Ukraine Tops Global Ranking for Stablecoin Activity Relative to GDP

- A new ranking shows which countries are shaping the centre of the crypto economy in 2025.

- According to the study, Ukraine topped the ranking of countries in terms of the use of stablcoins relative to GDP.

Ukraine has become the world leader in terms of the ratio of the volume of transactions with stablecoins to GDP and the indicator of their practical use. This follows from the global ranking of World Crypto Rankings for 2025, prepared by the analytical company DL Research in partnership with the Bybit exchange.

The study analysed 79 countries and territories based on 28 metrics and 92 datasets. Experts examined the level of retail usage, institutional readiness, regulatory environment and the development of onchain infrastructure.

This approach, according to the experts, allows them to assess not only the scale of the market, but also the sustainability of cryptoecosystems in different jurisdictions.

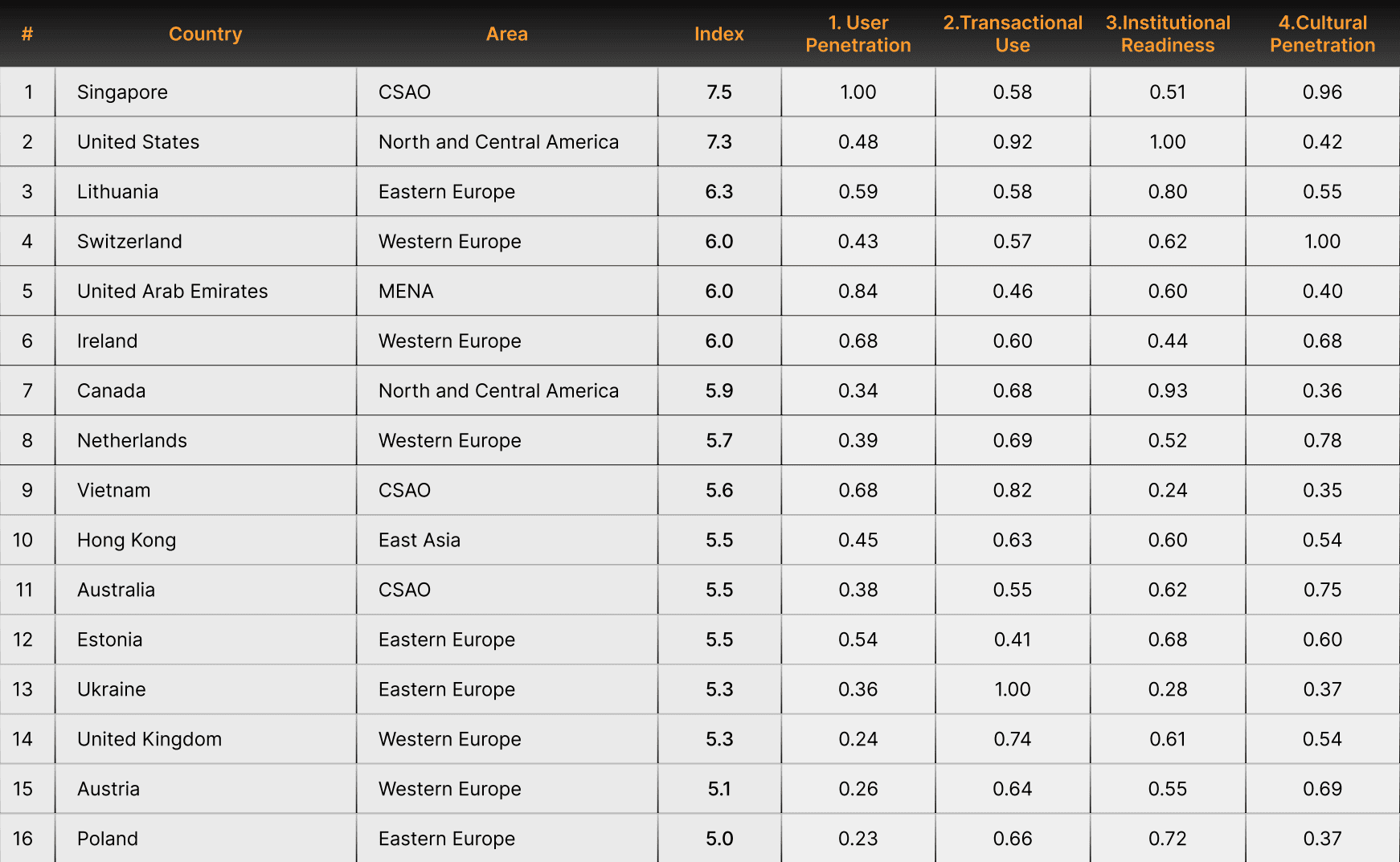

Top 16 countries in the ranking of cryptoasset adoption. Data: DL Research.

Top 16 countries in the ranking of cryptoasset adoption. Data: DL Research.

