Solana’s App Revenue Hits $2.4B as DEX Volume Tops $1.5T

By almost every on-chain and economic metric 2025 marked a breakout year for Solana.

What began as a high-throughput blockchain narrative has matured into a full-fledged financial ecosystem defined by real revenues, deep liquidity and sustained trading activity. The latest data from across applications, assets and infrastructure shows Solana not only scaling usage but monetising it.

App Revenues Reach New Highs

Applications built on Solana generated a combined $2.39 billion in revenue in 2025 up 46% year-on-year and a new all-time high. Seven applications crossed the $100 million revenue threshold led by Pump.fun, Axiom Exchange, Meteora, Raydium, Jupiter, Photon and BullX.

Beyond the top performers the long tail of Solana apps proved increasingly meaningful, with projects earning under $100 million collectively generating more than $500 million in revenue. The breadth of revenue generation highlights an ecosystem no longer reliant on a small handful of breakout apps.

Network Performance Scales at Low Cost

Solana’s underlying network metrics reinforced this growth. Network REV climbed to $1.4 billion, representing a forty-eight-fold increase over two years.

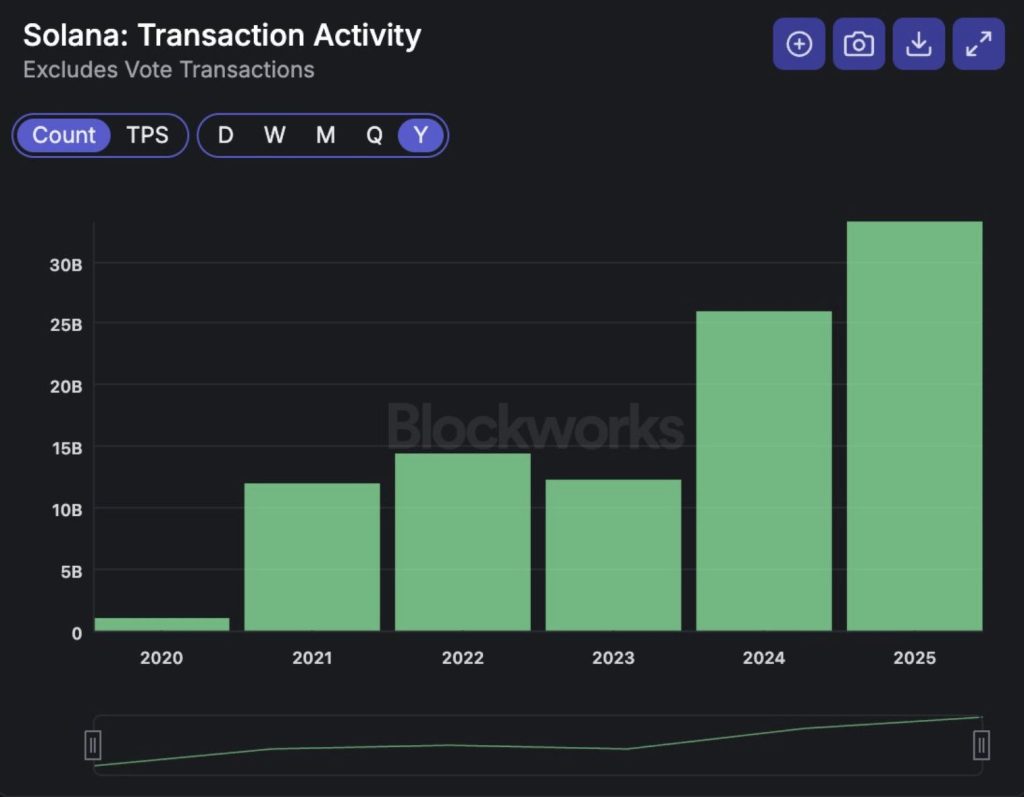

The chain processed 33 billion non-vote transactions during the year, or 116 billion including votes, while averaging over 1,050 non-vote transactions per second.

Daily active wallets averaged 3.2 million, up 50% year-on-year, and more than 725 million new wallets executed at least one transaction. Despite the surge in activity costs continued to fall with average transaction fees dropping to $0.017 and median fees near one-tenth of a cent.

Assets, Stablecoins and Institutional Flows Expand

Asset activity on Solana accelerated sharply. Stablecoin supply ended the year at $14.8 billion more than doubling year-on-year while $11.7 trillion of stablecoins moved across the network.

Tokenised equities debuted with $1 billion in supply and $651 million in trading volume. Bitcoin-related activity also surged, with trading volume rising fivefold to $33 billion and on-chain BTC supply doubling to $770 million.

Staked SOL reached a new high of 421 million tokens and Solana-linked exchange-traded products recorded $1.02 billion in net inflows, underscoring growing institutional engagement.

DEXs, Memecoins and Trading Platforms Drive Volume

Decentralised exchange volume reached $1.5 trillion in 2025, up 57% year-on-year. SOL-stablecoin pairs alone accounted for $782 billion in volume, while twelve DEXs processed more than $10 billion each.

Prop-style automated market makers expanded rapidly, capturing more than half of aggregator volume. Memecoin trading remained intense, generating $482 billion in volume, while launchpads doubled revenues to $762 million and facilitated the creation of 11.6 million tokens.

Meanwhile professional trading platforms earned $940 million in revenue and processed $108 billion in volume, cementing Solana’s position as one of the most active trading venues in crypto.

Taken together 2025 was the year Solana translated scale into substance. Revenue, assets, and trading all reached new highs showing a network that has moved decisively beyond experimentation into economic permanence.

You May Also Like

GCC and India to sign terms for start of free trade talks

PEPE Holders Looking For The Next 100x Crypto Set Their Sights On Layer Brett Presale