2026: The Year Utility Tokens Take Over

Crypto Industry Faces Realignment as 2025 Becomes a ‘Trump Year’ of Overestimation

Yat Siu, co-founder of Animoca Brands, reflects on 2025 as a pivotal year characterized by overconfidence in the political influence of Donald Trump. Contrary to expectations that Trump’s presidency would bolster crypto markets, Bitcoin experienced its fourth annual decline, and meme coin liquidity was heavily influenced by political narratives. Industry insiders warn that the sector’s optimism was misplaced, emphasizing a shift toward pragmatic strategies in 2026.

Key Takeaways

- Crypto markets underperformed in 2025 amid overestimated political influence, with Bitcoin declining for the fourth year in a row.

- Market leaders like Animoca Brands plan to utilize reverse mergers to create a liquid proxy for altcoin exposure in public markets.

- The anticipated regulatory clarity, including the Clarity and GENIUS Acts, could catalyze broader adoption and tokenization of real-world assets.

- 2026 is poised to be the year when utility tokens gain prominence, driven by a focus on products rather than speculation.

Tickers mentioned: None explicitly, but references to Bitcoin, Ether, and Solana are included in the context.

Sentiment: Cautiously optimistic about regulatory reforms and industry maturation.

Price impact: Negative overall, as 2025 saw significant declines and market disillusionment, but future potential remains contingent on regulatory developments.

Trading idea (Not Financial Advice): Hold, awaiting clearer regulations and more utility-driven market offerings.

Market context: Major reforms and legislative clarity are expected to reshape the crypto landscape, transitioning from speculation to sustainable growth.

As 2025 concludes with Bitcoin struggling through its fourth consecutive year of decline, industry leaders like Siu argue that the market’s overreliance on political narratives has led to mispricing and instability. The sector’s previous assumptions that political figures like Donald Trump could serve as a ‘cheat code’ for crypto’s growth have proven illusory. Instead, market performance has been subdued, with liquidity particularly strained in meme coins linked to political figures, such as the Trump and Melania Trump-branded tokens, which experienced dramatic value drops earlier this year.

Bitcoin’s 2025 performance. Source: CoinMarketCapSiu describes the year as a “B-/C+,” highlighting how traders treated Trump as if crypto was his “first child,” despite it actually being more distant in the hierarchy of presidential priorities. Policies centered around tariffs and trade wars particularly impacted risk assets, with little regard for their potential impact on Bitcoin prices.

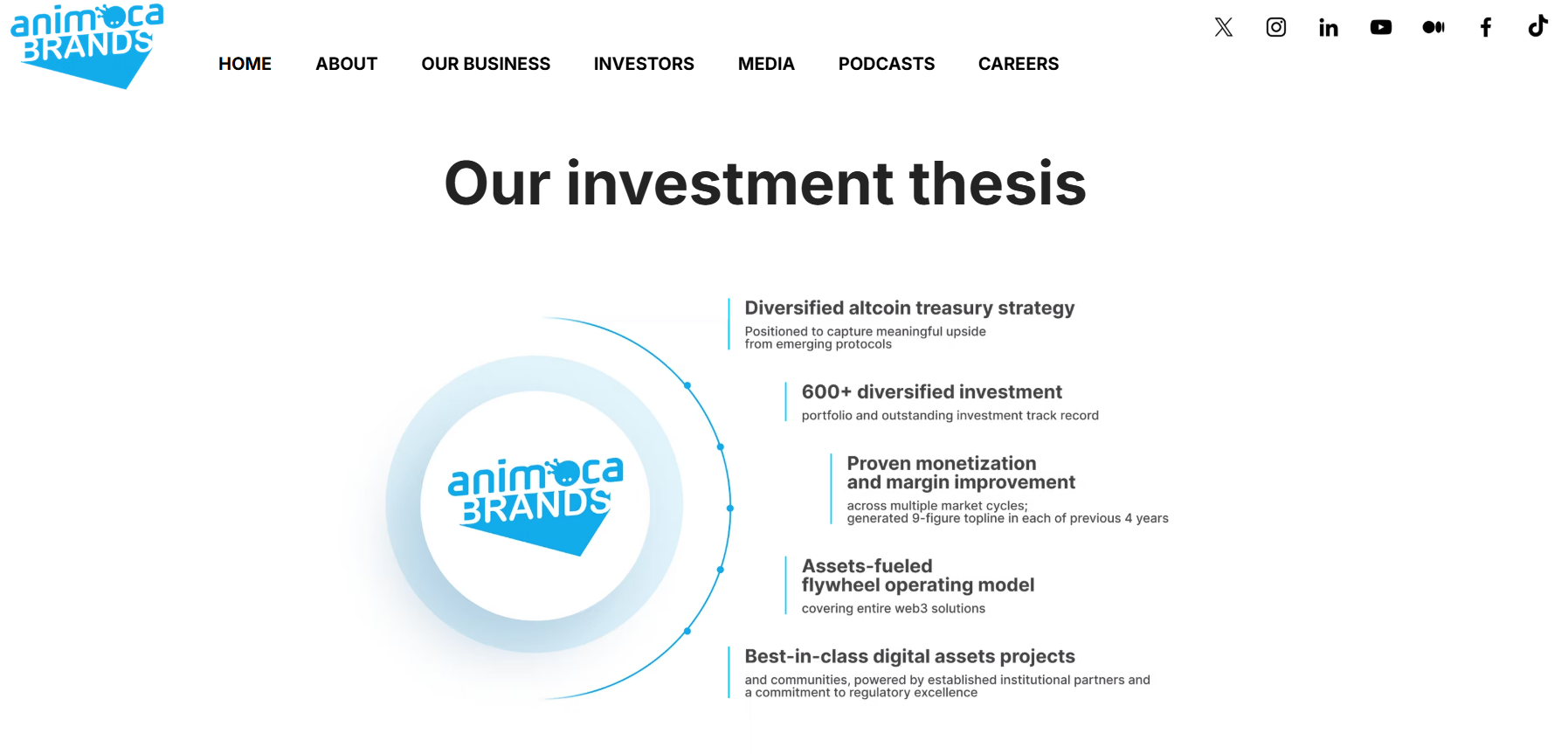

Looking ahead to 2026, Siu emphasizes that regulatory clarity will be vital. With legislation such as the Clarity and GENIUS Acts, the industry could see a wave of tokenization of real-world assets and established companies launching tokens tied to their core businesses, offering legal certainty that was previously lacking. Animoca Brands, with over 620 portfolio companies, plans to go public through a reverse merger with Nasdaq-listed Currenc Group. This move aims to create a liquid proxy for the altcoin and Web3 segments, providing retail investors with diversified exposure outside traditional Bitcoin holdings.

Animoca Brands’ investment thesis. Source: Animoca Brands

Animoca Brands’ investment thesis. Source: Animoca Brands

Siu views 2026 as the “year of utility tokens,” driven by a renewed focus on products with real-world applications. As regulatory barriers ease, established entities will launch tokens linked to tangible assets, ultimately transforming the crypto industry from a speculative arena into a space centered on functional utility. This maturation signals that crypto businesses are evolving, and with regulatory frameworks providing clarity, the sector is preparing for a more sustainable future rooted in utility and real-world integration.

This article was originally published as 2026: The Year Utility Tokens Take Over on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC