Dogecoin (DOGE) Whales Change Ship as This Best Cryptocurrency to Invest Today Sees Accumulation Surge

A lot of capital is transitioning on the cryptocurrency markets. Dogecoin (DOGE), the first meme cryptocurrency, has shown higher volatility levels, falling below the essential level of $0.13, with top holders re-assessing their holdings. However, money is pouring into a promising project.

Mutuum Finance (MUTM) is currently in the spotlight as it has proved to be a reliable alternative for those in pursuit of more substance than mere hype. In light of the larger traders drifting away from the conventional assets, there is undoubtedly an opportunity for MUTM as the next big cryptocurrency in the quickly growing presale phase.

Dogecoin Faces a Challenging Market

Dogecoin’s market trend has become less transparent, and its value is below the significant level of 0.13 USD. Current spot market sales and rising futures market volume indicate higher market volatility and market uncertainty. After the election rally, the DOGE/USD market experienced problems related to spot market sales and unwilling buyers from substantial market holders.

Moreover, the supply is unbounded with very limited intrinsic value in the market at the current level. Technological as well as intrinsic issues are forcing major investors to look for alternate investments.

Mutuum Finance attracts Strategic Capital

Unlike other coins that do not have any utility in decentralized finance, Mutuum Finance (MUTM) seems to have taken a path that may pay off in the future because the project not only launched a presale event but has already raised more than $19.5 million with 18,580 new holders. Now is a great time to accumulate the best crypto to invest in today.

The price per token is at $0.035, an increase of 250% from the previous price, although this level is 99% completed. As Phase 6 ends, Phase 7 begins with an increase in price to $0.040, providing another chance to buy the token prior to the launch price set at $0.06. More than a mere digital currency, MUTM holds potential for true growth within its roadmap. The design of the project facilitates the smooth execution of the project.

Mutuum Finance has a sustainable dual-market lending system that combines contracted Peer-to-Contract access with tailored Peer-to-Peer loans. However, the issue of safety has also been addressed extensively, with Halborn Security performing audits of core smart contracts before mainnet launch.

Additionally, to encourage community members to engage in the project, a leaderboard has been incorporated with a daily reward of a $500 MUTM bonus for the top community participant. In addition, access to MUTM tokens has been made easier, with purchases possible directly with a credit/debit card without any limit.

The moves taken by experienced capital participants deserve special consideration, given that the capital invested will end up facilitating a project with exemplary execution and a robust economic background. This requirement has been met by Mutuum Finance with a strategy for the utilization of presale power in completing the journey towards becoming a fully launchable protocol, which responds to the need for a reliable source of yield and sustainable growth for the DeFi market. The quick execution of Phase 6 provides an opportune time for smart money participants to be part of this platform.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

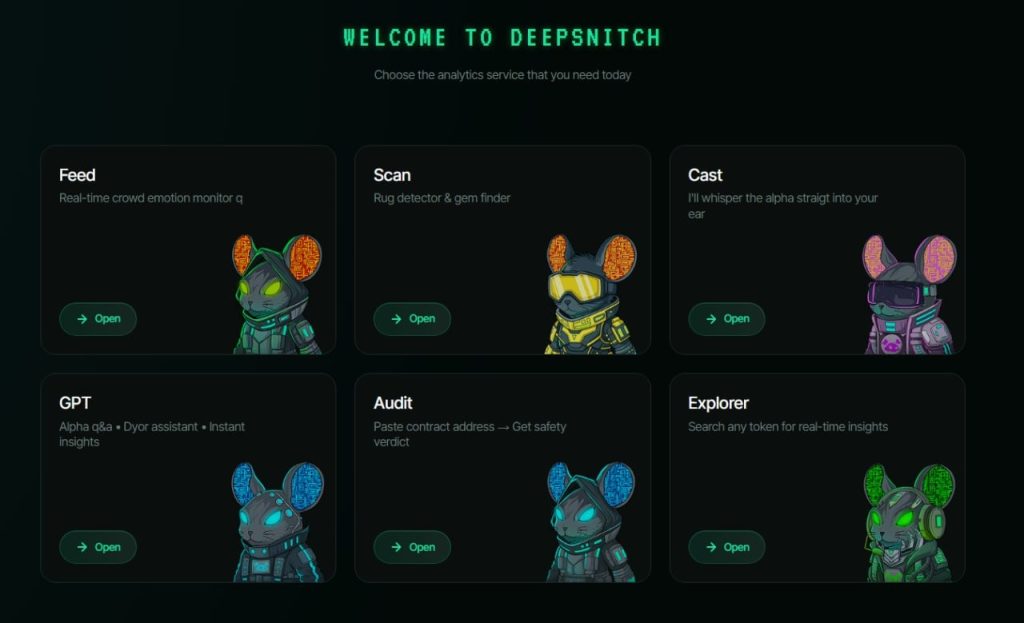

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24