China leads global crypto mining ranking as US dominance grows- report

A recent November 2025 report from ApeX Protocol offers a fresh snapshot of the global geography of crypto mining. According to the study, the world’s top ten mining nations continue to shape the bulk of global production, with surprising findings about energy efficiency, mining pressure on power grids and potential room for growth.

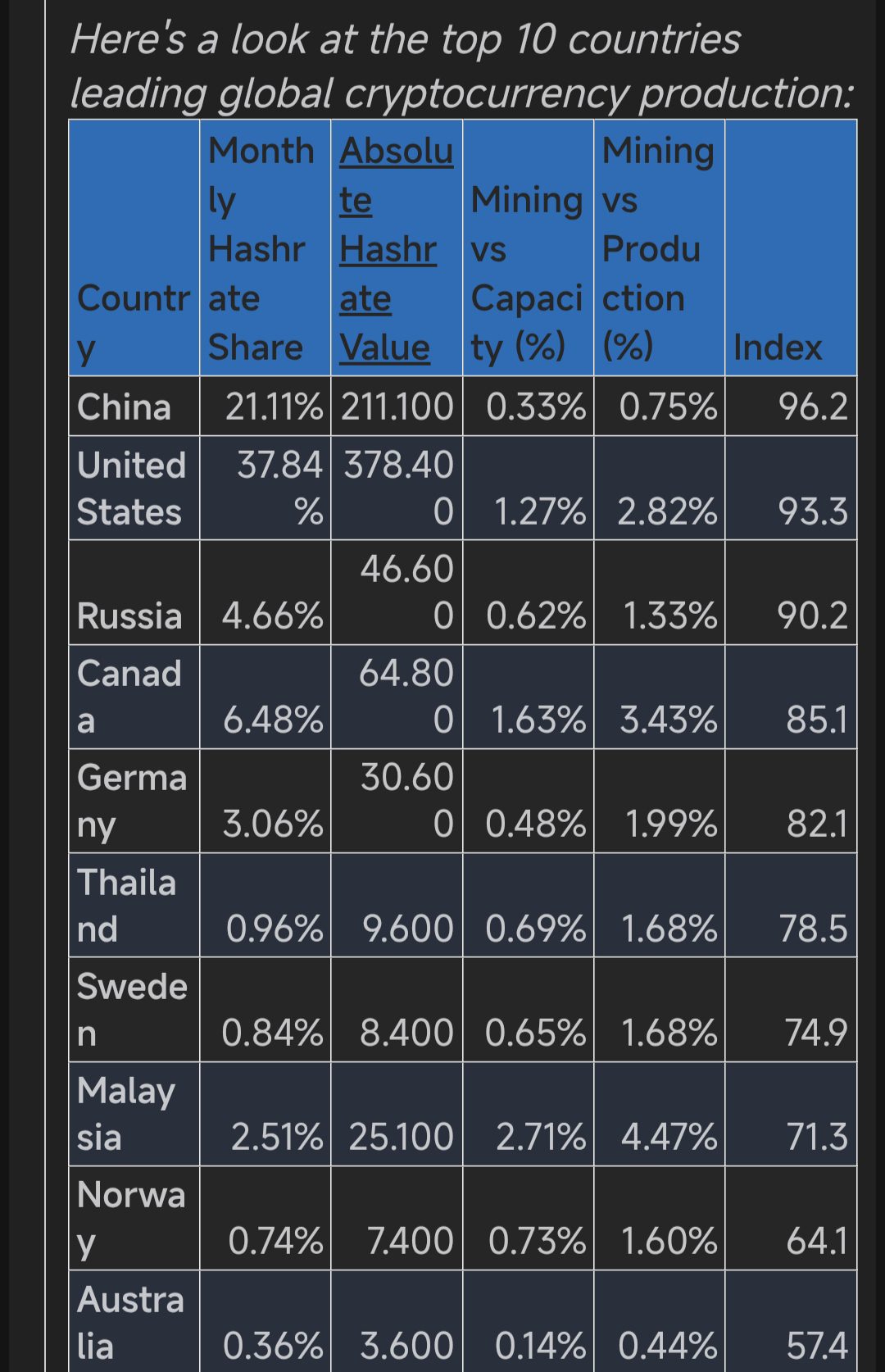

At the top of the ranking is China, producing 21.11 per cent of the global monthly hashrate. What stands out is the country’s efficiency. China reportedly uses just 0.33 per cent of its total electricity capacity for mining operations.

