How to Open a Standby Crypto Credit Line with No Fees on Clapp

When markets turn volatile, selling crypto to access cash often means locking in losses. For long-term holders and active traders alike, a standby crypto credit line offers a more efficient alternative: liquidity on demand, backed by crypto, without giving up market exposure.

Clapp offers one of the more straightforward implementations of this model. Its credit line combines low borrowing costs, flexible usage, and a no-fee structure for deposits, making it suitable for users who want control rather than rigid loan terms.

This article explains how Clapp’s standby crypto credit line works and how to open one step by step.

What Is a Standby Crypto Credit Line?

A standby crypto credit line is a pre-approved borrowing facility backed by crypto collateral. Instead of receiving a lump-sum loan upfront, you receive a credit limit and draw funds only when needed.

The key difference from a standard crypto-backed loan is efficiency:

-

No interest on unused capital

-

No fixed repayment schedule

-

Capital remains available at all times

This structure is closer to a revolving credit line than a traditional loan.

Why Investors Choose a Credit Line Over a Crypto Loan

Conventional crypto loans are simple but inefficient. You lock collateral, receive a fixed amount, and start paying interest immediately on the full balance—even if you only need part of it.

This creates two common problems:

-

You pay interest on funds you do not use

-

You lose flexibility once market conditions change

Clapp’s model removes these frictions by allowing users to borrow incrementally and repay on their own timeline.

How Clapp’s Standby Crypto Credit Line Works

Clapp uses a revolving credit structure backed by crypto collateral. The mechanics are simple:

-

You deposit crypto as collateral

-

Clapp assigns a credit limit based on LTV

-

You withdraw funds only when needed

-

Interest applies only to the amount used

-

Repayments instantly restore available credit

Unused credit carries 0% APR.

Example:If your credit limit is $10,000 and you withdraw $500, interest accrues only on the $500. The remaining $9,500 stays available at no cost.

No Repayment Schedule, No Penalties, Multi-Collateral Support

Clapp does not impose fixed repayment dates, minimum monthly payments, and early repayment penalties. You can repay partially, fully, or leave the balance open until it fits your strategy. This is particularly useful for users managing liquidity across multiple market cycles rather than short-term cash needs.

One of Clapp’s core advantages is its multi-collateral system. Users can combine up to 19 different cryptocurrencies into a single collateral pool.

This allows you to:

-

Increase your credit limit without concentrating risk

-

Use diversified portfolios more efficiently

-

Avoid over-reliance on a single asset like BTC or ETH

BTC, ETH, SOL, and other supported assets can be combined freely. For diversified holders, this often results in better capital efficiency than single-asset lending platforms.

Instant Access Through the Clapp Wallet

Once your credit line is active, all actions are managed through the Clapp Wallet:

-

Withdraw USDT, USDC, or EUR instantly

-

Monitor LTV and collateral health in real time

-

Reclaim collateral after repayment

Access is available 24/7, without manual approvals or operational delays. This makes the credit line usable not only as a loan alternative, but also as a liquidity buffer during fast market moves.

How to Open a Standby Crypto Credit Line on Clapp

The process is straightforward:

-

Create a Clapp account

-

Deposit supported crypto assets

-

Receive a credit limit based on your collateral

-

Withdraw funds when needed

-

Repay on your own schedule

There are no application fees, no deposit fees, and no obligation to borrow once the credit line is open.

For both long-term holders and active market participants, Clapp offers a practical way to access capital while keeping control over assets and timing.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

Why Following Sui Crypto News Gives Early Insight Into Cross-Chain and Interoperability Trends

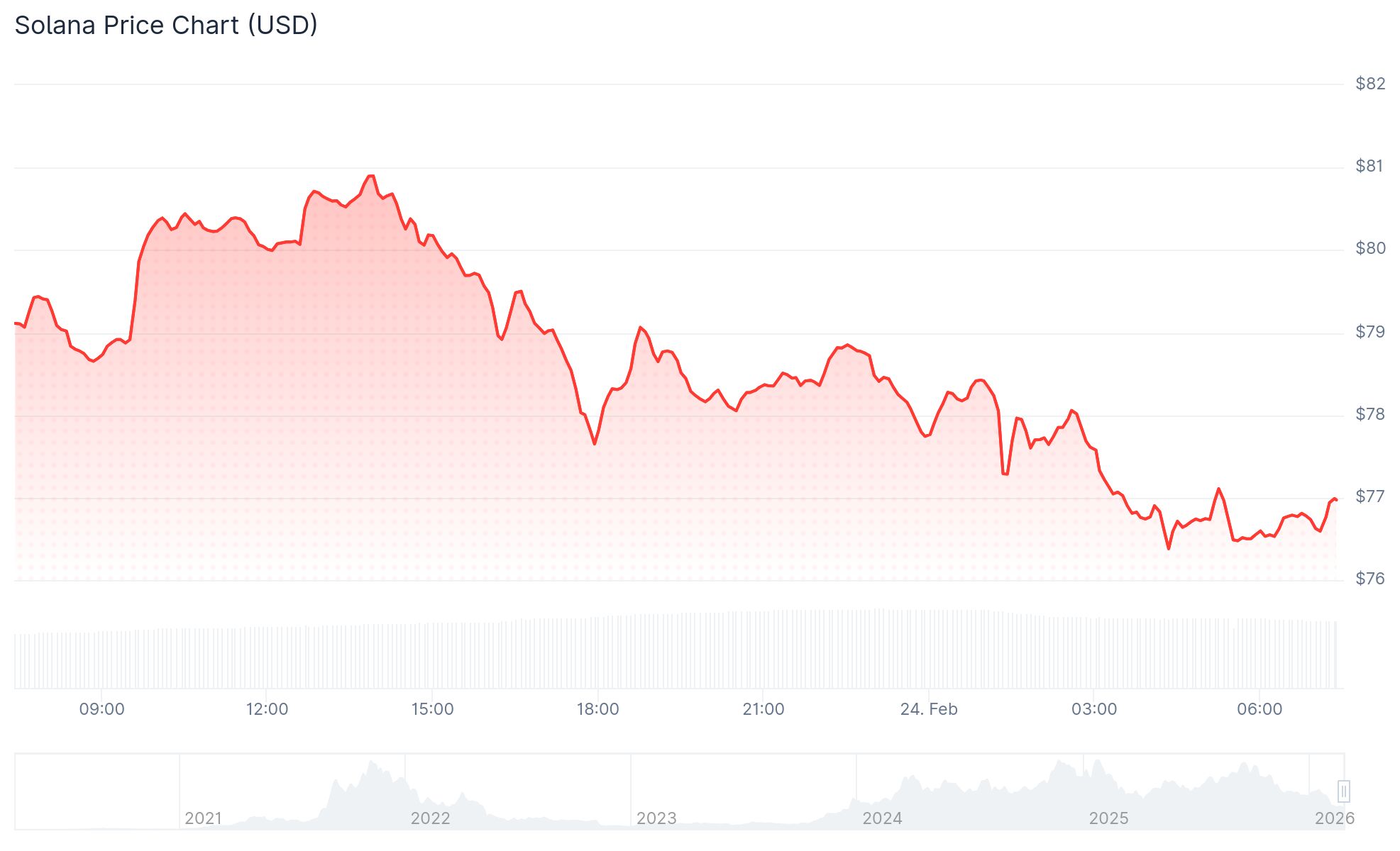

Solana (SOL) Price: Most SOL Holders Are Underwater as Token Drops to $76