Yield Basis (YB) Gains 17% After Securing Upbit Listing

Upbit, South Korea’s largest cryptocurrency exchange, has announced the listing of Yield Basis (YB), with trading set to go live today.

The announcement boosted market interest, triggering a double-digit surge in YB’s price. Trading activity also increased ahead of the launch, with a noticeable rise in volume.

Upbit Expands Market Access for Yield Basis

Upbit confirmed that YB/BTC and YB/USDT trading pairs will go live on December 26 at 15:00 Korean Standard Time (KST). According to the exchange, YB deposits and withdrawals will be supported on the Ethereum network.

It emphasized that transactions sent through unsupported networks will not be credited, urging users to verify network details and contract addresses before transferring funds. The contract address for YB is 0x01791F726B4103694969820be083196cC7c045fF.

As with previous listings, Upbit will apply temporary trading restrictions during the initial launch phase. The exchange will restrict buy orders for the first five minutes after trading begins. Sell orders priced more than 10% below the previous day’s closing price will also be restricted during that period.

Additionally, the exchange will only allow limit orders for approximately two hours after the start of trading. These measures are designed to reduce volatility and ensure orderly market conditions at launch.

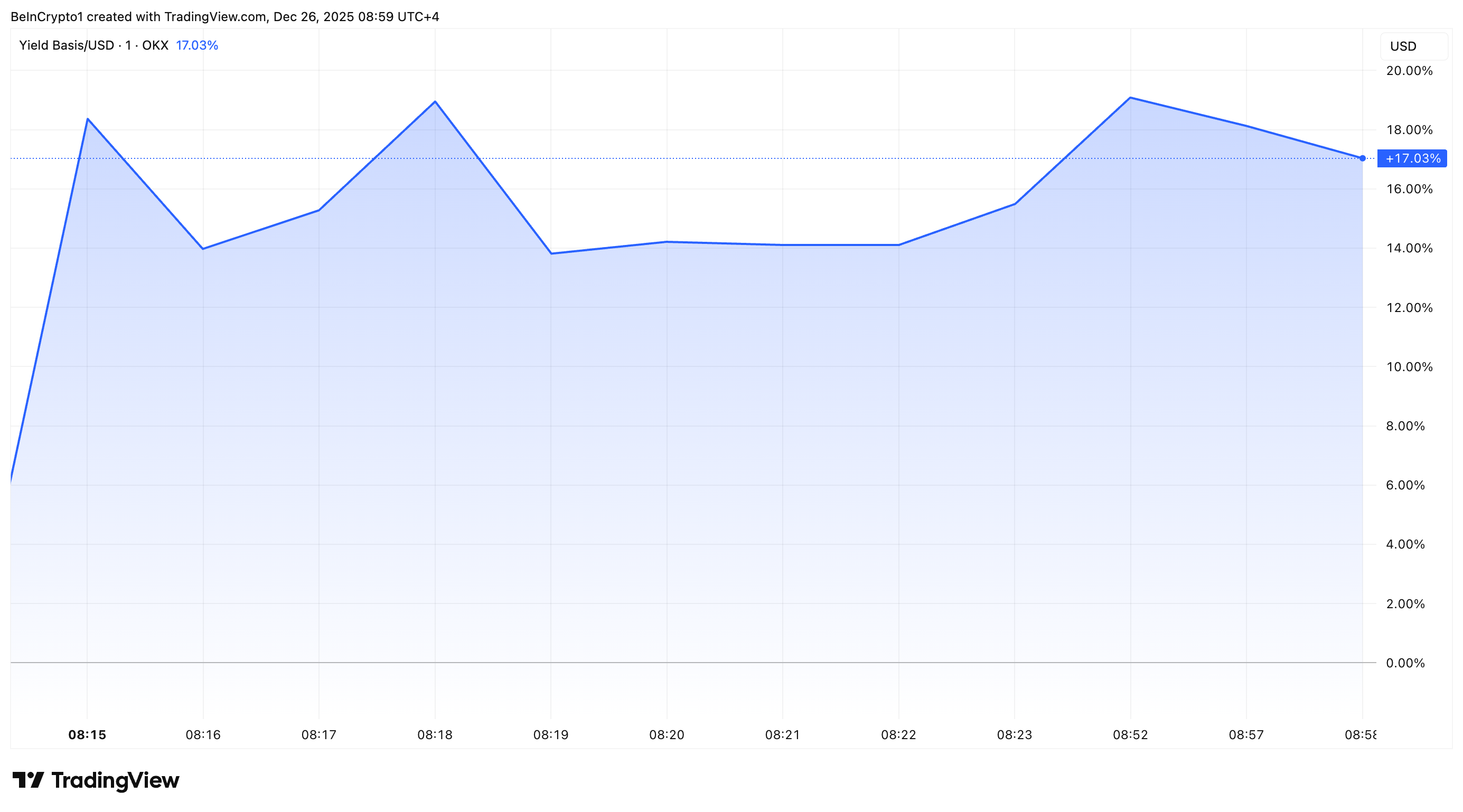

Following the announcement, YB’s price increased by over 17%. At the time of writing, the altcoin was trading at $0.43. CoinGecko data also showed a 169% surge in daily trading volume, indicating increased investor activity.

