FTX’s $1.6 Billion Might Spark Bull Run, Volatility With ETH and XRP, While Digitap ($TAP) Tipped to Explode

September 30 will see the FTX Recovery Trust release $1.6 billion in its third round of creditor distributions. However, this payout has been met with both sighs of relief and uncertainty, with volatility expected in the Ethereum price and XRP price. Meanwhile, Digitap ($TAP), an emerging DeFi-TradFi coin, has emerged as a hedge and is poised to skyrocket—the best crypto to invest in today.

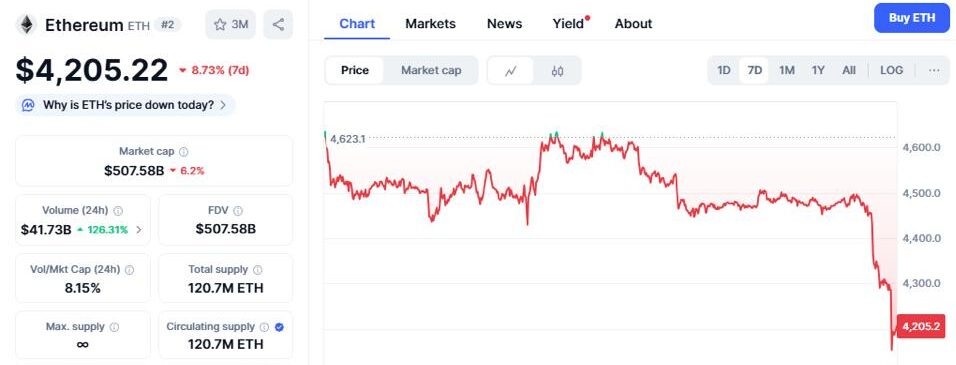

Can the Ethereum Price Dump Further?

The Ethereum price continues to lose key footings; the latest is an 8% decline on the weekly chart. It currently hovers around the $4,200 mark, with analysts predicting a possible decline below the $4,000 support in the coming weeks.

According to Zyro’s Ethereum price prediction, the altcoin could retest the $3,900 and $4,000 levels before riding to ATH in Q4, citing multiple rate cuts. Also, the uncertainty around FTX’s creditor payment on September 20 means many investors are cautious.

On the other hand, regaining $4,500 could improve confidence, potentially pushing the Ethereum price past its August all-time high of $4,953. However, until then, investors are advised not to throw caution to the wind.

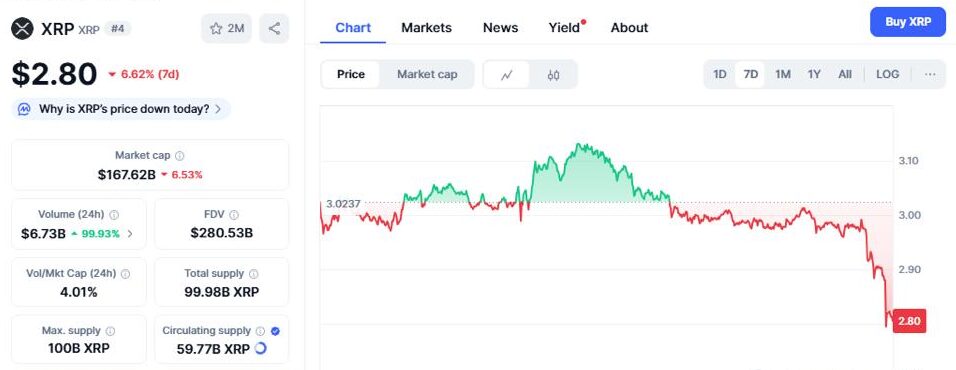

XRP Price Loses Key Support: Is a Rebound Close?

In the past 24 hours, over 400,000 traders were liquidated, with the total liquidations exceeding $1.70 billion, most of which were longs. The XRP price hovers below the $3.0 support following a 6% downturn over the past week.

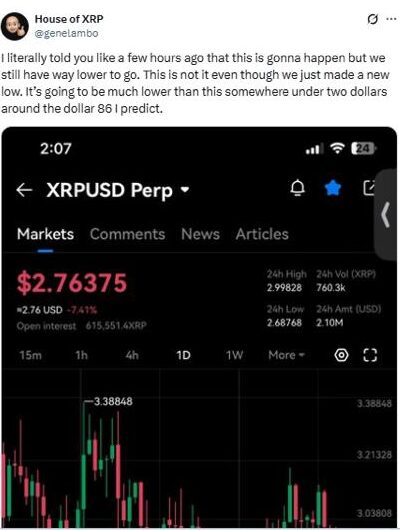

With sentiment quickly turning bearish post-Fed rate cut, the coming days and weeks promise intense volatility. The XRP price, currently trading around the $2.8 mark, could tumble below its 30-day low of $2.70 if bulls fail to pick up momentum.

