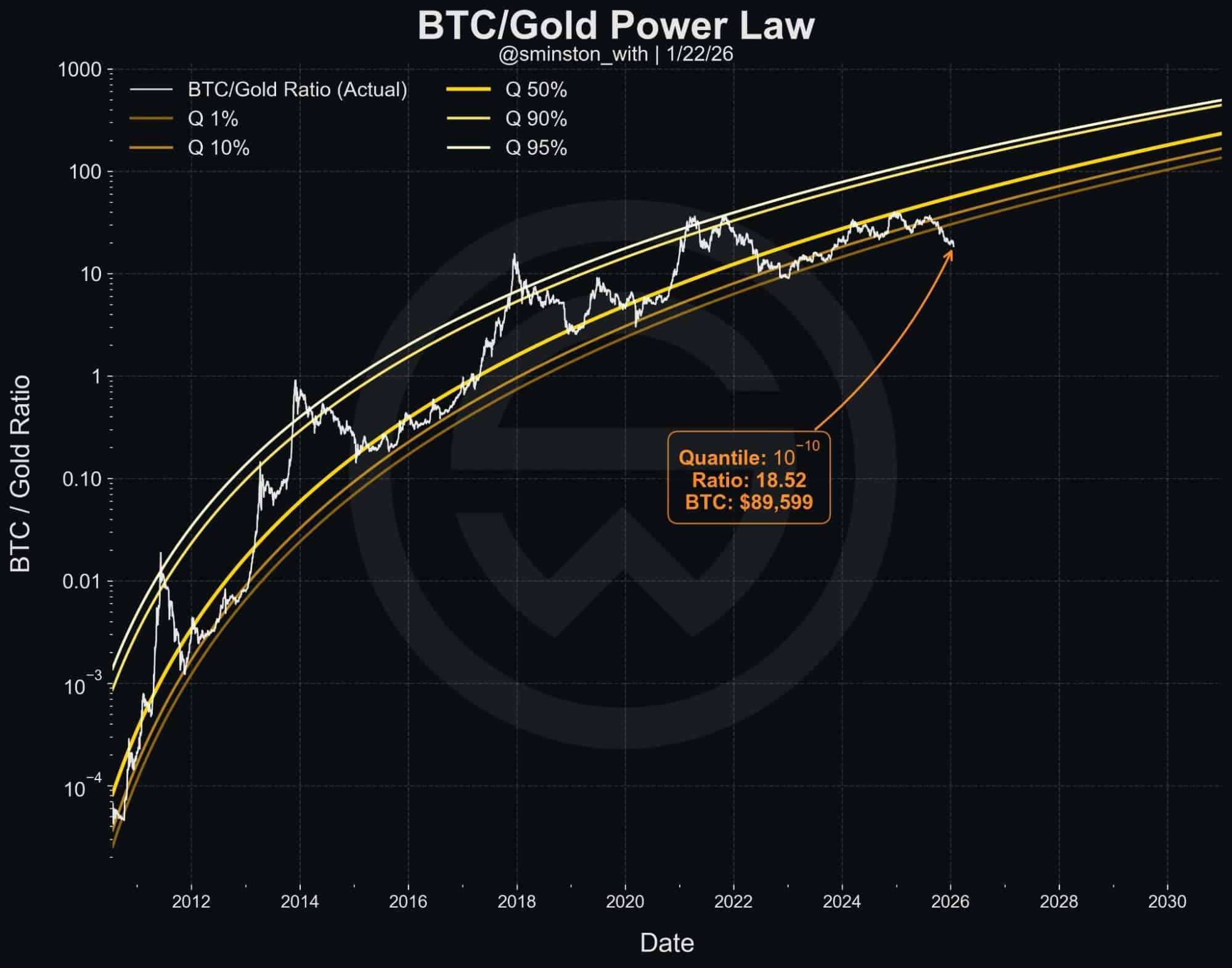

Market analysts said a potential rotation from gold into Bitcoin is becoming increasingly likely, citing a major drop in the BTC-to-gold ratio.

According to the image below, the BTC/gold ratio is displaying a rare historical outlier, which suggests a major imbalance between the two assets.

Bitcoin-to-Gold ratio. | Source: CryptosRus

Earlier today, gold prices rose above $5,000 for the first time amid ongoing macroeconomic uncertainty.

Analysts expect that for the BTC-to-gold ratio to return to equilibrium, capital will need to rotate from gold into Bitcoin.

nextThe post Crypto Market Dips Below $3 Trillion: Is It a Buy-the-Dip Opportunity? appeared first on Coinspeaker.

You May Also Like

Where is the Bottom for Bitcoin?

Mysterious whales are accumulating these cryptocurrencies after market crash