Yield Basis (YB) Price After Upbit Listing Announcement. Source: TradingView

Yield Basis (YB) Price After Upbit Listing Announcement. Source: TradingView

Yield Basis Gains Traction Amid Rapid TVL Growth

The Upbit listing comes amid growing adoption of the Yield Basis protocol itself. For context, Yield Basis is an on-chain liquidity solution that allows users to provide Bitcoin as liquidity to automated market maker (AMM) pools without avoiding impermanent loss (IL).

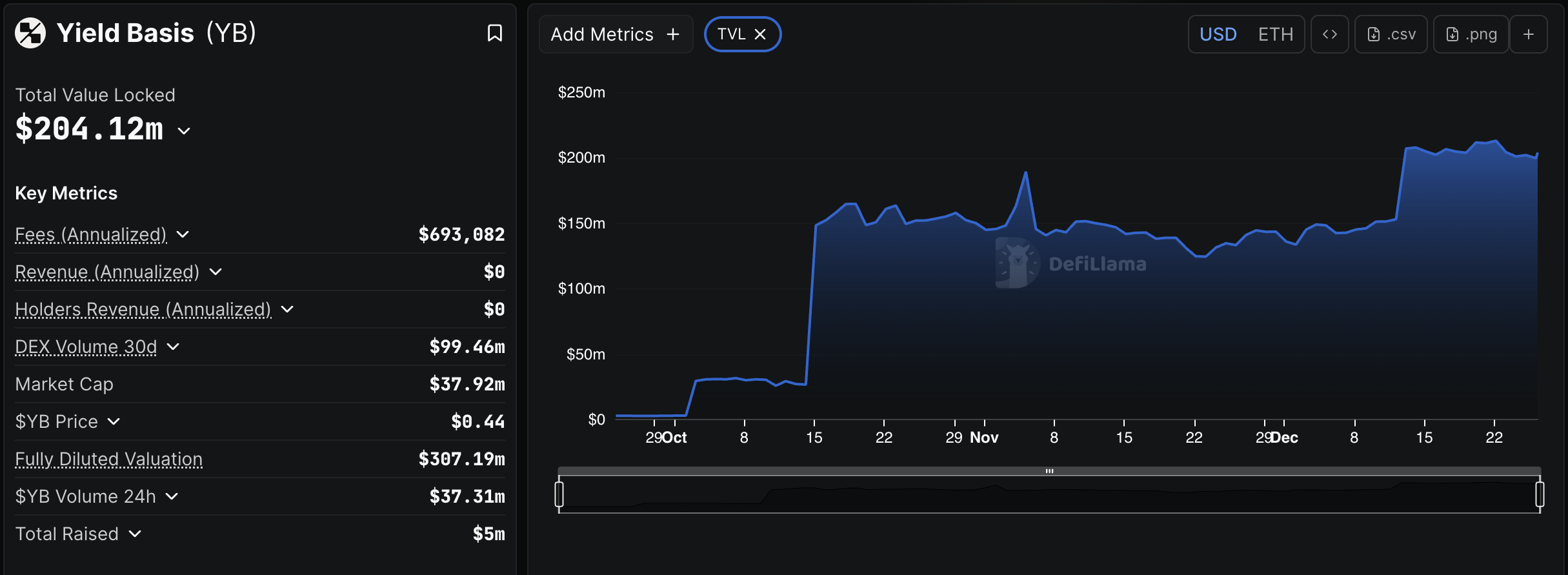

According to DeFiLlama, the protocol’s total value locked (TVL) has climbed from approximately $30 million in early October to over $200 million today, reflecting strong user demand.

Yield Basis TVL. Source: DeFiLlama

Yield Basis TVL. Source: DeFiLlama

The Upbit listing, therefore, arrives at a critical point for Yield Basis, combining rapid TVL growth with broader exchange exposure. Market participants are now watching whether the protocol and its token can sustain momentum amid upcoming token unlocks and rising competition from established DeFi platforms.

You May Also Like

WLFI Expands Into Forex With World Swap Launch

BUZZ HPC Closes Acquisition of 7.2 MW Toronto Site to Build Data Centre for Sovereign AI Infrastructure

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more