Here’s the Real Reason River (RIVER) Price Surged 208%

River (RIVER) has delivered one of the most aggressive moves in the market this week. The token is up 208% over the last seven days and is trading near $77 after adding another 33% today alone.

At writing, RIVER is the top gainer across major trackers, with trading volume rising by nearly 10% as attention shifts rapidly toward the project.

This kind of move does not happen without clear catalysts, and in River’s case, both fundamentals and market structure played a role.

The River price rally began after Justin Sun invested $8 million into the project on January 23, with plans to integrate River into the TRON ecosystem through the satUSD stablecoin.

Read Also: Hedera Is Already Where U.S. Crypto Policy Is Heading – Here’s Why

This was more than just a headline move. It placed River inside one of the largest liquidity networks in crypto, with TRON holding over $83 billion in USDT. That connection quickly changed how traders viewed River’s long-term role in cross-chain infrastructure.

The effect was immediate. Capital flowed in rapidly, turning what might have been a slow buildup into a sharp price move. River now reports more than $800 million in total value locked and over 150,000 users, which helped support the sudden rise in interest and price strength seen on the chart.

At the same time, new exchange listings and leverage options pushed demand even further. RIVER listed on Coinone with a KRW pair and shortly after on Lighter with leverage, bringing in South Korean retail traders and short-term speculators.

As volume passed $100 million and short positions were squeezed near $59, the move accelerated. CoinEx later added margin and futures trading, giving traders even more ways to amplify positions and keep volatility high.

Read Also: Ondo Is Becoming the On-Ramp for Wall Street’s Tokenization Push

What the RIVER Chart is Showing

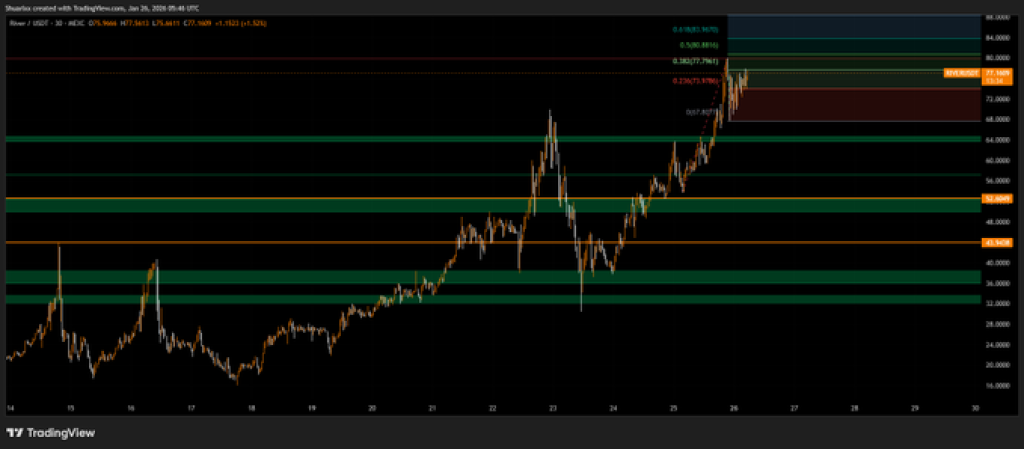

The chart reflects a classic breakout followed by continuation. After clearing the $50 zone, the River price moved rapidly through $60 and $70 with very little resistance.

The move peaked near $80 before pulling back slightly toward the current $77 level. Importantly, this pullback has so far remained shallow and controlled.

There are no signs of a structural breakdown at this stage. Instead, the RIVER price is consolidating near highs, which often suggests strength rather than exhaustion, at least in the short term.

Key levels to watch now are $72–$74 as near-term support and $80 as immediate resistance. A clean break above $80 would put $90 and $100 back into focus.

Source: X/Shuarix

Source: X/Shuarix

Why Traders Might Still Be Confident in RIVER

Crypto trader Shuarix summed up the current mood clearly. After the RIVER price pulled back from $80 to around $77, he noted that “nothing happened” and that conviction simply paid off.

In his view, the move toward $100 is still in play, especially while the rest of the market remains weak and River continues to build.

This relative strength matters. While many altcoins struggle to hold key levels, the RIVER price is doing the opposite by consolidating near highs. That kind of behavior often keeps traders engaged even after a large move.

Read Also: Why Chainlink’s CCIP Is Turning LINK Into a Financial Infrastructure Play

What comes next for RIVER

In the short term, RIVER remains driven by momentum and market structure rather than valuation models. As long as price holds above the $72–$74 zone, the path of least resistance remains higher.

A break above $80 would likely trigger another round of aggressive trading, with $90 and $100 acting as the next major psychological levels. On the downside, a loss of $72 would be the first sign that the rally is losing steam and that a deeper correction may follow for RIVER price.

For now, River’s 208% surge is not just the result of hype. It is the product of strategic capital, rising liquidity, and a market structure that turned bullish at exactly the right moment.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Here’s the Real Reason River (RIVER) Price Surged 208% appeared first on CaptainAltcoin.

You May Also Like

The Arweave network has not produced a block for over 24 hours.

HOT MOMENTS: FOMC Statement Released Following the Fed Interest Rate Decision – Here Are All the Details of the Full Text