Crypto Market Plunges 10%, Liquidations Hit $19B As Donald Trump Announces 100% Tariffs On China

The crypto market plunged more than 10% after US President Donald Trump announced 100% tariffs on China’s exports starting Nov. 1, triggering $19 billion in liquidations.

Solana slid 16%, XRP 14%, Ethereum 12%, Bitcoin 9%, and Dogecoin 22% as traders rushed to unwind leveraged positions.

Data from CoinGlass showed most of the $19 billion in liquidations came from long positions as markets turned risk-off. One trader estimated that it was ”likely the largest liquidation event, in $ terms, in crypto history.”

Trump’s actions came in response to what he said was an “extraordinarily aggressive” stance by China after it unveiled sweeping export controls on rare earths that are crucial to products from cars to smart phones.

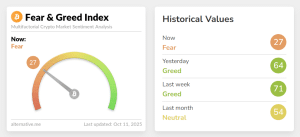

The announcement sent investors fleeing from risk assets as the Crypto Fear & Greed Index collapsed from a “Greed” reading of 64 to a “Fear” level of 27 in a single day as markets braced for an escalating confrontation between the world’s two largest economies.

Crypto Fear & Greed Index (Source: Alternative.me)

“It has just been learned that China has taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1, 2025, impose large-scale Export Controls on virtually every product they make, and some not even made by them” Trump wrote in a post on Truth Social.

He added that the US will also impose export controls on “any and all critical software.” Trump initially indicated he’d pull out of a meeting with China President Xi Jinping. Later, however, he said the meeting was not cancelled but that he did not know whether ”we’re going to have it.”

The S&P 500 stock index dropped 2.7%, the Nasdaq 100 plunged 3.5%, and the price of oil slumped to its lowest level since May. Gold climbed almost 1.5% as investors sought safe-haven assets.

Fears Of A Reignited Trade War See Investors Go Risk-Off

Data from CoinGlass shows that $16.81 billion of liquidations were from long positions, bets that crypto prices would rise. The remaining $2.50 billion was wiped out from short positions.

Trades for crypto market leaders Bitcoin and Ethereum took the largest hits, with $5.36 billion in longs being erased from BTC longs and $3.85 billion wiped out from ETH long positions.

Meme Coin Sector Hammered

The meme coin sector was among the hardest-hit as it market capitalization plunged almost 20% to $57.08 billion. Among the top 10 biggest meme coins, Dogwifhat (WIF) slumped 28%, Floki plunged 22%, and Official Trump, Bonk and Pepe all dropped more than 21%.

Among sub categories measured by CoinMarketCap, Chinese-themed meme coins tumbled 39% while AI-themed memes dropped almost 30%.

You May Also Like

Pi Network Targets Open Mainnet 2026, Millions Prepare as Utility and Migration Accelerate

Bitcoin Rainbow chart predicts BTC price for October 1, 2025