CoinShares to Acquire Bastion, Launching Active Crypto ETFs in the US

European cryptocurrency asset manager CoinShares is stepping up its strategic expansion in the United States by preparing a significant acquisition and gearing up for a U.S. public listing. The company’s moves signal a strong push to tap into the rapidly growing U.S. crypto markets, with a focus on innovative investment products, including actively managed ETFs that aim to outperform simple index tracking funds.

- CoinShares plans to acquire London-based Bastion Asset Management to expand its active crypto investment offerings in the U.S.

- The deal, pending regulatory approval, will enhance CoinShares’ trading, strategies, and team capabilities for actively managed crypto products.

- CoinShares aims to introduce actively managed ETFs in the U.S., blending systematic trading expertise with stringent regulatory compliance.

- The firm is also planning a U.S. IPO via a SPAC, aiming to access deeper capital markets and attract institutional investors.

- The rise of active ETFs marks a potential transformation in how institutional investors approach cryptocurrency markets.

European-based crypto asset manager CoinShares is making notable moves to strengthen its presence in the United States, including a planned acquisition of London-based crypto investment firm Bastion Asset Management. This strategic step forms part of CoinShares’ broader effort to expand its range of actively managed crypto investment products amid increasing institutional interest in sophisticated strategies beyond passive index tracking.

The acquisition, subject to approval from the UK’s Financial Conduct Authority, will see the integration of Bastion’s trading capabilities, team, and strategies into CoinShares’ platform. Although the deal’s financial terms remain undisclosed, the move underscores CoinShares’ commitment to offering innovative products tailored to U.S. investors.

Active ETFs versus passive ETFs

While most traditional crypto ETFs—such as those tracking Bitcoin or Ethereum—are passive and aligned with price indexes, active ETFs rely on professional management to select investments with the goal of outperforming the market. CoinShares’ move into active management is a response to rising demand for more sophisticated, risk-adjusted strategies in the crypto space.

Holding registered investment adviser status under the U.S. Investment Company Act of 1940, CoinShares is authorized to develop and offer actively managed ETFs, including strategies that use systematic and quantitative trading techniques—expertise they expect to gain from Bastion.

“Bastion’s team has over 17 years of experience developing systematic, alpha-generating strategies at leading hedge funds including BlueCrest Capital, Systematica Investments, Rokos Capital, and GAM Systematic,” a CoinShares spokesperson noted. “Their quantitative approach, using academically-backed signals to generate returns independent of market direction, aligns with our goal to develop differentiated active strategies for the U.S. market.”

The rising prominence of active ETFs

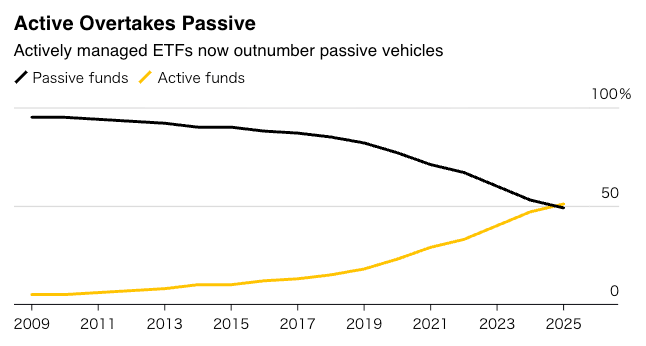

Although the US crypto ETF market has been dominated by passive funds tracking Bitcoin and Ether prices, recent developments suggest a shift. In July, active crypto ETFs surpassed passive funds in number, a trend that has been accelerating over the past five years—more than doubling the tally of active funds and signaling a market evolution.

Actively managed ETFs outnumbered passive funds in July 2025. Source: Bloomberg Intelligence

Actively managed ETFs outnumbered passive funds in July 2025. Source: Bloomberg Intelligence

CoinShares plans to offer both directional products, designed to track market trends, and strategies aimed at generating alpha regardless of market conditions, reflecting a more active approach to crypto asset management.

CoinShares’ U.S. expansion

The company’s push into the U.S. market aligns with plans to go public through a special purpose acquisition company (SPAC), with a pre-money valuation of approximately $1.2 billion. This move will grant the firm access to American institutional investors and deeper U.S. capital markets, vital for growth in the blockchain and digital assets space.

This strategic U.S. expansion comes on the heels of recent regulatory enhancements, including SEC rule changes that could streamline the approval process for future crypto ETFs, reducing approval time from up to 240 days to around 75 days.

As CoinShares builds its infrastructure and team in the U.S., it aims to position itself as a leading institutional player, tapping into the world’s most liquid and mature crypto markets—a move that could reshape how traditional finance interacts with digital assets and blockchain technology.

This article was originally published as CoinShares to Acquire Bastion, Launching Active Crypto ETFs in the US on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

RFK Jr. reveals puzzling reason why he loves working for Trump