Starlink rolls out instalment payments for internet kits in Kenya

Starlink, the SpaceX-owned satellite internet service, has introduced instalment payments for its mini kits in Kenya, cutting upfront cost for users as it seeks to revive subscriber growth that has slowed over the past year.

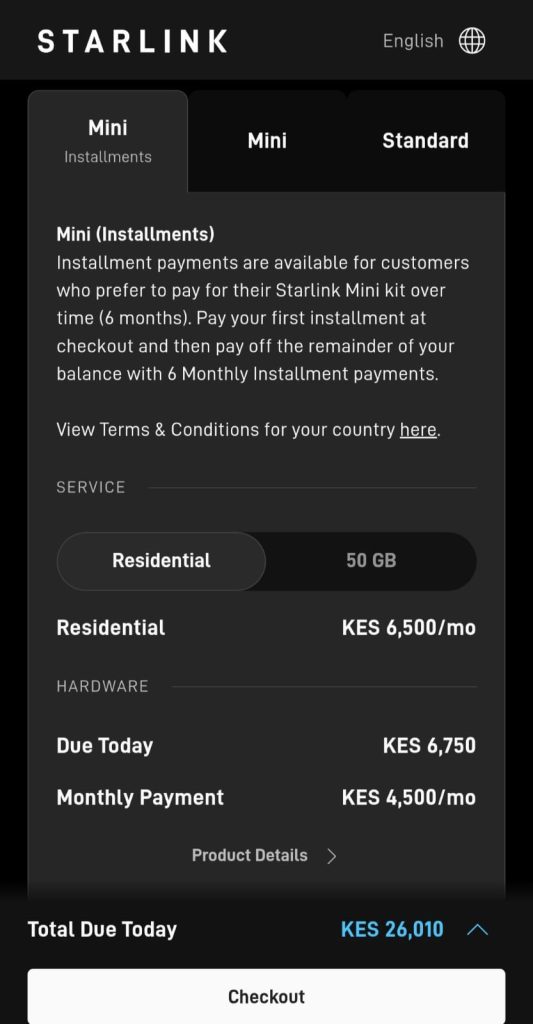

The new plan requires a KES 6,750 ($52.8) upfront payment, plus KES 16,250 ($125.8) in activation fees and KES 3,010 ($23.3) for shipping, with the balance spread over six months. It adds KES 4,500 ($34.8) a month for the kit over six months to the standard KES 6,500 ($50.3) residential subscription fee.

The instalment plan cuts the upfront cost of Starlink’s equipment, which has been a barrier to adoption for most users. It is likely to increase access among price-sensitive users, particularly in rural and underserved areas where paying the full amount upfront has reduced uptake. Priced at KES 27,000 ($209.1), the mini kit now requires less upfront cash, with more of the cost spread across recurring monthly payments.

A screenshot of a checkout for a Starlink mini kit. Image source: TechCabal

A screenshot of a checkout for a Starlink mini kit. Image source: TechCabal

The Starlink mini kit was introduced into the Kenyan market in September 2024, one year after the company launched to offer a cheaper alternative to the standard kit, which is KES 49,900 ($386.46).

Since it entered Kenya in 2023, the company has expanded rapidly within the first six months, reaching a 0.5% market share. According to data from the Communications Authority of Kenya, the number of customers rose from 16,786 in September 2024 to 19,146 as of December 2025.

However, growth was slowed after the company, in November 2024, halted new sign-ups in densely populated urban areas like Nairobi and Mombasa due to capacity challenges. The freeze, which remained in place until June 2025, reduced its momentum, with active subscriptions falling to 17,066 by March that year.

The pause created an opening for competitors. Safaricom and Airtel, the country’s biggest telcos, moved to deploy 5G routers priced below KES 3,000 ($23), targeting the same rural users Starlink had aimed to reach. Safaricom controls 35.6% of Kenya’s fixed internet market, followed by Jamii Telecom (20.6%), Wananchi Group (12.7%), Poa Internet (12.5%), Ahadi Wireless (7.5%), and Mawingu Networks (3.6%). Starlink follows at a distant (0.8%).

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Marathon Digital BTC Transfers Highlight Miner Stress