Dogecoin Price Prediction: DOGE Targets $0.14 Breakout as Bullish Momentum Builds

Highlights:

- The Dogecoin price has steadied at $0.13, as bulls eye a potential breakout above the falling wedge pattern.

- The DOGE derivatives data signal improving sentiment with rising bullish bets and positive funding rates.

- The technical outlook shows a potential breakout reinforced by the positive momentum indicators, as DOGE targets $0.14 soon.

The price of dogecoin (DOGE) is trading within a falling wedge pattern at $0.13, as its daily trading volume is up 17%. Meanwhile, the overall crypto market conditions are still showing mixed signals, as the on-chain and derivatives indicators improve. There is a growing confidence among traders that the market can improve, and there is a chance of an upside breakout in DOGE should momentum continue building.

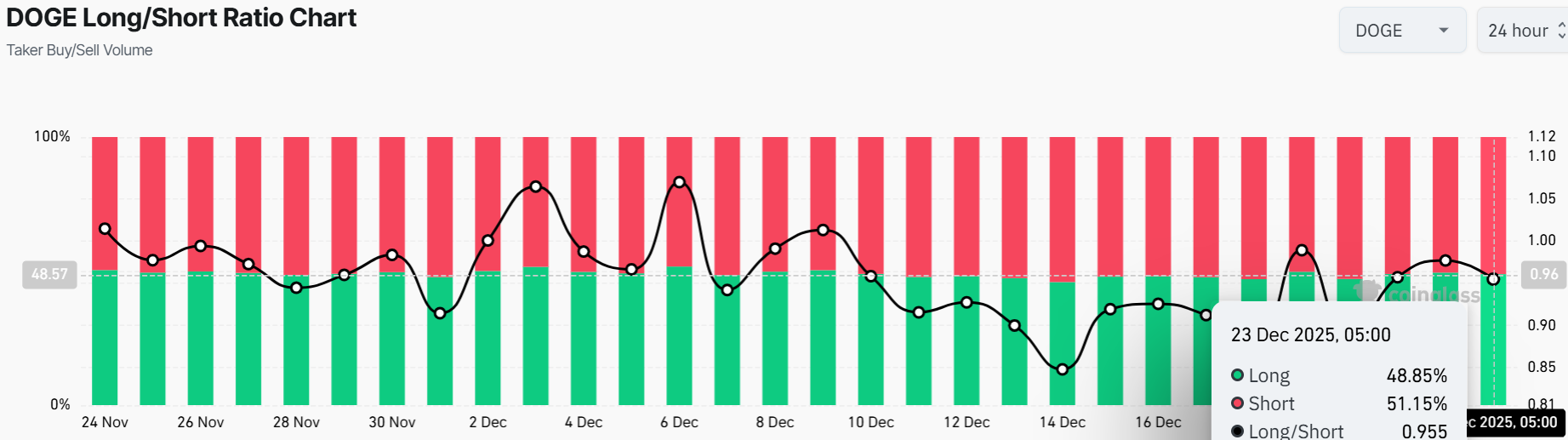

On the derivatives side, Coinglass’ long-to-short ratio of DOGE is 0.955 on Tuesday, which is approaching the monthly high. The above ratio indicates that more traders believe in the Dogecoin price rallying.

DOGE Long/Short Ratio: CoinGlass

DOGE Long/Short Ratio: CoinGlass

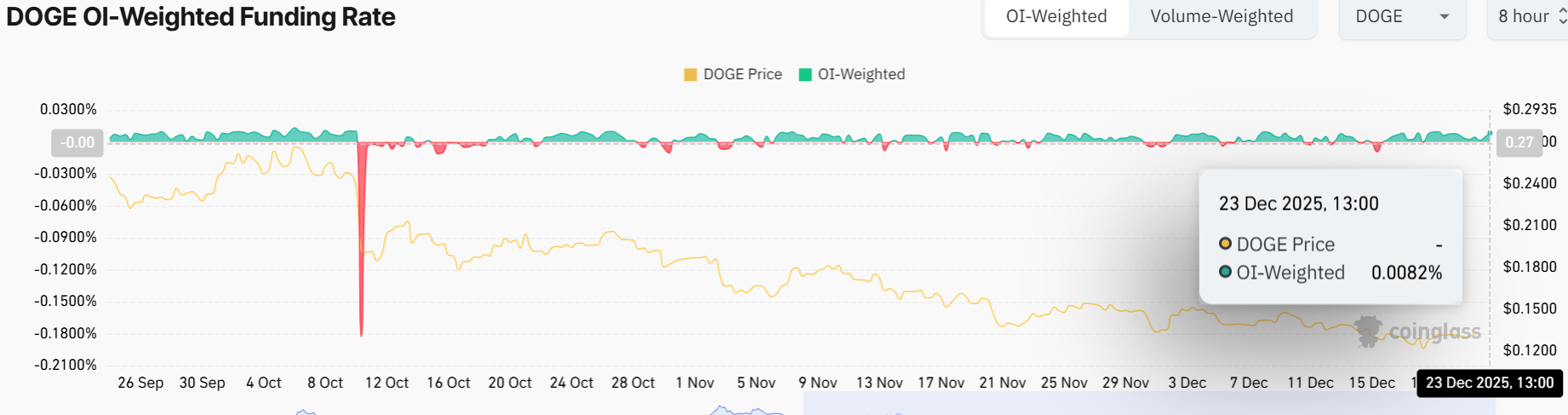

Also, the data on the funding rate of Dogecoin suggests a possible rally. OI-Weighted Funding Rate data of Coinglass shows that fewer traders are betting that the price of DOGE will fall further than those who bet that the price will rise.

DOGE OI-Weighted Funding Rate: CoinGlass

DOGE OI-Weighted Funding Rate: CoinGlass

The indicator has reversed to a positive rate and is currently at 0.0082% on Tuesday, which shows that the longs are paying the shorts. Often, whenever the funding rates have changed to positive after being negative, Dogecoin has had a strong response in terms of price increase.

DOGE Targets $0.14 Breakout as Bullish Momentum Mounts

The Dogecoin price chart shows that bulls are holding the line above key support at $0.12, currently trading at $0.13. After breaking below the 50-day simple moving average at $0.14 and the 200-day at $0.19, DOGE has found temporary support around $0.12. The next strong support is marked near $0.10, with a historical floor down at $0.085.

Indicators suggest the coin is regaining momentum, with the Relative Strength Index sitting at 41.77. It has rebounded from the oversold region, signalling strength among bulls. Additionally, the MACD indicator has flipped bullish, indicating the possibility of more upside action in the DOGE price. The blue MACD line has flipped above the signal line, signaling traders to buy more DOGE tokens.

DOGE/USD 1-day chart: TradingView

DOGE/USD 1-day chart: TradingView

The recent price action shows that the $0.088 level remains a structurally strong support zone for Dogecoin. On the upside, resistance levels are clearly defined at $0.14 and $0.19. Both of these barriers have repeatedly rejected bullish attempts in previous rallies. A confirmed breakout and close above the first resistance at $0.14 would open the door for a potential move toward the secondary resistance near $0.19, where sellers have historically been active.

However, failure to hold above the $0.14 barrier could trigger renewed downside pressure, increasing the probability of another retest of the $0.12-$0.10 demand zone. For now, technical indicators lean slightly bullish, with volume expansion supporting a potential upside.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

“Oversold” Solana Mirroring Previous Bottoms

XRP Takes Hit as Whales Sell 1 Billion Coins, But Pro-Ripple Attorney Says XRP Will ‘Shock the World in 2026’