Best Crypto Presales to Buy: How Best Wallet Is Transforming Crypto Storage

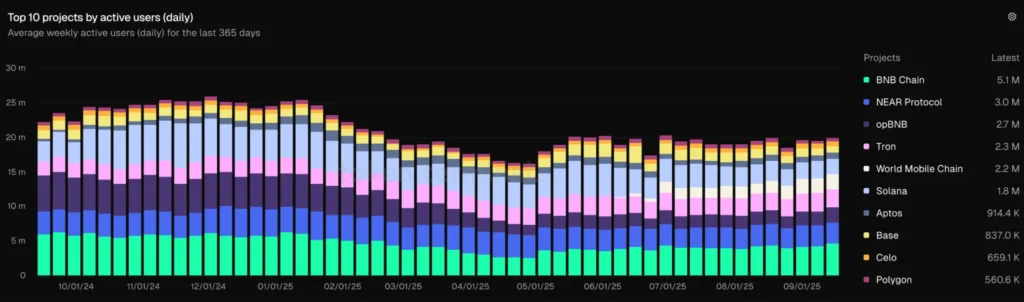

There is no longer one chain that dominates the crypto industry. Traders are spreading far and wide in search of the best rates, opportunities, and the user experience most suited to their specific needs.

Meme coin traders remain fixated on Solana and BNB, while AI development is running hot on Near Protocol, and stablecoin activity thrives on Tron. In this world, where innovation continues to spread and users splinter from legacy blockchains, fragmentation is a pressing issue.

It’s hard for users to keep track of assets across all these chains; liquidity is spread thin across ecosystems, and users are forced to rely on trusted blockchain bridges that have proved vulnerable to attacks on countless occasions.

Even the top crypto wallets like MetaMask and Trust Wallet are unable to keep pace. However, a next-generation wallet, simply called Best Wallet, was designed explicitly with these issues in mind.

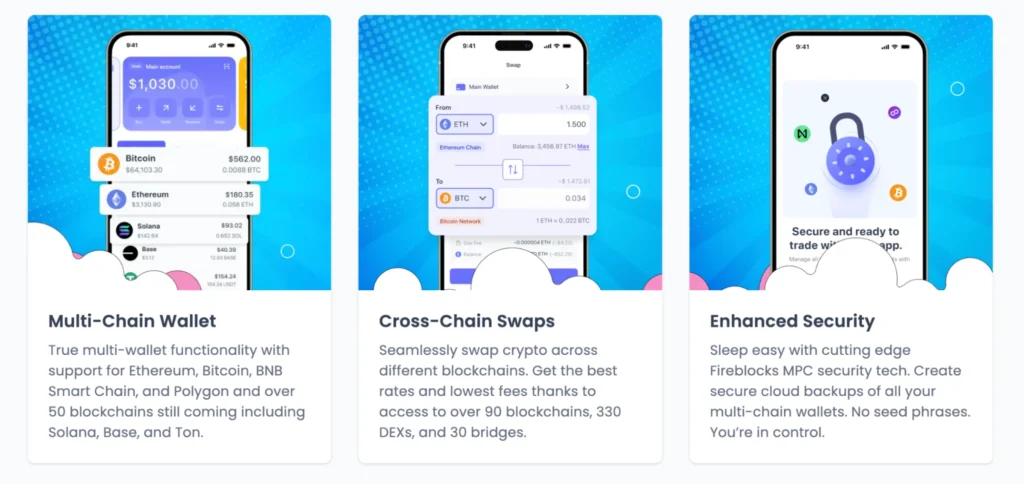

The project is rapidly transforming the crypto storage industry, modernizing it with cross-chain infrastructure, secure MPC technology, and an array of built-in features that make users feel like they’re trading on Coinbase, not a fully on-chain, non-custodial wallet.

It’s powered by Best Wallet Token (BEST), which is an Ethereum-based utility coin that is currently available to buy in its presale at a rate of $0.025685. The presale has raised $16 million so far, making it one of the strongest launches currently ongoing and signaling significant potential once it hits exchanges.

Transforming crypto storage with one super app

The crypto market has grown rapidly this cycle, with the industry’s total valuation reaching a record high of $4.17 trillion, surpassing the current combined market cap of Meta, Tesla, and JP Morgan.

However, the industry still faces a major challenge with crypto wallets. Consumer apps for storing cryptocurrencies have largely remained unchanged since the last cycle, which is seen as a reason why crypto has struggled to achieve true mass adoption. Let’s examine the specific issues with crypto wallets and how Best Wallet solves them:

Blockchain fragmentation

Users are increasingly shifting away from traditional blockchains like Bitcoin, Ethereum, and even Solana toward emerging alternatives. Using more chains makes managing, trading, and transferring cryptocurrencies increasingly complicated. It also forces users to rely on blockchain bridges, which can be less secure and often deliver suboptimal exchange rates.

