Binance Investment Arm YZi Labs Backs Genius Terminal for Private Onchain Trading

YZi Labs—formerly Binance Labs, Binance’s venture capital and investment arm—has announced a $10 million seed investment in Genius Terminal. Genius is described as a professional trading terminal for private, high-velocity onchain operations.

According to the announcement, Binance and YZi Labs co-founder Changpeng Zhao (CZ) has been nominated as one of the startup’s advisors under claims of “alignment” to YZi Labs’ vision of backing infrastructure to compete with centralized exchanges (CEXs). Armaan Kalsi, co-founder and CEO of Genius, is deemed to be “creating an on-chain Binance.”

YZi Labs staff have also vouched for the startup and the mission it is aiming to accomplish. Head of YZi Labs Ella Zhang told how she met Armaan at the NYC Builder Bunker during a BNB Chain MVB demo and praised his attitude and vision. Additionally, Alex Odagiu, investment partner at YZi Labs, elaborated on the thesis that motivated this capital allocation, explicitly mentioning how Genius can offer a private experience with high-velocity execution.

DEX-CEX Volume Ratio Favors Decentralized Venues in 2026

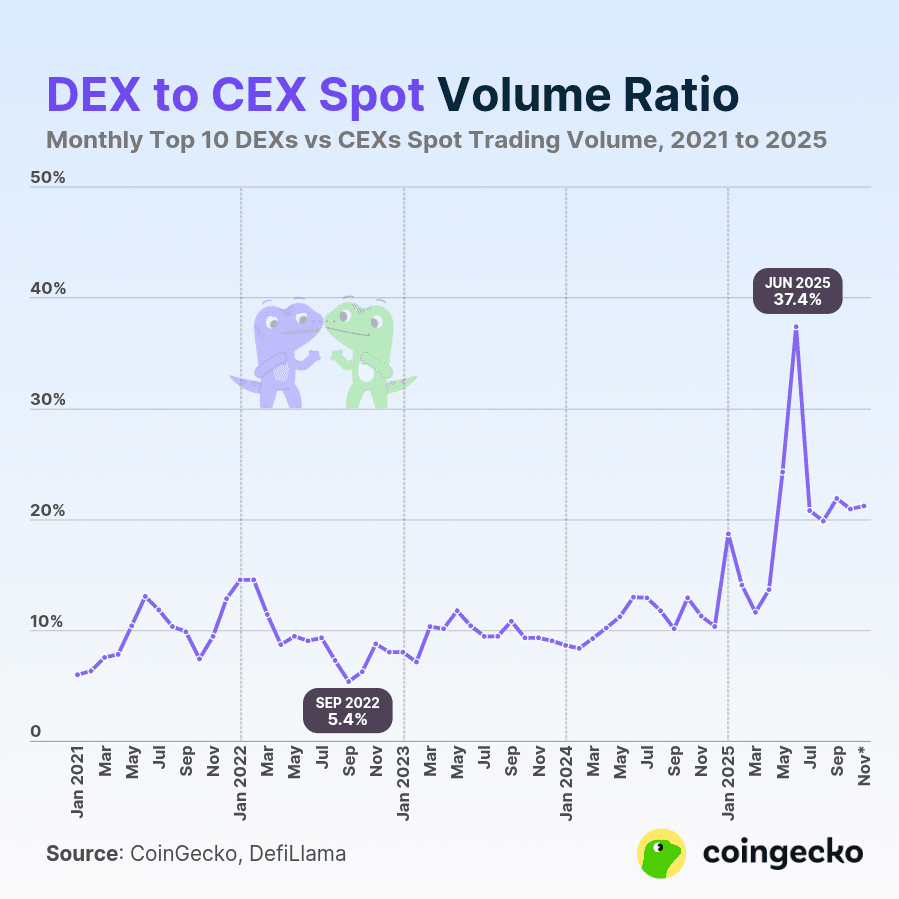

According to the announcement and backed by publicly available data, the volume ratio between decentralized exchanges and centralized exchanges (DEX-CEX volume ratio) has been shifting favorably towards decentralized venues in 2026.

Crypto-native traders and other users have been favoring the use of DEXs over CEXs, enjoying the extra security and sovereignty layer of self-custody and credible neutrality blockchains can offer.

In November 2025, CoinGecko reported the exponential growth for the DEX-CEX ratio growing more than three times in the past five years—going from 6% in November 2021 to 21.2% by reporting time. Decentralized exchanges saw a peak of 37.4% market share in June 2025.

DEX to CEX spot volume ratio from January 2021 to November 2025 | Source: CoinGecko

Notably, centralized enterprises like Bitfinex have noted this trend and acted to strengthen their position in response, as Coinspeaker covered in December 2024. Bitfinex, in particular, cut its trading fees to zero in an attempt to regain market share.

On that note, another Binance-backed decentralized exchange and the leading DeFi protocol on the BNB Chain, PancakeSwap, has now proposed a supply reduction for its governance token CAKE, as Coinspeaker reported.

nextThe post Binance Investment Arm YZi Labs Backs Genius Terminal for Private Onchain Trading appeared first on Coinspeaker.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns