Best Crypto Gainers to Buy Today, December 18 – Pippin, Midnight, Canton

Highlights:

- Top crypto gainers to buy today include PIPPIN, NIGHT, and CC, each showing strength despite a shaky broader market.

- PIPPIN jumped on Robinhood exposure, pulling in retail traders and boosting liquidity and short-term volatility.

- NIGHT and CC gained on real-world use cases, from privacy tech to tokenized Treasuries backing institutional interest.

The crypto market is on a decline again, despite the brief rally witnessed on Wednesday. Most assets are trading in red, with the global market capitalization dropping by 1.10% to $2.91 trillion. The volatile movement has led to major liquidations, erasing more than $500 million in leveraged positions across the entire crypto futures market, as per Coinglass data. However, several assets have displayed resilience by recording gains amidst this decline. In the section below, we will discuss the top crypto gainers to buy today, such as pippin, Midnight, and Canton.

Top Crypto Gainers to Buy Today

1. PIPPIN

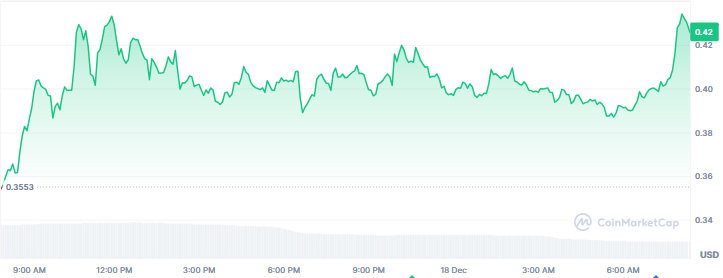

Pippin has become one of the standout performers among low-cap assets this month, with a surge of 1400%. Today, it has emerged as the top crypto gainer with a gain of 16% to trade at around $0.42. Its market cap and trading volume stand at around $400 million and $60 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

PIPPIN’s recent surge has been attributed to Robinhood listing the token on 17 December for crypto trading. The listing places PIPPIN alongside Bitcoin and Ethereum, increasing exposure in a mainstream investment platform. As a result, millions of retail investors are exposed to a popular mobile trading application.

Robinhood furthermore facilitates fractional trading, which allows access among its 23 million users with limited capital. Historically, these types of listings boost awareness, liquidity, and short-term retail participation. Meanwhile, zero-commission trading promotes high volume, regularly increasing the price volatility.

2. Midnight (NIGHT)

After posting a 25% rally on its weekly chart, Midnight is back on track again today with a 7.30% surge over the last 24 hours. NIGHT surged from lows of $0.05895 to highs of $0.06704 before retracing to $0.06364. Meanwhile, its market cap has climbed to $1.06 billion despite the trading volume declining by 25% to $1.13 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Midnight and Creditcoin recently established a collaboration to overcome AI deepfakes with decentralized identity systems. The project combines on-chain credit history with zero-knowledge verifications in the case of personal verification. Privacy architecture is offered by Midnight, while verifiable financial behavior records are offered by Creditcoin. Collectively, they propose human authentication without revealing sensitive personal documents.

Additionally, consumers are able to attest to repayment reliability without disclosing extensive histories, enhancing access to global finance in the world. NIGHT can be used in private computation using DUST, which can affect long-term network demand. Charles Hoskinson’s Midnight aligns with Cardano research, whereas Creditcoin anchors trust through behavior data.

3. Canton (CC)

Canton has emerged as the third top crypto gainer today with a surge of 6% on the daily chart. This latest surge has elevated the weekly gains to 3% despite the altcoin being down by 30% on the monthly chart. As of this writing, the price is hovering around $0.07610, with a market cap of $2.75 billion.

Source: CoinMarketCap

Source: CoinMarketCap

DTCC has chosen Canton Network to pilot tokenized U.S. Treasuries on a private blockchain. The initiative focuses on the security of trading and seeks to address the issues of confidentiality in the digital markets. The pilot is scheduled for early 2026 on the ComposerX issuance platform by DTCC. Moreover, the project will be the first effort by DTCC to mint Treasury assets through a Layer 1 network.

Canton Network provides selective disclosure to reduce the visibility of the data among approved market participants. Yuval Rooz, the CEO of Digital Asset, stated that through treasury trading, sensitive positions are exposed in public blockchains.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam

MSCI’s Proposal May Trigger $15B Crypto Outflows