Ethereum Staking Queue Hits $5.5B as New Validators Face 30-Day Wait

- New Ethereum validators to wait 30 days for activation as the staking exit queue climbed to 1.759 million ETH.

- ETH price is still down despite strong institutional accumulation and staking from giants like BitMine.

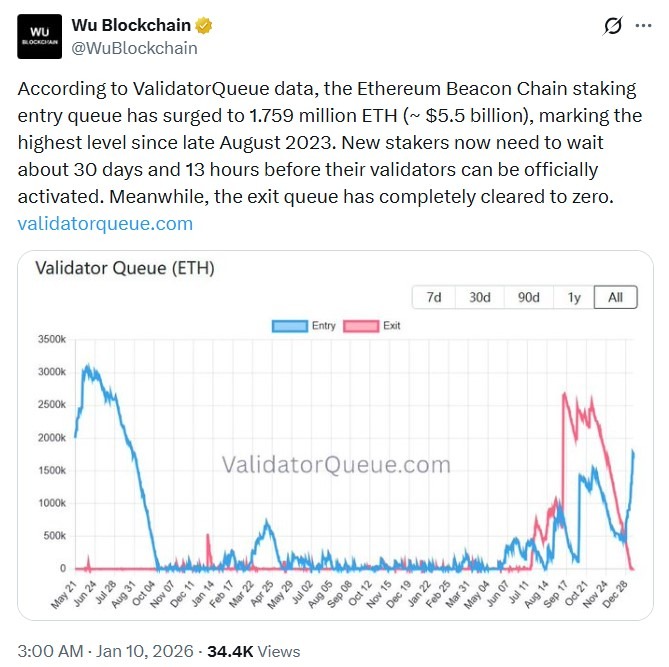

The Ethereum (ETH) staking queue recently experienced a shift in dynamics. While the Ethereum staking entry queue rose to $5.5 billion, the exit queue completely cleared to zero. According to ValidatorQueue data, the Ethereum staking queue has surged to 1.759 million ETH, valued at about $5.5 billion. This is a historic milestone as it marks the highest level since late August 2023.

The entry queue represents the ETH waiting to become active validators. The estimated wait time for new stakers is about 30 days and 13 hours. This is the time before their validators are activated and start earning rewards. In contrast to the entry queue, the Ethereum exit queue has dropped completely to zero. Exit queue validators waiting to unstake and withdraw their funds.

The exit queue declining to zero means anyone who wants to leave, do so almost immediately with no backlog. Almost no one is unstaking their ETH assets at the moment. This eliminates immediate sell pressure from exiting validators who would receive their ETH back after withdrawal.

Ethereum Staking and Validator Queue Outlook | Source: Wu Blockchain

Ethereum Staking and Validator Queue Outlook | Source: Wu Blockchain

Such a bullish move indicates fewer people want to sell or reduce exposure. It is also a potential support for the ETH price in a positive market environment. Large ETH holders such as BitMine are actively staking large amounts for yield. BitMine recently added 118,944 new ETH to staking as it continues with its aggressive accumulation plan, as mentioned in our previous news brief.

Their action comes shortly after JPMorgan invested $102 million in BitMine. In our last update, we examined that JPMorgan held 1,974,144 shares of the company as of September 30, 2025.

How Ethereum Price Reacts

Generally, the Ethereum queue flip represents an on-chain sign of accumulation and network strength in recent years. Analysts claim traders and investors currently view Ethereum as a solid long-term bet. Usually, the network security increases, while the liquid supply reduces when more ETH is locked away. This potential supports the ETH price in a positive market environment.

Moreover, community sentiments remain bullish for ETH despite the price falling slightly by 0.08% over the previous day to $3,092.61 per data from MarketCap. On the weekly and monthly charts, ETH also dropped 0.02% and 3.27%, respectively.

Nevertheless, positive developments remain within the ETH ecosystem. For instance, co-founder Vitalik Buterin recently made a major network announcement. Buterin argued that getting zkEVM and PeerDAS on mainnet will help the blockchain to achieve scalability, security, and decentralization. In a previous report, Buterin said Ethereum must achieve global scale usability and remain genuinely decentralized. At the same time, he criticized Ethereum dApps that went offline following the Cloudflare outage.

]]>You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Robinhood Chain Public Testnet Launch: A Strategic Pivot into Ethereum’s Layer 2 Ecosystem