Dogecoin (DOGE) Price Jumps Following Nvidia CEO Comments on Elon Musk Partnership

TLDR

- Dogecoin price jumped 2% after Nvidia CEO Jensen Huang said he wants to follow Elon Musk in everything

- Whales moved nearly $100 million worth of DOGE in the last 24 hours with continued accumulation

- Token hit resistance at $0.26 and pulled back to $0.253 after institutional profit-taking

- Large holders added 30 million DOGE tokens despite the price rejection at resistance

- October 17 is the final deadline for SEC to approve a spot Dogecoin ETF

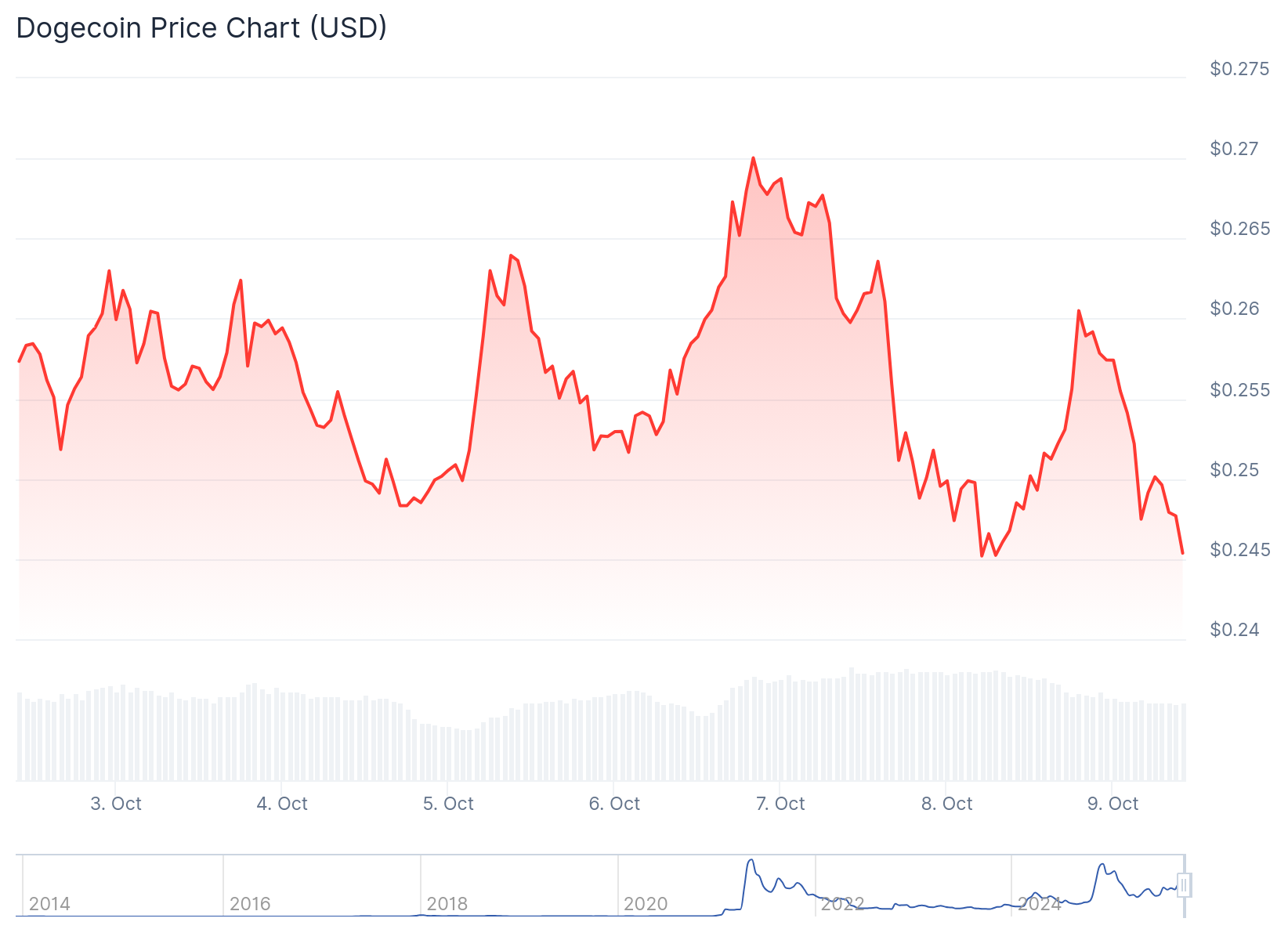

Dogecoin price bounced back 2% in an hour on Wednesday after Nvidia CEO Jensen Huang made comments about Elon Musk. The token is currently trading at $0.253 after recovering from recent lows.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

Huang appeared on CNBC’s “Squawk Box” to discuss Nvidia’s latest $2 billion investment in Elon Musk’s xAI company. The artificial intelligence firm is raising $20 billion after strong demand from investors.

During the interview, Huang said he wants to be part of almost everything Elon Musk is involved in. The Nvidia CEO had previously called Musk the most world-class builder in the country back in September.

The comment triggered speculation about potential connections to the Dogecoin community. Elon Musk has been deeply involved with Dogecoin for years.

Musk allows Bitcoin and DOGE payments for Tesla merchandise on the company website. He also plans to integrate DOGE into the upcoming payments feature X Money.

The billionaire previously tried to boost Dogecoin by naming a government department DOGE (Department of Government Efficiency) in the Trump administration. The price rallied over 300% before he left the role due to political pressure.

Whale Activity Continues

Large holders continue to buy DOGE ahead of the ETF deadline and network upgrades. Whale Alert tracked multiple transactions worth almost $100 million total in the last 24 hours.

One transaction moved 400 million DOGE from Robinhood to an unknown wallet. On-chain data shows large holders added 30 million tokens worth approximately $8 million.

