Best Crypto to Buy Now: Bitcoin Price Prediction

Despite the near-term weakness, Bitcoin’s price action continues to suggest a consolidation phase rather than a structural breakdown, shaping the current Bitcoin price prediction around a period of base-building before a larger directional move.

Previous cycles show that similar pullbacks driven by macro uncertainty have often resolved higher once liquidity conditions stabilize and risk appetite returns. If inflation data continues to cool and financial conditions ease, Bitcoin could recover toward prior resistance zones later this year.

In that context, the best crypto to buy now is increasingly defined by networks showing measurable demand, rising transaction activity, and clear economic incentives, rather than speculative momentum alone.

Bitcoin Faces Pressure: Japan’s Rate Hike Sends Ripples Through Crypto

Bitcoin faced downward pressure from multiple factors, with no single catalyst driving the move, and prices may remain under stress in the near term. The largest macro influence came from Japan, where markets anticipated a Bank of Japan rate hike to historic levels later this week.

Even a modest hike matters because Japan has long driven global risk markets through the yen carry trade. For years, investors borrowed cheap yen to buy higher-risk assets like equities and crypto. As Japanese rates rise, that trade unwinds. Investors sell risk assets to cover yen liabilities.

Bitcoin has reacted sharply to past BOJ hikes, falling 20% to 30% in the weeks after the last three decisions. Traders priced in that historical pattern ahead of the move, pushing Bitcoin lower in advance.

Traders reduced risk ahead of key U.S. macro data, including inflation and labor reports, while the Federal Reserve signaled cautious pacing after its recent rate cut. This uncertainty impacts Bitcoin, which now reacts more to liquidity and macro conditions than as an independent hedge.

With inflation above target and jobs data expected to soften, markets hesitated on the Fed’s next move. That caution slowed speculation, and Bitcoin lost momentum near key technical levels.

Strategy Inc. Doubles Down on Bitcoin While Prices Drop

Bitcoin dropped as much as 7.21% to around $85,300 over the past seven days. It briefly recovered earlier this week, on Wednesday, December 10, reaching around $94,000 before retreating to its current level. The crypto asset remains down roughly 30% from its all-time high above $126,000.

Bitcoin’s decline has mirrored other risk assets in recent weeks, reflecting what analysts describe as a market under pressure from weak liquidity and reduced risk appetite, even after last week’s Federal Reserve rate cut.

Despite this, Michael Saylor’s Strategy Inc. continued its Bitcoin purchases. The digital asset treasury firm reported on Monday that it acquired nearly $1 billion in Bitcoin for the second week in a row.

Most of these recent purchases were funded through at-the-market sales of its Class A common stock, which critics argue may dilute existing shareholder equity and diminish the premium previously supported by its roughly $50 billion Bitcoin holdings.

Bitcoin Price Prediction

Bitcoin is approaching a historically strong support zone around the mid-$80,000 range, where a short-term bounce is possible, though a slightly deeper dip may be needed to trap short positions before a meaningful reversal occurs.

The market remains relatively stable despite occasional bearish pressure, providing opportunities for buyers near key support levels. Technical indicators point to potential moves toward $90,000 to $91,000, filling gaps and single prints from previous sessions.

On higher time frames, Bitcoin is expected to continue consolidating until a decisive breakout occurs, potentially around the holiday period when liquidity may be lower.

Top Crypto to Buy Now: Promising Early-Stage Meme Coin Presales

While most altcoins remain highly correlated with Bitcoin, early-stage presale tokens are showing strong independent potential based on their funding momentum and market interest.

Below are two meme coin presales that have raised millions in funding and are recognized by many as the best crypto to buy now.

Bitcoin Hyper (HYPER)

Bitcoin Hyper, a new layer 2 upgrade for Bitcoin, is gaining significant attention as it raises nearly $30 million during a period of widespread market fear. The project is designed to enhance Bitcoin’s usability by enabling near-instant transactions on its layer 2 network.

This approach addresses Bitcoin’s long-standing limitation of slow transaction speeds, allowing applications and payments to operate efficiently without congesting the base layer.

Source – ClayBro YouTube Channel

Analysts highlight that Bitcoin Hyper provides a practical solution for Bitcoin to move, circulate, and scale within a high-speed environment, effectively giving the network room to function as a living economic ecosystem.

Current prices remain accessible for early-stage investors, and the layer 2 network could significantly increase Bitcoin’s real-world utility. Market interest continues to grow as adoption and community engagement expand.

Visit Bitcoin Hyper

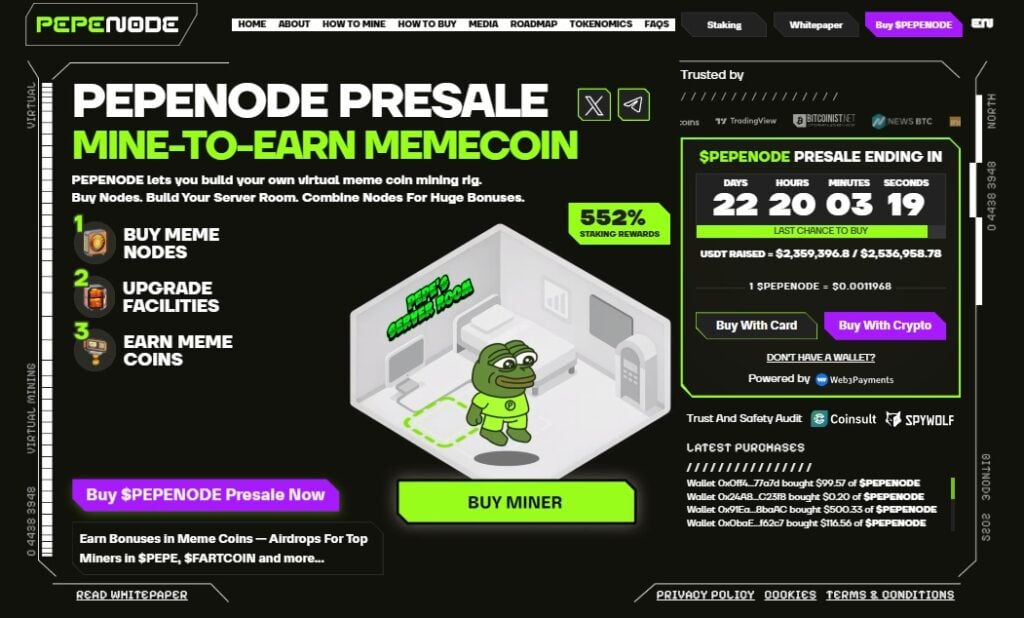

Pepenode (PEPENODE)

Pepenode has emerged asone of the best crypto to buy now, gaining attention for its innovative presale and in-game utility mechanics. The project combines mine-to-earn GameFi features with meme coin elements, allowing users to build virtual server rooms, purchase nodes, and engage in competitive mining for bonuses.

Its presale has already raised nearly $2.5 million, reflecting strong investor interest, with staking offering annualized returns of around 550%. Despite a broader market dominated by fear and muted altcoin performance, Pepenode stands out for its potential during speculative market upswings.

The combination of funding momentum, gaming utility, and staking incentives positions it as a prominent early-stage altcoin to watch. Market sentiment may drive further growth as fear transitions to greed.

Visit Pepenode

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income

US Senate Democrats plan to restart discussions on a cryptocurrency market structure bill later today.