A subsidiary of Dominari Holdings (DOMH), the investment firm with ties to President Donald Trump’s sons, Eric and Donald Jr., is teaming up with Bitcoin programmability project Hemi to progress its digital asset treasury and exchange-traded fund (ETF) plans.

Broker-dealer Dominari Securities and Hemi, which is backed by veteran Bitcoin developer Jeff Garzik, teamed up to develop a digital asset treasury and ETF platform, according to an emailed announcement on Friday.

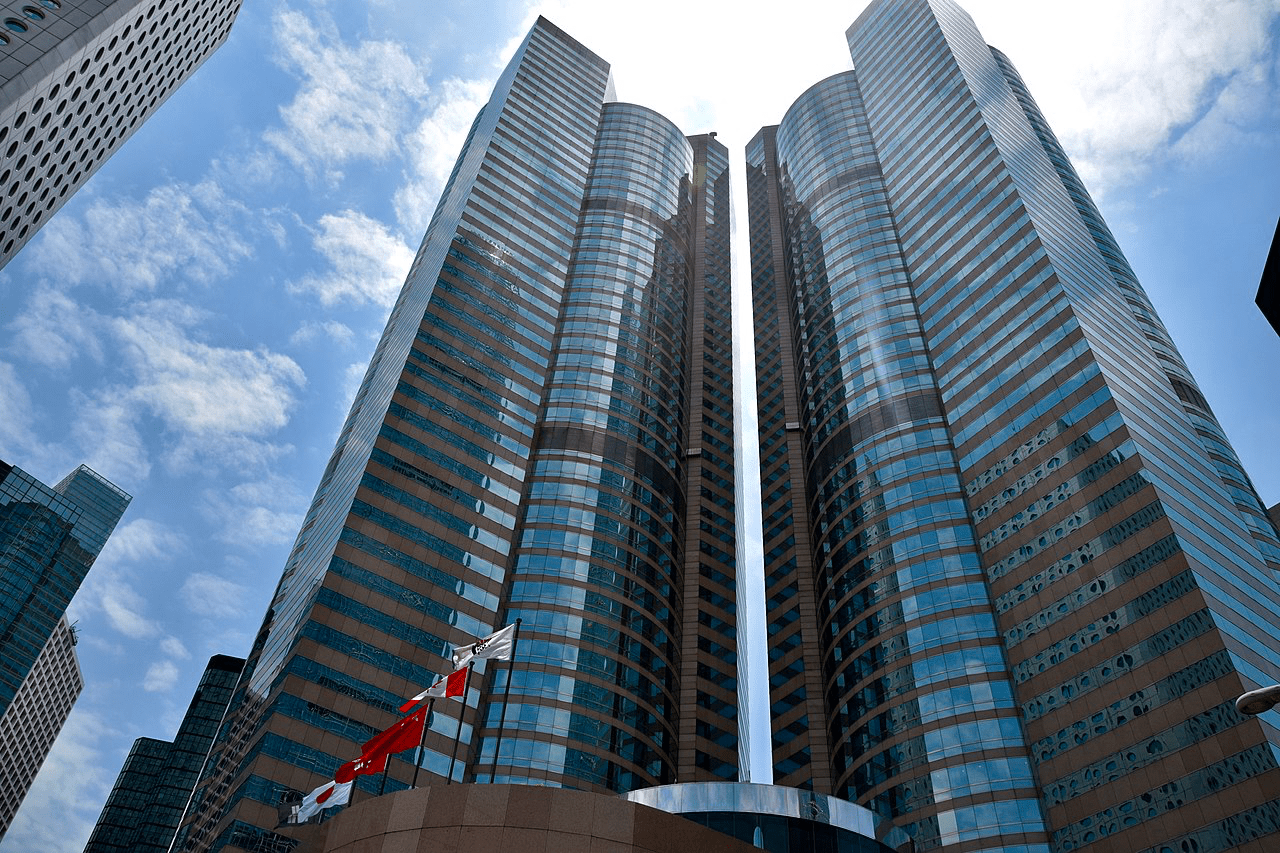

Dominari Holdings is located in the Trump Tower in New York City and counts Eric and Donald Trump Jr. among its investors. They also sit on its board of advisors. In March, the company took a different twist on the method of adopting bitcoin BTC$112,239.62 as a treasury asset, by committing $2 billion to buy shares in BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot bitcoin ETF on the market.

The joint venture between Dominari and Hemi will allow institutions to invest in BTC-centric markets via the HEMI token.

As part of the joint venture American Ventures LLC, of which Dominari is a member, made an undisclosed investment in the Hemispheres Foundation, the principal stewards of the Hemi project.

Hemi’s goal is to transform the possibilities for decentralized finance (DeFi) on Bitcoin by unifying it with Ethereum into a single “supernetwork”. It raised $15 million in funding to expand its ecosystem in August.

Alongside competitors like Lombard, with liquid staking token LBTC, and BOB, a hybrid chain built atop Bitcoin and Ethereum, Hemi is building infrastructure to make Bitcoin more compatible with DeFi, thus harnessing its $2.4 trillion market cap for the betterment of the wider digital asset industry.

Source: https://www.coindesk.com/business/2025/10/10/trump-linked-firm-looks-to-bitcoin-programmability-to-build-btc-treasury-etf-platform