According to Genelambo’s XRP price prediction, Ripple could go even lower, targeting a dip below the $2.0 support. However, a rebound could push the payment-based altcoin above $3.0.

Digitap ($TAP): One of the Low-Cap Gems of 2025 – A Compelling Hedge Against ETH and XRP

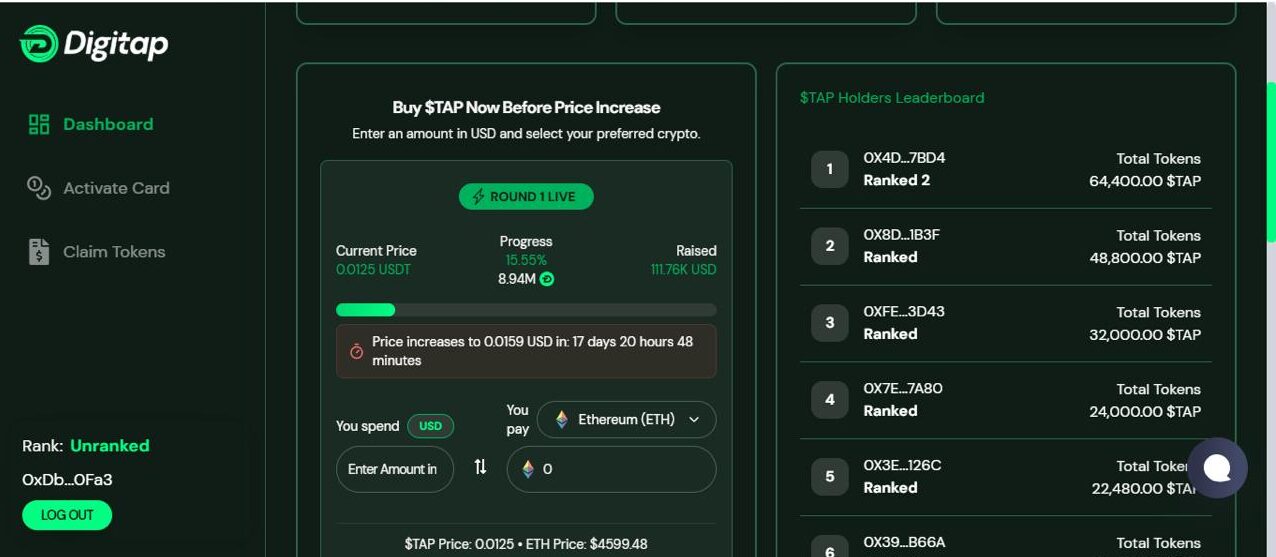

While Ethereum and XRP are in downtrends, Digitap ($TAP) is flying high and selling out fast in presale. Just days after the ICO went live, early funding has surpassed $160,000 in record time, proving to be a strong hedge against market uncertainty and volatility.

Further driving demand is its innovative approach to solving universal money problems. Expected to break into the trillion-dollar cross-border payments market, it is at the forefront of the PayFi revolution with its unmatched speed. In addition, it slashes remittance costs from the 6.2% industry average to instant, near-zero fees.

At the same time, users will enjoy stealth privacy mode—KYC isn’t required. With the app fully developed and available for download right now, its offerings aren’t mere promises. Hence, at $0.012 in the first presale round, experts consider $TAP the best new crypto to buy now.

For Info about $TAP, visit Digitap.app Presale or Join the Community

The Best Move for Altcoin Investors

While Digitap costs just $0.0125 in the first presale round, it is expected to jump to $0.015 in the next round, driving FOMO. Its competitive advantages over legacy banks position it for massive gains, setting it up for huge future growth. Although the Ethereum price and XRP price are in downtrends, $TAP is poised to explode as a new low-cap DeFi-TradFi coin.

Digitap is Live NOW. Learn more about their project here:

Presale: https://presale.digitap.app

Social: https://linktr.ee/digitap.app

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post FTX’s $1.6 Billion Might Spark Bull Run, Volatility With ETH and XRP, While Digitap ($TAP) Tipped to Explode appeared first on Coindoo.

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

Sonic Holders Accumulate Millions as Price Tests Key Levels