$119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge

$119K WBTC stolen in wallet scam as bogus airdrop links inundate crypto. Find out how such frauds defraud users and empty their wallets in no time.

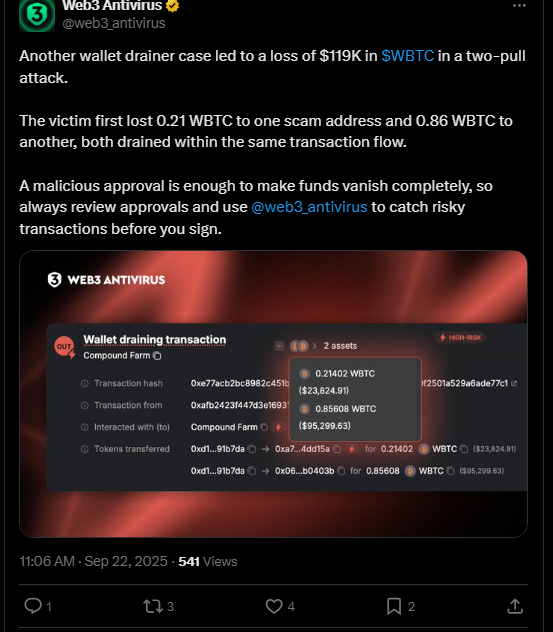

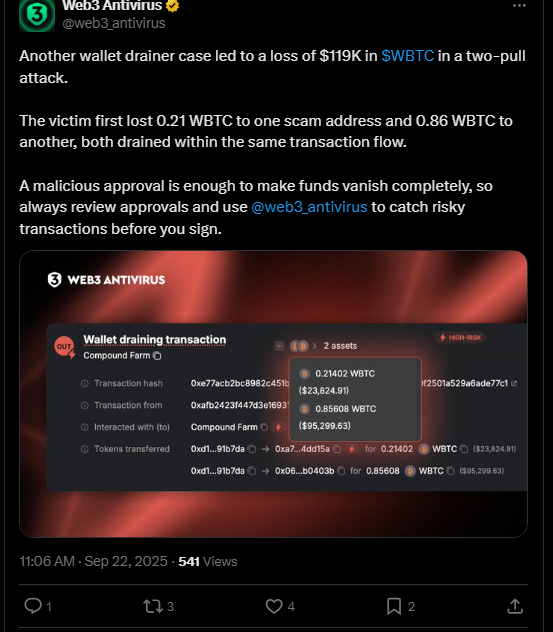

More than 119,000 Wrapped Bitcoin ($WBTC) was stolen through a scam involving two pulls of a wallet.

Source – X

The victim lost 0.21 WBTC on one scam address and 0.86 WBTC on another, both in the same flow of the transaction. The attack shows how one malicious approval can drain wallets in seconds.

On social media, airdrop scammers often promote fraudulent links to wallets. These phishing attacks attract users to attach wallets to unauthenticated sites resulting in immediate loss of funds.

These fraudulent links are forcefully promoted by accounts claiming to be genuine crypto professionals, which adds to their propagation and risk.

Fake Airdrop Links Exploit Trust

Counterfeit $BARD airdrop links keep rolling rapidly on sites such as X (Twitter). These connections are usually made through the accounts that are posing as approved crypto personalities.

The followers of Lombard Finance have been one of the targets as they were sent phishing sites that appear to be genuine, yet they are a trap.

The users who have their wallets connected to these sites without knowing, give their consent to malicious approvals.

Source –X

Such grant scammers get access to drain funds at once. Web3 Antivirus, live monitoring of transactions on X, warns that you have to approve only one transaction to lose it all.

According to the Web3 Antivirus Twitter page, one should always verify the official channels before believing any links in claims.

They caution them: approvals should be scrutinized to prevent fraud. Their domain flagging in real time identifies hazardous transactions before interaction by the user.

Wallet Draining Techniques Grow Sharper

In the most recent scam, a two-pull attack on the victim consumed a substantial amount of WBTC in an orchestrated flow.

The risk is in the fact that the suspicious approval request appears so insidious when one interacts with the wallet. A lot of users do not realize the threat and sign out, losing investments.

Analysts underline that fraudsters use social engineering and bogus hype to persuade the targets. False airdrops are used to distribute free tokens but empty wallets are received.

The linked wallets are authorised to access contracts through which funding is transferred immediately. Care should be taken in examining short approval requests. Check only official sources of trust and airdrops.

Knowledge about these developing scams would assist users in escaping such losses.

This is not the first of a series of incidents, and fraudsters are using high-tech impersonation through social media platforms to mislead crypto users. To minimize exposure to such threats, it is prudent to be vigilant.

The post $119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge appeared first on Live Bitcoin News.

You May Also Like

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

BlackRock Increases U.S. Stock Exposure Amid AI Surge