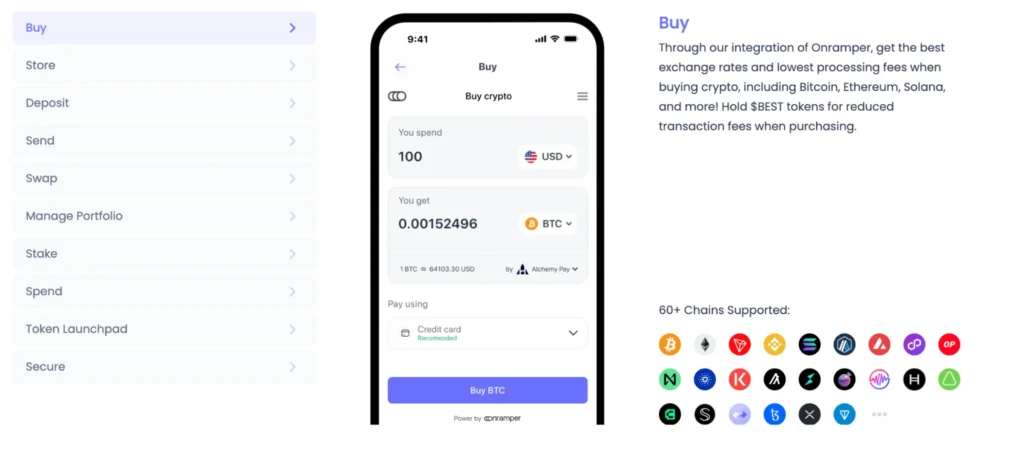

Best Wallet’s solution – a cross-chain, non-custodial wallet app supporting over 60 blockchains, including Bitcoin, Ethereum, Solana, BNB, XRP, Cardano, Ton, and more. It also features a secure cross-chain DEX that enables users to securely swap any token across any chain, powered by Onramper to deliver the best exchange rates and lowest processing fees.

Complex user experiences

Connecting wallets to external dApps, authorizing transactions, and tracking which DeFi apps you’ve used and have tokens locked up on – especially across different chains – is a tedious task and can easily result in losses through misplaced funds.Best Wallet’s solution – integrated dApps for staking, buying presales, browsing NFTs, and even futures trading from the Best Wallet dashboard. It also includes fiat on and off ramps (including Apple Pay deposits), all within an easy-to-use mobile app. This ensures a frictionless and intuitive user experience that’s ready for mass adoption.

Security

Crypto wallet users risk falling prey to scams, whether through phishing attacks or bad actors compromising seed phrases stored online. Additionally, managing seed phrases for multiple wallets can easily lead to losing access to accounts.

Best Wallet’s solution – employ Fireblocks MPC technology that cryptographically secures cloud backups of all your multi-chain wallets without the need for seed phrases. Phishing risk is also lowered since Best Wallet dApps are built into the wallet’s core interface, meaning less need to connect to external dApps, which risk being compromised.

Next 100x crypto? BEST token fuels the Best Wallet app

The BEST token powers the Best Wallet app, providing trading fee discounts, higher staking yields, governance rights, and access to promotions on partner projects.

And so with Best Wallet’s problem-solving use case holding the potential to attract users from across the entire crypto industry, it’s not surprising that analysts are expecting significant demand for the BEST token.

In a recent YouTube video, Borch Crypto even suggested that BEST could deliver 100x gains once it hits the open market.

Don’t miss BEST’s 83% staking APY

The Best Wallet Token presale gives investors a chance to earn extra rewards through its staking system. Currently, staking provides an 83% APY, but this rate will decrease as the staking pool grows.

Looking ahead, there is a lot planned for Best Wallet. Roadmap updates, such as the “Best Card,” will enable users to spend their crypto in the real world and earn cashback. Meanwhile, its browser extension will let users easily integrate Best Wallet into their laptops and PCs. This all suggests that BEST will gain even more traction in the coming months.

Right now, investors still have the chance to be early in this project – but as funds pour in and tokens sell quickly, the opportunity is closing fast. Therefore, potential investors should act now to avoid missing out.

Visit Best Wallet Token Presale

You May Also Like

Unlocking Massive Value: Curve Finance Revenue Sharing Proposal for CRV Holders

Best Crypto To Buy Now: Pepeto vs BlockDAG, Layer Brett, Remittix, Little Pepe, Compared