The leader of the ranking was Singapore, where digital assets are integrated into the financial system due to transparent licensing and a high level of public trust. The US ranked second due to institutional capital, ETF approval and dominance in the DeFi and centralised trading segments.

The top five also included Lithuania, Switzerland and the UAE, each of which has shaped its own implementation model. Ukraine placed 13th, ahead of countries such as the UK, Austria and Poland.

The report emphasises that the high level of cryptocurrency adoption is most often related to the quality of regulation and maturity of financial institutions, rather than the scale of the economy. European and Asian financial centres are showing steady growth due to clear regulations and a focus on international markets, according to experts.

The study pays special attention to stablecoins, which have become the most mass crypto-product in the world. They are used for cross-border payments, remittances, access to DeFi and protection against currency volatility.

At the same time, more and more countries consider the issuance of stablecoins in national currencies as an element of financial sovereignty.

This is also reflected in the structure of global steiblcoin flows. Ukraine ranked first in the world in terms of the ratio of the volume of transactions with stablecoins to GDP, ahead of Nigeria and Georgia.

Such an indicator points to the high practical role of stablecoins in the country’s economy — primarily in transfers, savings and cross-border settlements.

Ratio of stablcoin transactions to GDP in different countries. Data: DL Research.

Ratio of stablcoin transactions to GDP in different countries. Data: DL Research.

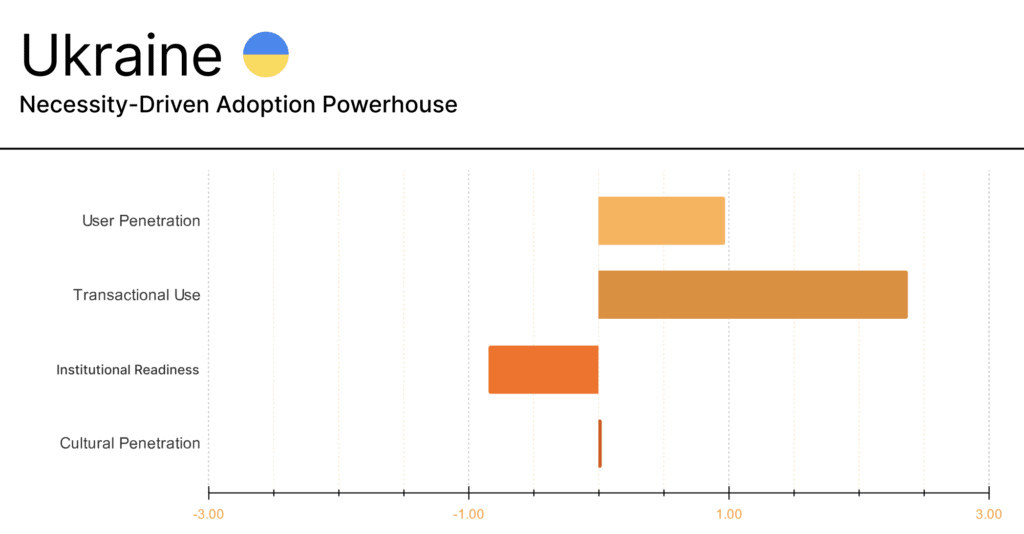

In addition, Ukraine ranked first in the world in terms of practical use of stablcoins (Transactional Use) and demonstrates high values of transaction volume both on centralised exchanges (CEX) and in the DeFi segment, the report said.

According to analysts, Ukraine’s position as one of the leading countries in the use of stablecoins is «directly related to the crisis».

Profile of cryptocurrency adoption in Ukraine. Data: DL Research.

Profile of cryptocurrency adoption in Ukraine. Data: DL Research.

Note that Ukraine also ranked first in Chainalysis’ population-adjusted ranking of cryptocurrency adoption and eighth overall. The study covered 151 countries and took into account the use of various crypto services, from centralised exchanges to DeFi solutions and institutional activity.

In parallel, the tokenisation of real assets is accelerating. The onchain value of RWAs excluding stablecoins has grown by more than 60 per cent since the beginning of the year, reflecting the shift from pilot projects to systemic integration of blockchain into capital markets.

Countries with high institutional readiness and developed legal frameworks are benefiting the most, the analysts emphasised.

Onchain salaries have become another sustainable trend. The share of professionals receiving income in cryptocurrency has more than tripled in a year, with the vast majority of payments being made in stablecoins. This reduces the costs of cross-border settlements and makes cryptocurrency part of everyday financial life, experts believe.

The authors of the report note that by 2026, states that have managed to create a clear regulatory framework and supporting infrastructure will have a structural advantage. On the contrary, overly cautious approaches may lead to an outflow of capital, talent and innovation to more flexible jurisdictions.

The global adoption of cryptocurrencies is increasingly defined not by individual metrics, but by a combination of regulation, infrastructure and actual use, the analysts concluded.

You May Also Like

The Benefits of 40ft Shipping Containers and Passport Solutions

Upward pressure expected – UOB