NYSE Breaks New Ground: Trump Media’s Crypto ETF Eyes Listing

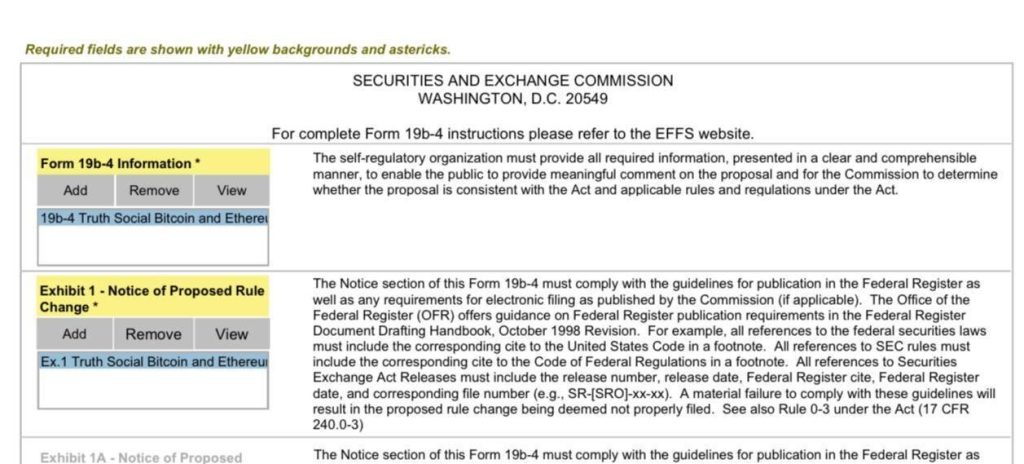

NYSE Arca has officially submitted a rule change proposal (SR-NYSEArca-2025-45) to the U.S. Securities and Exchange Commission (SEC), seeking approval to list the Truth Social Bitcoin and Ethereum ETF.

The dual-asset fund, introduced last week by Trump Media & Technology Group (TMTG), seeks to provide direct exposure to both Bitcoin and Ether within a single investment vehicle.

Source: NYSE

Source: NYSE

The application, filed via SEC Form 19b-4, represents the next step following the ETF’s initial prospectus submission, which proposed a 3-to-1 value allocation favoring Bitcoin over Ether.

If approved, the ETF would trade under NYSE Arca Rule 8.201-E, which governs commodity-based trust shares.

NYSE Seeks Rule Change to List Trump Media’s Bitcoin-Ethereum ETF

As outlined in the filing, the fund is sponsored by Yorkville America Digital, LLC, with digital asset custody managed by Foris DAX Trust Company.

Notably, pricing transparency will be provided through benchmark rates supplied by CF Benchmarks, a standard provider used in other SEC-approved ETFs.

And also, the daily NAV, total holdings, and intraday indicative values will be published, with updates every 15 seconds during market hours.

The fund’s creation and redemption process will occur in-kind, in blocks of 10,000 shares through authorized participants. This model allows the trust to deliver and receive Bitcoin and Ether directly, reducing potential tax implications and improving pricing efficiency.

To meet SEC expectations for investor protection, NYSE Arca emphasized its membership in the Intermarket Surveillance Group (ISG) and cited reliance on market data from CME’s Bitcoin and Ether futures markets for pricing accuracy and fraud detection.

The exchange also reaffirmed that it can apply existing market safeguards such as trading halts and compliance monitoring.

NYSE Arca further emphasized that existing frameworks are sufficient to detect and prevent potential fraud or manipulation in the crypto markets.

The proposed rule change must now go through the SEC’s formal review process. Once published in the Federal Register, the agency will open a comment period. The SEC will then decide to approve, reject, or extend the review timeline.

If granted, the Truth Social Bitcoin and Ethereum Trust would be one of the first U.S.-listed ETFs to offer simultaneous exposure to both Bitcoin and Ether. The move follows the SEC’s earlier approval of single-asset Bitcoin or Ethereum ETFs from BlackRock, Fidelity, and others.

Trump Media Expands with Crypto ETF Ambitions

This is not the only ETF in development. Earlier this month, NYSE Arca also filed to list the Truth Social Bitcoin ETF, which would hold Bitcoin exclusively. Both products are part of Trump Media’s broader push into digital assets.

The company has announced plans to repurchase up to $400 million of its own shares and raised $2.32 billion through a private placement to establish a Bitcoin treasury. As of late May, $2.4 billion has been raised, though no acquisitions have yet been disclosed.

Trump Media, which owns the Truth Social social platform, streaming service Truth+, and fintech brand Truth.Fi, has proposed additional funds, including the America First Bitcoin Fund and the America First Stablecoin Income Fund.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale