Bitcoin Critical Holders’ Profit Crashes To Monthly Low: Will Price Further Suffer?

Bitcoin has shown mixed price action in recent sessions, marked by sharp fluctuations and tentative recovery attempts. BTC rebounded after a brief breakdown, yet momentum remains fragile.

A key concern is weakening confidence among one of Bitcoin’s most influential cohorts, which could complicate efforts to sustain a broader price recovery.

Bitcoin Holders Witness A Dip In Gains

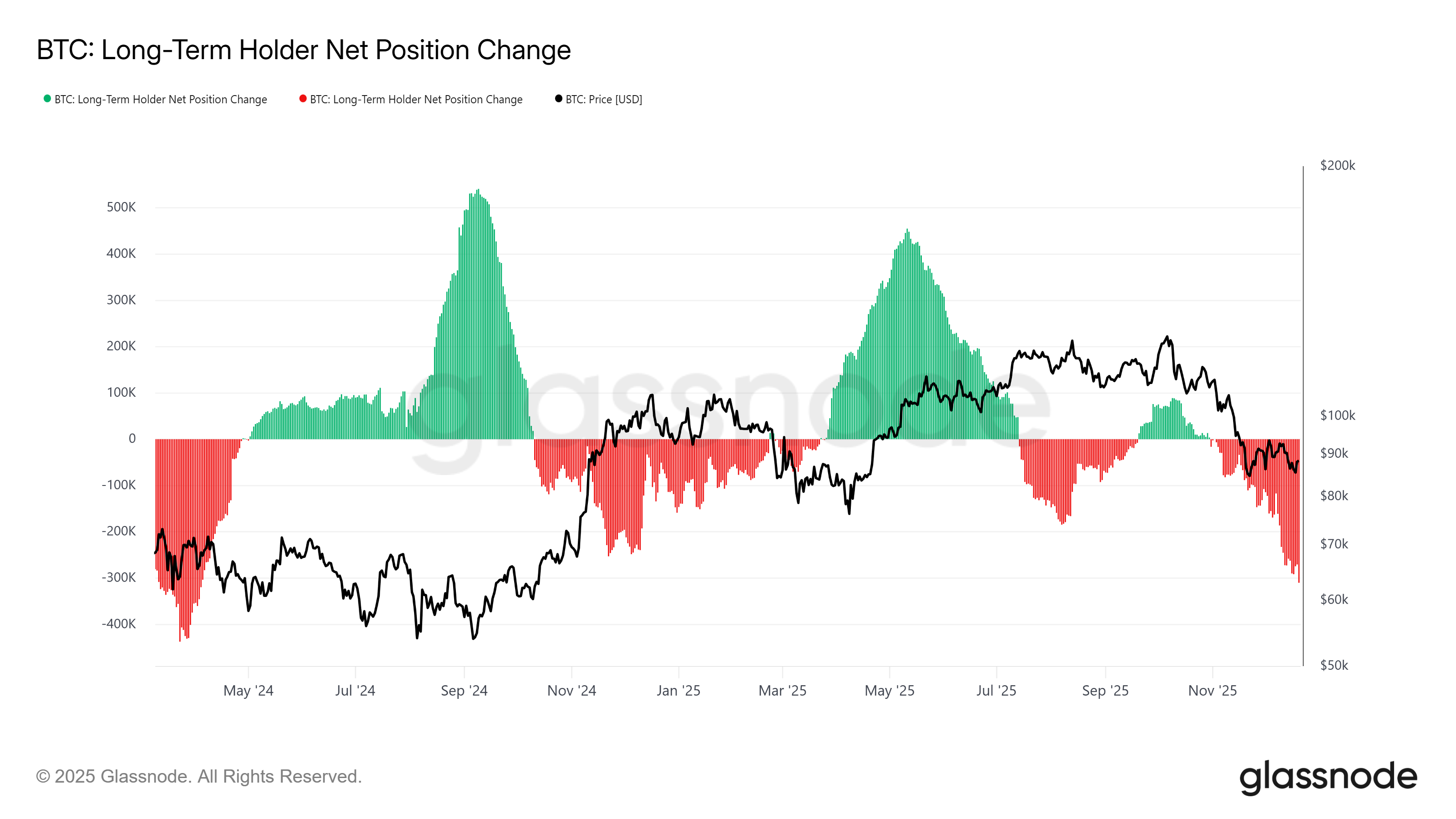

Bitcoin long-term holders have increased selling activity over the past several days. On-chain data shows the 30-day change in long-term holder supply has dropped to a 20-month low.

Similar levels were last recorded in April 2024, signaling elevated distribution pressure.

