Bitcoin options expire as bulls eye upside with $23B looming Dec. 26

Record $23B Bitcoin options expire Dec. 26, with max pain near current ranges and liquidity thin, setting the stage for sharp BTC volatility.

- A record $23B in Bitcoin options expire Dec. 26, the largest BTC options expiry on record.

- Calls are stacked at high strikes while puts cluster at lower levels, with max pain near current prices.

- Thin holiday liquidity and position unwinds could amplify BTC volatility as institutional flows reset.

A record $23 billion in Bitcoin options contracts are scheduled to expire on Friday, December 26, representing the largest BTC options expiry in history, according to market data.

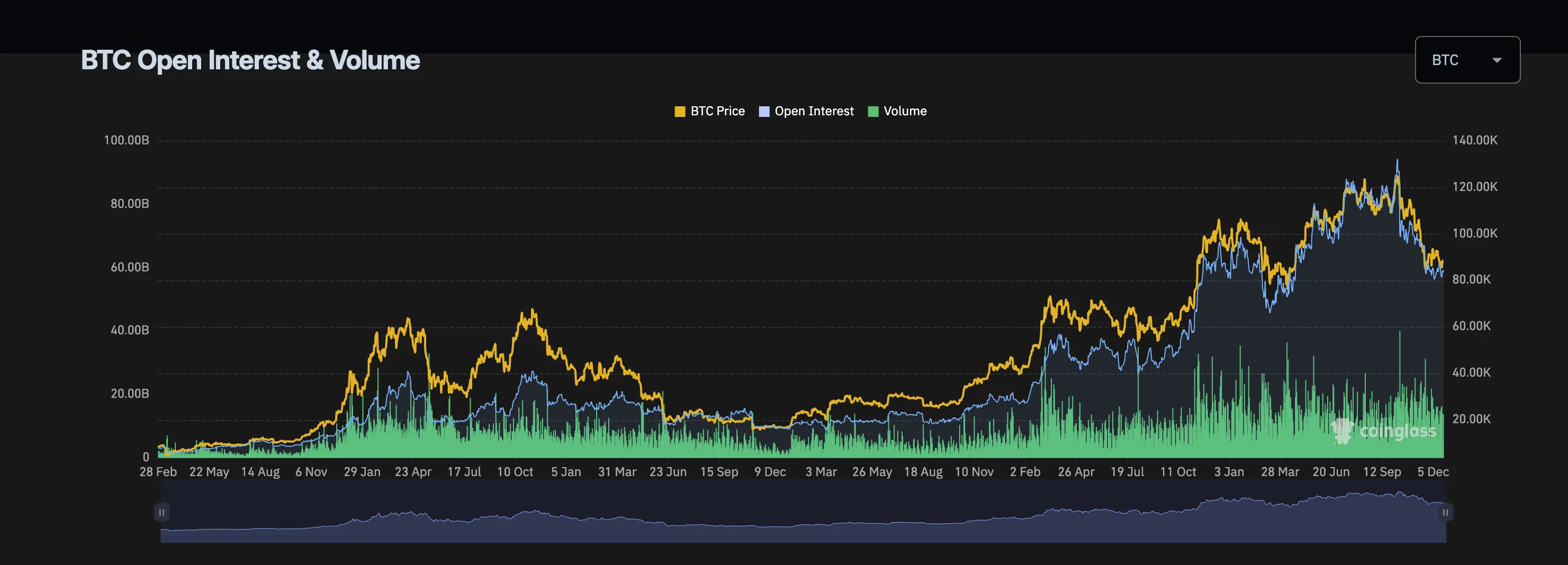

Open interest data from CoinGlass shows a heavy concentration of call options at high strike levels, indicating traders are positioning for price increases. Put options are clustered at lower strike prices, suggesting key support levels are being monitored closely.

Bitcoin options heading into Dec. 26 expiry

The Max Pain Level, defined as the price at which option holders would experience the greatest losses, sits near the high end of current trading ranges, according to the data.

The expiry total exceeds previous years’ figures, making it one of the most significant Bitcoin-related events on record.

The put-to-call ratio indicates traders are seeking upside exposure rather than downside protection, according to market analysts.

Bitcoin was trading below recent highs at the time of publication. The cryptocurrency typically experiences increased volatility ahead of major options expiries, with sharp price movements likely once contracts expire and open interest resets.

Price fluctuations near the expiry could trigger volatile swings as traders close positions and unwind hedges, according to market observers.

The expiry falls during a holiday week when market liquidity is typically reduced, allowing large orders to move prices more significantly than during normal trading periods.

The figures underscore the growing institutional presence in cryptocurrency markets, with derivatives flows increasingly influencing price movements, according to market analysts.

You May Also Like

Gold Price Hits Record High, Why Is Bitcoin Silent? Analyst Evaluates and Reveals Bitcoin Price Forecast

Lithuania Warns Crypto Firms to Exit or License Before Dec. 31, 2025