Bitmine redefines ETH treasury dominance and risk

Bitmine has drawn renewed attention as markets weigh exchange dynamics, treasury posture and evolving regulation. The miner’s ETH position sits at the crossroads of liquidity, market structure and broader blockchain trends.

Bitmine ETH holdings and market context

Bitmine’s visible ETH reserves are part of a broader conversation about how miners and treasuries interact with the crypto market. Observers track holdings because they influence exchange flows, price formation and short‑term volatility. Exchanges and OTC desks react to large movements. That, in turn, affects Bitcoin and Ethereum correlations and the wider DeFi and NFT markets.

Industry sources highlight that miner sales often follow reward cycles. Yet liquidity needs, hedging strategies and operational costs all shape disposition decisions. It should be noted that miners may also use derivatives on regulated venues to mitigate exposure. The combination of on‑chain flows and off‑chain hedges matters for traders and regulators alike.

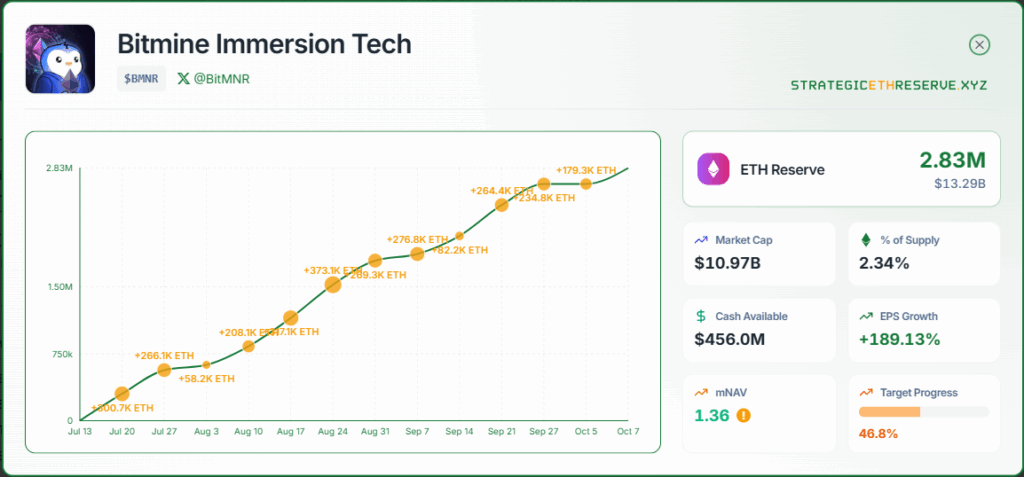

Bitmine Immersion Tech ($BMNR) ETH reserves over time. Source: STRATEGICETHRESERVE.XYZ

Bitmine Immersion Tech ($BMNR) ETH reserves over time. Source: STRATEGICETHRESERVE.XYZ

Largest Ethereum treasury: scale and risks

When a miner or operator controls a significant portion of ETH, it becomes a de facto market participant with outsized influence. Such holdings can amplify market moves during periods of stress. Regulators and market participants watch for concentration risks, counterparty exposures and the potential for rapid unwinding.

From a corporate perspective, the priorities are clear: preserve liquidity, enforce robust custody, and report transparently. An EEAT reviewer emphasized treasury practices, which underpins many firms’ frameworks:

BMNR daily trading volume and liquidity patterns

Trading volume metrics, such as BMNR daily trading volume, are a proxy for market depth and resilience. Higher volumes generally reduce price impact for large trades. Conversely, thin order books can turn routine liquidations into larger price dislocations.

Market makers and exchanges respond to shifts in volume swiftly. They widen spreads or throttle risk when flows spike. That behaviour has implications for institutional participants and for retail investors accessing DeFi protocols or centralized exchanges.

You May Also Like

Pi Network Tech Upgrade Unlocks Mainnet Migration for 2.5 Million Users and Introduces Palm Print Security

PayPal P2P, Google AI Payments, Miner Pivot — Crypto Biz