This behavior suggests long-term holders are reducing exposure to protect remaining gains. As unrealized profits shrink, selling accelerates to avoid losses. Such actions often weigh on price recovery, as supply increases without a matching rise in new demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin LTH Position Change. Source: Glassnode

Bitcoin LTH Position Change. Source: Glassnode

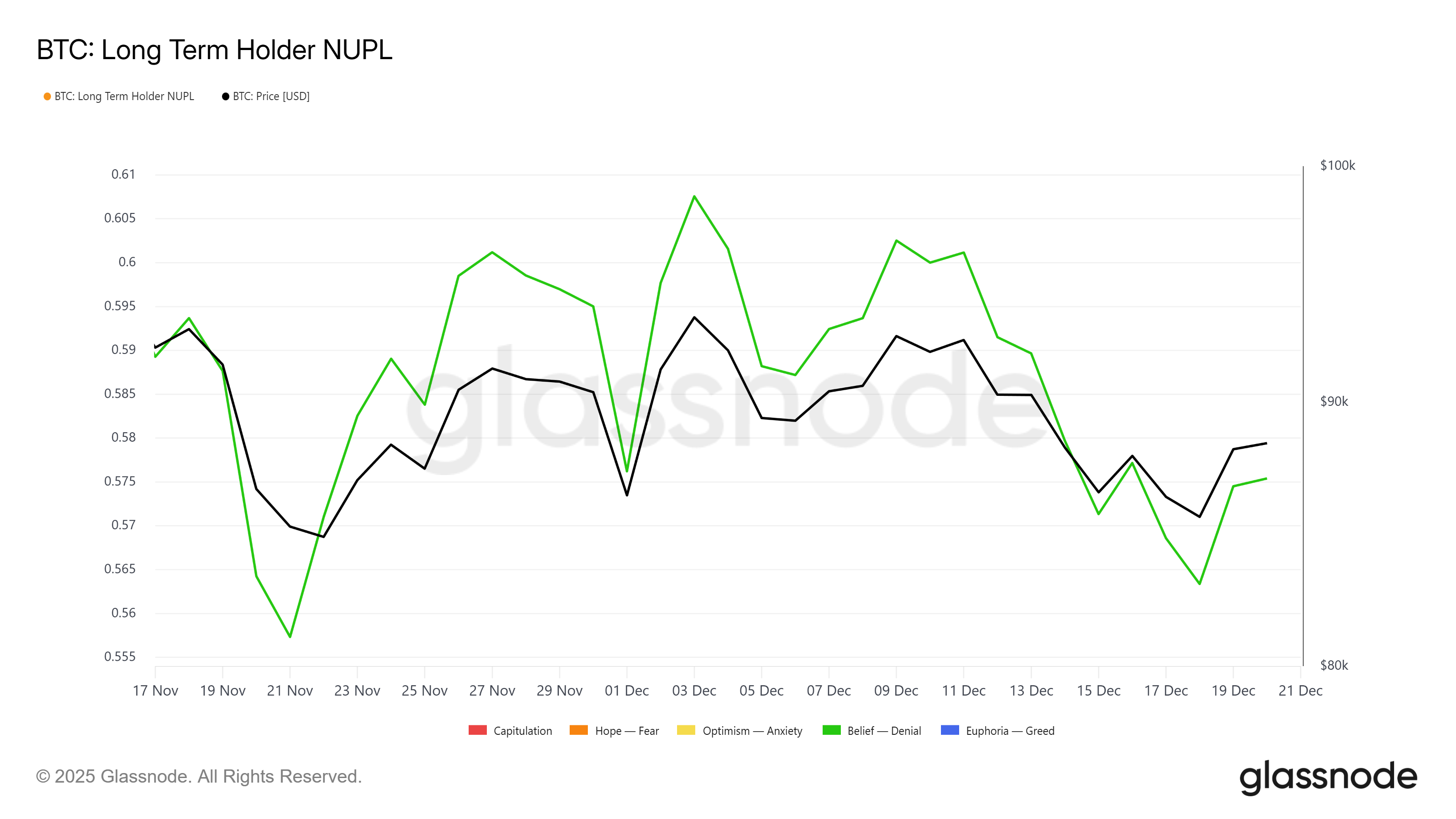

Macro indicators provide additional context. The long-term holder net unrealized profit or loss metric has declined to a monthly low. This drop indicates profits among this group are eroding, increasing sensitivity to further downside moves.

Historically, falling LTH NUPL readings trigger defensive selling. However, once the indicator declines further, selling pressure often slows.

At those levels, long-term holders typically pause distribution, allowing Bitcoin price to stabilize and potentially recover if demand improves.