Even compared to overall national electricity production, crypto mining consumes a paltry 0.75 per cent, despite China having the highest total electricity generation in the study. With a final “ApeX index” score of 96.2, China remains the world’s leading crypto producer and, according to the report, has room to expand further without overtaxing its grid.

Top ten crypto-producing countries

Top ten crypto-producing countries

Closely behind is the United States, responsible for 37.84 per cent of the global monthly hashrate share, more than a third of all global crypto mining activity. That makes the US the biggest crypto-mining nation in absolute terms.

However, this comes with a heavier impact on electricity systems: mining in the US accounts for 1.27 per cent of electricity capacity and 2.82 per cent of total power production. With a final index score of 93.3, the US remains a powerhouse, but the strain on infrastructure is clearly higher than China’s.

Also read: Crypto mining: Africa is missing out on a key pillar of the global digital economy

Other players: Russia, Canada, Germany and more

Russia takes third place with 4.66 per cent of global crypto mining output. Russian operations consume only 0.62 per cent of total electricity capacity, or 1.33 per cent of production, yielding an index score of 90.2.

Canada ranks fourth, contributing 6.48 per cent of the global hashrate while using 1.63 per cent of its electrical capacity, equal to 3.43 per cent of its total power production. That produced a score of 85.1.

In Europe, Germany leads with a 3.06 per cent share of global mining. German miners use just 0.48 per cent of the country’s electricity capacity, representing 1.99 per cent of national production. The country attained an index score of 82.1, cementing its place as the continent’s most efficient mining hub.

Beyond the top five, the report highlights several emerging or efficient mining nations. Malaysia, for instance, devotes nearly 5 per cent of its electricity production to mining, among the highest rates globally.

With 2.51 per cent of the global hashrate, Malaysia earned a 71.3 index score, showing how smaller economies can attract mining activity through heavy energy dedication. Other countries in the top ten include Sweden, Thailand, Norway and Australia, each with modest hashrate shares but varying energy-use patterns and grid impact.

What the data reveal, and why it matters

The study by ApeX Protocol evaluated countries across four metrics: share of global mining activity; total computing (hash) power; electricity-use efficiency; and stress on national power grids.

The final index reflects each country’s ability to balance large-scale production with grid stability. Under that lens, China’s mining machine stands out. Producing over a fifth of global crypto while using only a fraction of its power capacity gives it a clear edge.

The United States, while the largest in absolute mining terms, seems to carry a greater energy and infrastructure burden. Russia and Canada offer mixed models, combining decent output with moderate energy consumption.

Meanwhile, smaller or emerging mining nations such as Malaysia show how mining can take root in unexpected places, though their high proportion of energy production dedicated to mining raises questions about sustainability and grid stress.

Crypto mining by location

Crypto mining by location

Apex Protocol’s spokesperson noted that crypto mining “has become a serious economic sector that governments can’t ignore anymore.” The study underscores how even relatively small countries can influence the global mining landscape if they channel sizeable portions of their energy grids toward mining operations.

Yet that kind of energy dedication inevitably pushes up pressure on national power infrastructures, making it imperative for regulators to keep systems of checks and balances in place.

At a moment when energy policy, climate concerns and geopolitics increasingly shape the future of crypto, this report offers a clear barometer. It reveals where large-scale mining thrives, where it risks overburdening systems, and where there may still be room for growth, setting the stage for fresh competition among mining hubs and fresh scrutiny by regulators.

You May Also Like

Unlock Potential: OKX Lists LIGHT Perpetual Futures with 50x Leverage

New Gold Protocol's NGP token was exploited and attacked, resulting in a loss of approximately $2 million.