US Bitcoin ETFs Face $903M Outflow in Record November Sell-Off

- November has become the worst month on record for U.S. Bitcoin ETF outflows, with withdrawals exceeding $3.79 billion so far.

- BlackRock’s iShares Bitcoin Trust (IBIT) accounts for approximately 63% of total ETF redemptions, marking its largest weekly outflow.

- Bitcoin price plunged to $83,400 after nearly $1 billion in ETF outflows, hitting a seven-month low.

- Crypto industry voices warn that recent redemptions and declining digital asset fund inflows could lead to a prolonged bear market.

- Data indicates that Digital Asset Treasuries (DAT) inflows have sharply decreased, signaling waning institutional interest in crypto markets.

US spot Bitcoin ETFs experienced a significant downturn this Thursday, erasing a brief moments of optimism earlier in the week. Following a five-day streak of outflows halted with $75.4 million in inflows on Wednesday, the trend reversed sharply with redemptions totaling $903 million—the largest single-day outflow since these products launched in January 2024, according to industry analysts.

The $3.79 billion withdrawn in November positions this month as potentially the worst on record for Bitcoin ETF outflows, surpassing the previous high of $3.56 billion set in February. If redemptions continue at this pace, the month could become the most adverse for crypto investment funds in recent history.

BlackRock’s IBIT drives majority of outflows in November

BlackRock’s iShares Bitcoin Trust (IBIT) has become the primary contributor to these massive outflows, with $2.47 billion redeemed this month—roughly 63% of total Bitcoin ETF withdrawals. The fund also led recent outflows with $1.02 billion just this week, marking what industry analysts describe as IBIT’s “largest weekly outflow ever,” according to CryptoQuant founder Ki Young Ju.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) ranks as the second-largest outflow source in November, with $1.09 billion withdrawn. Despite smaller than IBIT’s, these redemptions reflect broader liquidity draining across the sector. Cumulatively, IBIT and FBTC account for over 91% of all US spot Bitcoin ETF outflows this month.

Market observers warn that such substantial redemptions could indicate deeper issues in crypto investing, especially as institutional investors pull back amid ongoing regulatory uncertainties and market volatility.

Bitcoin price drops below $83,500 amid record ETF outflows

Following this trend, Bitcoin’s price declined to roughly $83,461, its lowest in seven months, mirroring the $1 billion in ETF redemptions. The decline revisited price levels last seen in April and feeds into growing concerns about the sustainability of Bitcoin’s recent rally.

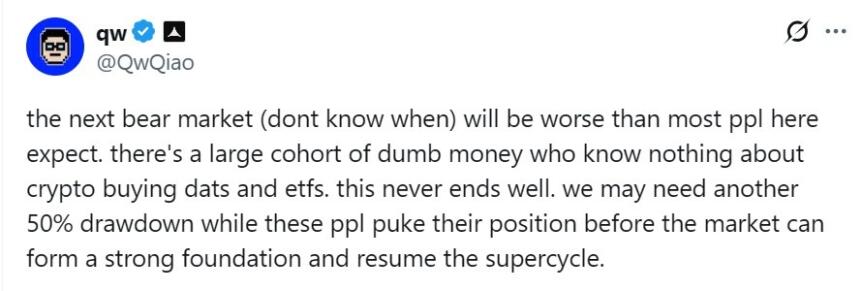

Industry voices caution that this downturn might be just the beginning. Alliance DAO co-founder QwQiao recently warned that the next bear market could be more severe than previous episodes, citing the influx of uninformed retail investors buying into digital assets at ETF channels as a risk factor.

He remarked, “There’s a large cohort of inexperienced traders buying into ETFs and DApps. This pattern often leads to sharp corrections.”

Source: QwQiao

Source: QwQiao

Chris Burniske, co-founder of crypto venture firm Placeholder, echoed these concerns, noting that “The era of digital asset treasuries (DAT) selling has only begun.” He pointed out that the very instruments that helped amplify Bitcoin’s gains may now accelerate its decline, especially if institutional redemptions continue to grow.

Data from DeFiLlama shows that DAT inflows have plummeted to just $505 million in November, marking a sharp drop from September’s $10.89 billion and a significant decline from October’s $1.93 billion. This trend signals waning institutional interest amid market turbulence, with the sector possibly facing its lowest inflow month in 2025.

This article was originally published as US Bitcoin ETFs Face $903M Outflow in Record November Sell-Off on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Bad News for European Crypto Holders? EU Calls For Harsher Crypto Regulation Despite MiCA

Here’s Why This Analyst Predicts Shiba Inu 568% Surge