The Dogecoin network recently launched the Cardinals Index Node upgrade. This update improves transaction validation and data indexing speeds.

CleanCore Solutions now holds over 710 million DOGE worth $188 million. This corporate treasury position is one of the largest known holdings.

Price Action and Technical Levels

Dogecoin has recovered 4% in the past 24 hours. The 24-hour low was $0.244 and the high reached $0.255.

The token spiked from $0.25 to $0.26 on 750 million in turnover, double the daily average. Heavy profit-taking at $0.26 reversed these gains and pulled the price back to $0.25.

Trading volume decreased by almost 16% over the last 24 hours. This shows cautious trading ahead of the FOMC Minutes release and Fed Chair Jerome Powell’s speech on Thursday.

Derivatives data shows strong buying activity despite the volume drop. Total DOGE futures open interest jumped 4% to $880 million in the last four hours.

ETF Deadline and Price Predictions

October 17 is the final deadline for the US SEC to approve a spot Dogecoin ETF. Analysts believe approval could trigger a rally to $0.50 in the short term.

Crypto analyst Ali Martinez has been tracking the ETF timeline. Other analysts like Crypto Tony claim the dip to $0.238 creates a perfect zone for the next move up.

Crypto Tony expects Dogecoin to break the $0.29 resistance level. Analyst WIZZ predicts the token could rally to $1 in this cycle based on current accumulation patterns.

Resistance remains at $0.26 after repeated rejections on high volume. Support at $0.25 broke late in the session under liquidation flows, with a 14.6 million surge confirming distribution.

A sustained move above $0.26 would open the path toward $0.27 to $0.30. Traders are watching whether DOGE can quickly regain $0.25 support after the recent liquidation event and if whale accumulation continues to offset selling pressure at resistance levels.

The post Dogecoin (DOGE) Price Jumps Following Nvidia CEO Comments on Elon Musk Partnership appeared first on CoinCentral.

You May Also Like

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

BlackRock Increases U.S. Stock Exposure Amid AI Surge