JPMorgan: Stablecoin Boom Tied to Crypto Reality, Not Trillion-Dollar Dreams

- JPMorgan rejects trillion-dollar stablecoin forecasts, projecting a US$500–600bn market by 2028 aligned with crypto growth.

- Most stablecoin expansion remains driven by crypto trading, particularly derivatives and DeFi activity.

- Payments growth alone is unlikely to push supply higher due to competition from tokenised deposits and CBDCs.

JPMorgan has reiterated its position that the stablecoin sector is unlikely to approach a US$1 trillion (AU$1.51 trillion) valuation within the next few years, pushing back against projections that assume rapid decoupling from broader crypto market growth. Instead, the bank expects total supply to reach approximately US$500–600 billion (AU$755–907 billion) by 2028, consistent with earlier forecasts.

The analysts base this view on how supply has expanded so far this year, with the stablecoin market increasing by roughly US$100 billion (AU$151 billion) to exceed US$300 billion (AU$453.5 billion). They note that issuance has been heavily concentrated, with USDT growing by around US$48 billion (AU$72.5 billion) and USDC by about US$34 billion (AU$51.4 billion).

Related: J.P. Morgan Brings Onchain Debt to Solana

Payments Adoption Unlikely to Reshape Supply

According to JPMorgan, this pattern supports its long-standing assessment that stablecoin demand continues to originate largely from within crypto markets rather than external payment adoption. Market participants primarily use stablecoins for trading-related purposes, including derivatives activity, DeFi lending and borrowing, and short-term cash management.

The bank identifies derivatives trading as a particularly important driver, pointing out that exchanges increased stablecoin holdings by approximately US$20 billion (AU$30.2 billion) during the year as perpetual futures volumes climbed. This dynamic, JPMorgan says, explains why supply growth has closely tracked overall crypto market conditions.

Although stablecoins are increasingly used in payments, the analysts argue this does not necessarily require a proportionate rise in supply. They highlight competition from tokenised deposits and central bank digital currencies, which could meet payment needs without expanding the stablecoin market at the same pace.

JPMorgan contrasts its outlook with more aggressive forecasts from other banks but maintains that trillion-dollar projections remain too optimistic while trading-driven demand dominates.

Related: Crypto Market Structure Bill Gains Momentum as Senate Push Accelerates

The post JPMorgan: Stablecoin Boom Tied to Crypto Reality, Not Trillion-Dollar Dreams appeared first on Crypto News Australia.

You May Also Like

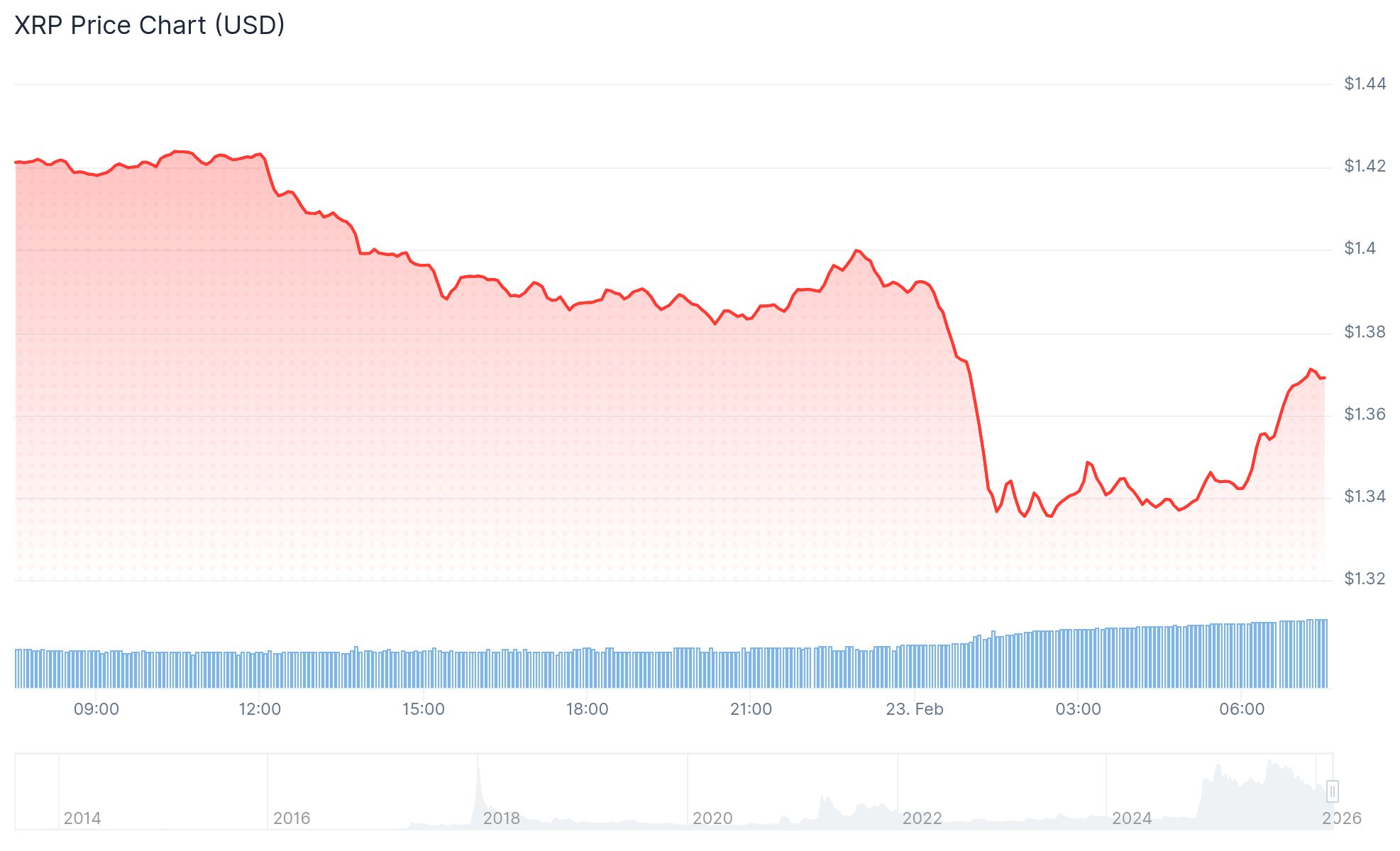

XRP Price Crashed 69% From its Peak

XRP Price: Falls to $1.33 as Realized Losses Hit 39-Month High – Watch These Levels