Chainlink Acquires FastLane’s Atlas to Expand Liquidation Value Recovery

Chainlink LINK $12.23 24h volatility: 2.3% Market cap: $8.67 B Vol. 24h: $436.13 M acquired Atlas intellectual property and key personnel from FastLane, bringing order-processing technology under its control and expanding its Smart Value Recapture (SVR) system to Arbitrum ARB $0.18 24h volatility: 1.0% Market cap: $1.04 B Vol. 24h: $107.06 M , Base, BNB Chain BNB $883.8 24h volatility: 2.0% Market cap: $120.49 B Vol. 24h: $1.49 B , Ethereum ETH $2 938 24h volatility: 2.1% Market cap: $354.63 B Vol. 24h: $28.57 B , and Hyperliquid’s HyperEVM.

Atlas now exclusively supports Chainlink SVR, according to the joint announcement.

SVR helps decentralized finance (DeFi) lending platforms recover profits that would otherwise go to third parties when borrowers’ crypto-backed loans are liquidated.

The system has processed more than $460 million in liquidations and recovered over $10 million for integrated protocols, according to Chainlink.

The recovered value is split between DeFi protocols and the Chainlink Network.

How the Technology Works

When borrowers fail to maintain sufficient collateral, their loans are automatically sold off. Chainlink SVR captures profit opportunities that arise during these liquidations and returns a portion to the lending protocol instead of letting outside traders take it.

Maximal extractable value represents the profits third parties can extract by reordering blockchain transactions.

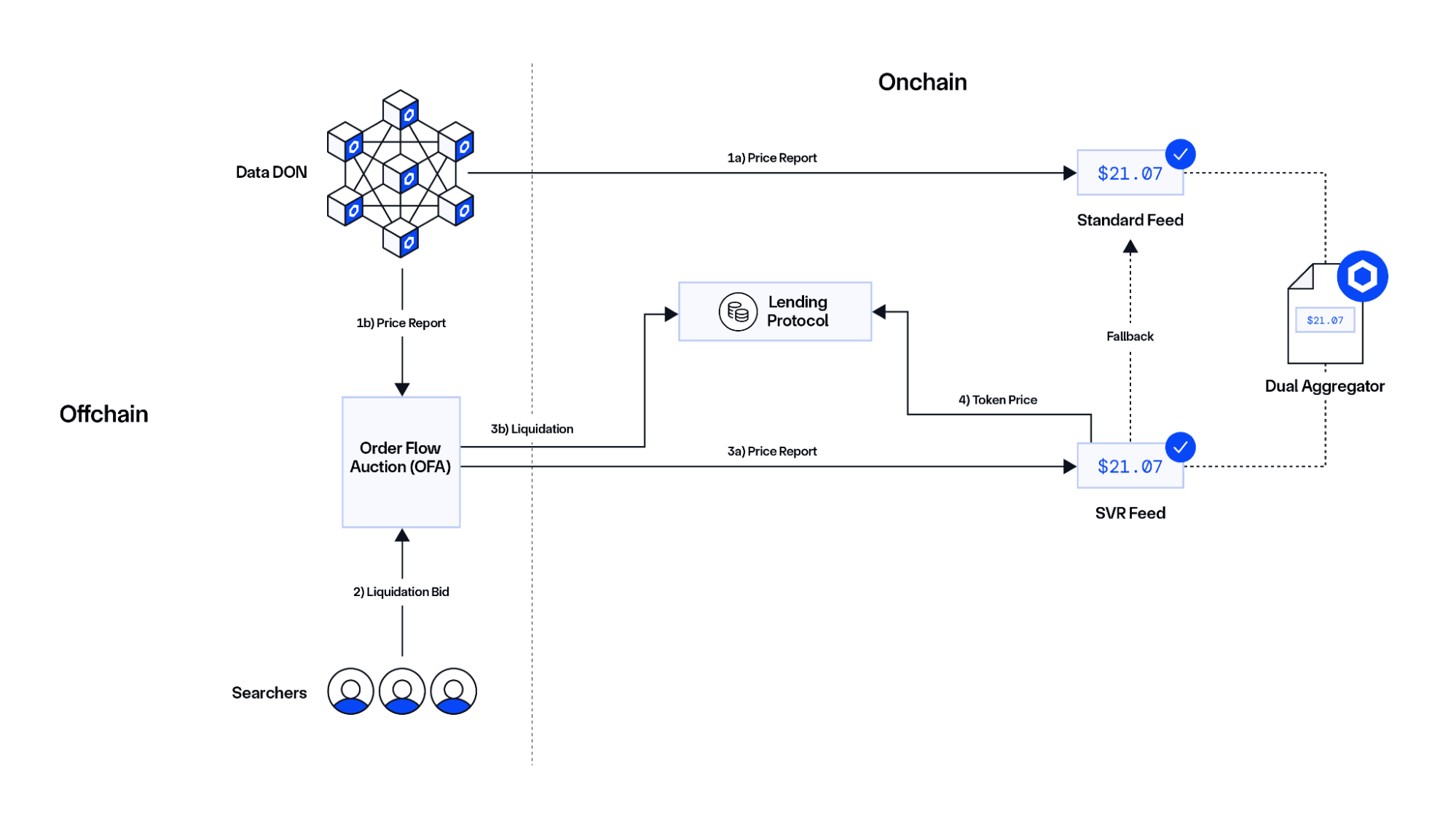

Chainlink SVR uses a dual-path system where price updates flow through both a standard feed and an order flow auction, allowing searchers to bid for liquidation rights while the lending protocol receives verified pricing. | Source: Chainlink

Johann Eid, Chief Business Officer at Chainlink Labs, said the acquisition creates an effective value recovery system that increases revenue for DeFi through expansion to new blockchain networks.

FastLane will continue to operate independently as a strategic partner.

Protocol Adoption

Major DeFi lending platforms including Aave AAVE $157.1 24h volatility: 2.9% Market cap: $2.39 B Vol. 24h: $361.28 M , which helps facilitate billions in crypto-backed loans, and Compound COMP $24.07 24h volatility: 1.0% Market cap: $232.96 M Vol. 24h: $13.22 M have adopted SVR.

Chainlink secures approximately 70% of the DeFi ecosystem by value and has enabled over $27 trillion in transaction value, according to DefiLlama data and company metrics.

The acquisition accelerates SVR deployment across networks where lending protocols operate.

Alex Watts, CEO of FastLane, said Chainlink is positioned to lead the oracle value recovery market, where it competes with API3 and Pyth Network.

Meanwhile, LINK has seen steady whale accumulation despite a recent pullback, with analysts pointing to a long-term support zone and projecting higher upside as market conditions stabilize.

nextThe post Chainlink Acquires FastLane’s Atlas to Expand Liquidation Value Recovery appeared first on Coinspeaker.

You May Also Like

GCC and India to sign terms for start of free trade talks

PEPE Holders Looking For The Next 100x Crypto Set Their Sights On Layer Brett Presale