Silver Price Already Took Off – Now Copper Is Flashing Supercycle Signals

Silver has already made its move.

After months of tight supply, rising industrial demand, and growing pressure in the physical market, silver pushed into triple-digit territory and forced many investors to rethink how scarce industrial metals really are. That move was not driven by hype. It came from real shortages, forced buying from manufacturers, and investors returning to hard assets.

Now attention is starting to shift toward another metal that shares many of those same traits, but on an even bigger scale: copper.

Analyst Lukas Ekwueme believes copper is about to enter a supercycle, and when you look at both history and current conditions, the argument becomes hard to ignore.

Why Copper Matters More Than Ever

Copper is not just another commodity. It is one of the few materials that sit at the center of almost every industrial system.

Power grids, electric vehicles, data centers, solar panels, wind turbines, housing, electronics, and now AI infrastructure all depend on copper. There is no easy substitute at scale. When copper becomes scarce, entire industries feel it.

That is what makes copper different from many other raw materials. Demand does not fade easily when prices rise. It simply shifts the cost further down the supply chain.

This is already something silver traders have seen play out. Now similar dynamics are forming in copper.

What History Says About Copper Cycles

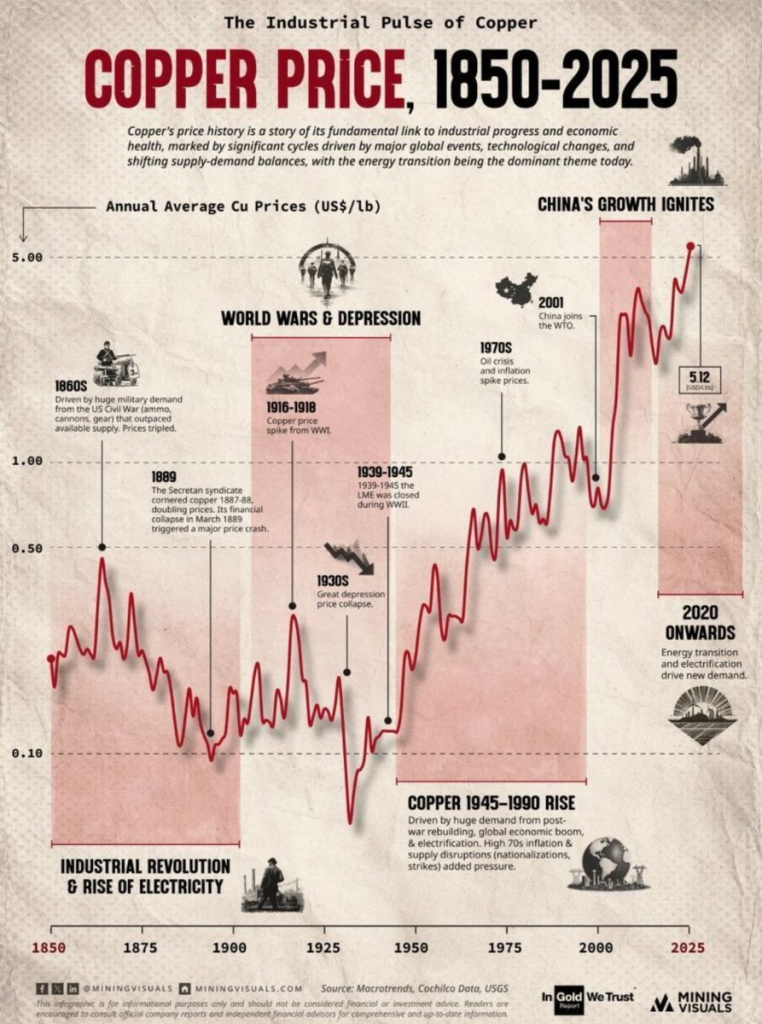

The image shared alongside Lukas Ekwueme’s post tracks copper prices from 1850 to today. It shows a clear pattern.

Copper prices tend to rise during three types of periods:

First, during major waves of industrialization and electrification.

Second, during wars or severe supply disruptions.

Third, during post-war rebuilding phases.

Source: X/@ekwufinance

Source: X/@ekwufinance

Those are moments when societies need massive amounts of physical infrastructure built quickly, and copper becomes a bottleneck.

Looking back, copper surged during the Industrial Revolution, spiked around both World Wars, rose again during post-war reconstruction, and then entered another long rally as China’s growth ignited global demand in the early 2000s.

Each cycle was tied to structural shifts in how economies functioned.

Why Today Resembles Every Past Copper Boom at Once

Ekwueme’s main point is that today’s world reflects all three historical drivers of copper bull markets at the same time, but on a larger scale.

The West is actively rebuilding its industrial base to reduce dependence on China. That alone requires massive copper usage across factories, grids, transport, and manufacturing.

At the same time, the global economy has committed to electrifying almost everything. From vehicles to heating systems to industrial machinery, electricity is replacing fossil fuels. Every step of that transition requires copper.

Then there is reconstruction.

Rebuilding Ukraine and Gaza will demand huge volumes of copper for power, water systems, housing, and transportation. These are not small projects. They will take years and consume enormous material resources.

This combination has not existed in modern times at this scale.

Read also: Silver Tops the List: Best Metals to Buy for the 2026 Bull Cycle

Supply Has Been Left Behind

While demand is rising sharply, copper supply has not kept pace.

For decades, investment in new copper mines has lagged behind consumption growth. Environmental regulation, long permitting processes, declining ore grades, and political risk have slowed the development of new projects.

It can take more than 10 years to bring a large copper mine from discovery to production. That means today’s shortages cannot be fixed quickly, even if prices rise aggressively.

This is the same structural issue that helped push silver higher. In copper, the scale is even larger.

Why Silver’s Move Matters for Copper

Silver’s recent rally was not just a price story. It was a signal that industrial metals are being repriced as strategic assets, not just raw materials.

When silver broke out, it showed what happens when supply cannot respond fast enough to real-world demand. Copper is now facing a similar imbalance, but tied to energy systems and global infrastructure rather than niche industrial use.

That is why many traders see copper as the next candidate for an explosive run after silver.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Silver Price Already Took Off – Now Copper Is Flashing Supercycle Signals appeared first on CaptainAltcoin.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Santander’s Openbank Sparks Crypto Frenzy in Germany