Floki Eyes Rebound Toward $0.000075 as Open Interest Declines and Market Stabilizes

The token has shown signs of exhaustion among sellers, while derivatives data points to a cooling speculative environment.

As market volatility eases and the asset consolidates near a crucial support zone, attention now turns to whether this pause will form the foundation for a sustained recovery or precede further downside pressure.

Open Interest Data Signals Market Reset

At the time of writing, FLOKI was trading at approximately $0.0000705, recovering slightly after a steep sell-off earlier in the week. According to aggregated derivatives data, open interest dropped from around 3.88M to 3.85M, confirming that several leveraged positions were closed or liquidated during the decline. This reduction highlights reduced speculative activity, as traders retreat to the sidelines following heightened volatility.

Source: Open Interest

Such a decline in open interest typically reflects a “reset” phase, where excessive leverage is flushed out of the market. This process often leads to lower volatility and a period of accumulation, during which buyers assess re-entry levels.

The subdued market participation also suggests that a cleaner foundation may now be forming, one that could support a gradual price recovery if sentiment improves. Still, the muted open interest readings imply that a strong upside breakout remains unlikely until new capital flows into the derivatives market.

Market Data Reflects Weak Momentum but Solid Liquidity

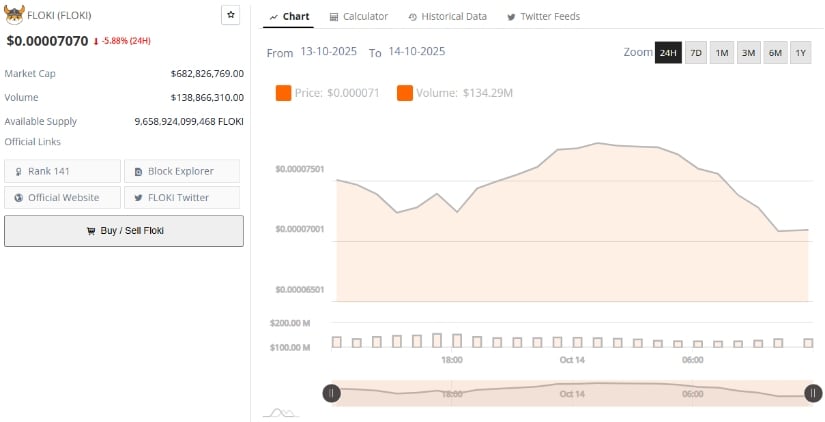

Additional data from BraveNewCoin, FLOKI is currently valued at $0.00007070, down 5.88% in the past 24 hours. The meme-inspired token’s market capitalization stands at $682.82 million, supported by a daily trading volume of $138.86 million and a circulating supply of 9.65 trillion memecoin.

These metrics reveal that, while the token remains highly liquid, it is still struggling to attract strong inflows after the recent sell-off.

Source: BraveNewCoin

The price correction underscores a broader cooling across mid-cap altcoins, where traders have shifted toward defensive positioning. The coin’s position at rank 141 reflects this sentiment shift, though its relatively high volume indicates that underlying market interest remains intact.

If the token can sustain support above $0.00007, it may begin to consolidate and prepare for a modest recovery attempt, with potential upside resistance seen near $0.000075 and $0.000080.

Technical Indicators Suggest Gradual Stabilization

On the other hand, data from TradingView reinforces this stabilization narrative. The chart shows FLOKI holding within a tight consolidation range after a significant red candle, suggesting that selling pressure has weakened.

The Chaikin Money Flow (CMF) currently reads -0.01, indicating marginal capital outflows, while the MACD histogram remains slightly negative, confirming that bearish momentum persists but is weakening.

Source: TradingView

This pattern often precedes a sideways-to-upward move if buyers regain control. Maintaining the $0.00007 support is therefore crucial, as a breakdown below this level could trigger another wave of liquidations. Conversely, a sustained close above $0.000075 could attract fresh interest and potentially pave the way for $0.00008 in the short term.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

XRPR and DOJE ETFs debut on American Cboe exchange