Ethereum Price Signals Bullish Rebound Amid Rising Odds for a 25bps Fed Rate Cut in December

The post Ethereum Price Signals Bullish Rebound Amid Rising Odds for a 25bps Fed Rate Cut in December appeared first on Coinpedia Fintech News

Ethereum (ETH) price has signaled a market reversal in the coming weeks. The large-cap altcoin, with a fully diluted valuation of about $352 billion, surged over 5% on Monday, November 24, 2025, to trade at about $2,922 during the mid North American trading session.

Ethereum Price Eyes New ATH Soon

After a heavy bloodbath last week, the Ethereum price opened the last week of November in bullish sentiment. In the weekly timeframe, the ETH price retested and rebounded from a crucial support level around $2,850, which has been established over the years.

As such, the ETH/USD pair is well positioned to rally towards a new all-time high soon. The next major targets for ETH bulls to break through include $3,968 and $4,758.

Main Reasons to Bet for an ETH Rebound Ahead

Exponential drop in exchange balances amid rising capital rotation from Bitcoin

According to market data analysis from CoinGlass, the supply of Ethereum on centralized exchanges has dropped exponentially since mid-August 2025. Historically, a declining supply of ETH on CEXes has been associated with a bullish outlook.

Source: CoinGlass

The notable decline of Ether supply on centralized exchanges has coincided with a potential reversal in Bitcoin dominance. Since the beginning of November, the BTC dominance has dropped from 61% to hover around 58% at press time, thus increasing the odds of an altseason 2025.

Upcoming liquidity injection in the United States amid rising global money supply

The midterm bullish outlook for the ETH price is backed by the expected surge in global liquidity in the coming months. Furthermore, the United States Fed announced that it will kickstart its Quantitative Easing (QE) on December 1, 2025.

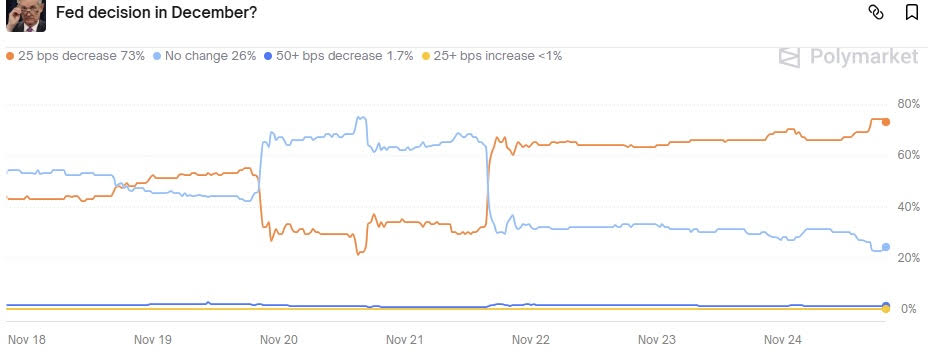

Source: Polymarket

Meanwhile, Polymarket traders are betting that the Fed will initiate another 25 bps rate cut in December. The reopening of the U.S. government earlier this month has provided key economic data to influence monetary policy ahead.

You May Also Like

XRP Confirms Downtrend After $1.50 Breakdown, with $1.15 in Focus

Will Bitcoin Crash Again After Trump Insider Whale Dumps 6,599 BTC?