Bitcoin LTH NUPL. Source: Glassnode

Bitcoin LTH NUPL. Source: Glassnode

BTC Price Is Awaiting Stronger Cues

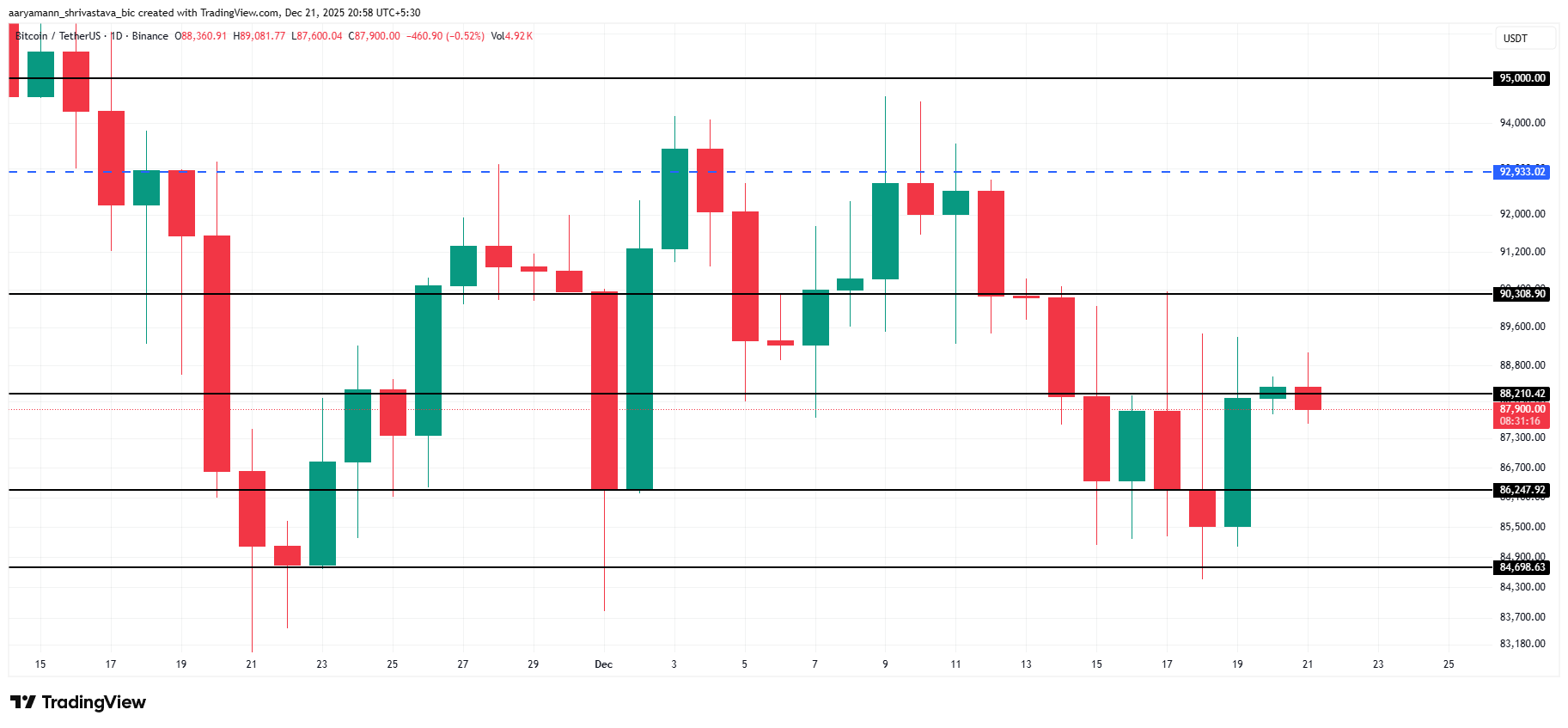

Bitcoin trades near $87,900 at the time of writing, remaining below the $88,210 resistance. The asset recently bounced after briefly slipping under the $86,247 support. This recovery shows buyers are still active at lower levels, though conviction remains cautious.

A short-term climb toward $90,308 remains possible. However, resistance near that level could cap gains. Given ongoing long-term holder selling, Bitcoin may continue consolidating near the $88,201 zone while the market absorbs excess supply.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

Upside potential improves if long-term holders shift their stance. A slowdown in selling could reduce overhead pressure.

In that scenario, Bitcoin may break above $90,308 and target $92,933. Such a move would invalidate the bearish thesis and signal renewed confidence among key market participants.

You May Also Like

How to avoid buying fake products on online marketplaces

Uniswap Fee Switch Set to Take Effect Before New Year