P2P Satellite Networks Invoking Edge-AI and Decentralized Intelligence-: Internet-AI Optimization

AI is hungry.

Not just for data, but for real-time data - processed fast, everywhere, all the time. From self-driving cars to drone swarms to predictive healthcare; artificial intelligence has evolved over the years, and which each passing evolution, there is an increasing dependance on regularly updated (and re-opted) real-time data… AI is currently changing shift to an internet designed for machines, not just humans anymore.

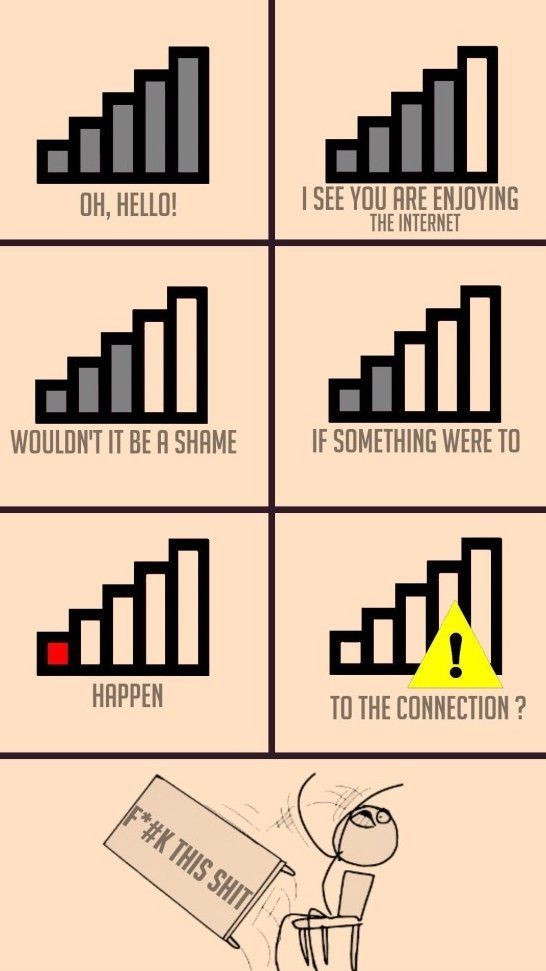

Here’s the thing, today’s internet wasn’t built for AI. It was built to send emails, browse memes, and (eventually) binge cat videos in 4K. So when autonomous vehicles need to talk to each other across continents, or when distributed AI agents want to collaborate without a central server bottleneck, our baby bloomer internet coughs and wheezes.

\ Now, imagine thousands of satellites orbiting Earth, not owned by a single corporation but by decentralized communities. These satellites don’t just beam internet; they act as the AI cloud in space - routing data, training models, and enabling machines to coordinate without depending on Big Tech data centers.

This is where peer-to-peer satellite networks comes in.

\ \

Why AI Needs a New Internet…

What’s the point really? Why can’t AI just use the internet we already have?

Well, I mean, if the internet was that good, the satellite-network companies won’t still be operating now would they.

\

- Latency Kills: It’s the classic Garbage-In-Garbage-Out (GIGO). Self-driving cars or real-time drones can’t afford millisecond delays caused by distant servers. Unlike humans who can wait, machines can’t.

- Centralization Bottlenecks: Today’s AI pipelines flow through mega-clouds (AWS, Google Cloud, Azure). If those clouds should supposedly go down, machines can’t go up (literally).

- Bandwidth Pressure: AI workloads involve massive streams of sensor data, models, and updates. Our existing fiber + terrestrial networks would choke under that weight.

- Trust Issues: Do you really want your AI surgeon’s decision-making routed through a handful of corporations that monetize your data? I know I don’t.

AI demands an internet that’s:

- Ubiquitous (global coverage, no dead zones)

- Decentralized (no single choke point)

- Low-Latency (near-instant responses)

- Resilient (immune to censorship, shutdowns, or single-point failures)

And that’s where satellites swoop in.

\ \

P2P Satellites: Lights, Camera, ACTION!

Starlink, Kuiper, OneWeb — these are today’s poster children for satellite internet. But they’re still centralized ISPs in the sky - owned, controlled, and managed by mega-corporations. Great for watching Netflix in the Sahara, terrible for building a censorship-resistant AI network.

Now picture this instead: peer-to-peer (P2P) satellite networks.

- Each satellite is a node in a decentralized mesh.

- Nodes communicate with each other directly via laser links.

- Data routes dynamically, not through a central hub.

- Ownership? Distributed. Think DAO-funded launches, tokenized bandwidth, and community-controlled governance.

In short, the same logic behind blockchains and Web3, but scaled into orbit. It’s BitTorrent, but with satellites and AI workloads.

We’ve seen similar decentralized revolutions before:

- There was Bitcoin for money… Ethereum for contracts… Filecoin for storage… Helium for IoT; and a few others.

Now add: P2P Satellites for AI. 🛰️

This approach extends decentralization literally above our heads. You don’t just fork code; you fork infrastructure (from launchpads to orbit). This ultimately flips the script on today’s AI monopolies. Now, instead of OpenAI, Google, or Meta running planetary-scale models in locked-up server farms, intelligence could be community-distributed, censorship-resistant, and sovereign.

\ \

Edge AI + Satellites = Intelligence Everywhere

Okay, so we’ve got satellites forming a decentralized backbone. But how does this help AI?

Welcome to Edge AI.

Instead of shipping all data back to a distant cloud for processing, AI models run closer to where the data is generated: on devices, local servers, or - as you must’ve guessed - satellites.

The whole idea of Edge AI is… (from ChatGPT)

\ So basically, instead of relying on cloud computing, the AI model is deployed on the “edge” of the network - close to where the data is created. The device then processes information locally, makes decisions in real time, and only sends essential data to the cloud if needed (basically).

Example Scenarios:

- Autonomous Vehicles: Cars in Lagos, London, and Libya sharing driving conditions via satellites in milliseconds.

- Drones + Disaster Relief: In an earthquake zone, drones collaborate in real-time, mapping rubble and finding survivors, all while communicating through orbital P2P relays.

- Agricultural IoT: Smart sensors in farms connect to satellites, running local AI to predict crop disease before it spreads.

- Decentralized AI Agents: Imagine GPT-style AIs distributed globally, collaborating on tasks through a censorship-proof satellite internet.

\ \

Building Blocks of a P2P AI Internet in Space

What does this infrastructure actually look like?

➡️ Constellation of SmallSats

Forget the era of giant, single-owner satellites. The backbone here is a swarm of affordable, modular SmallSats—miniature spacecraft that multiple stakeholders (startups, research labs, even community co-ops) can launch and maintain. Their modularity means you can swap out sensors or processing units without scrapping an entire satellite.

\

➡️ Laser Inter-Satellite Links

Instead of bouncing signals back to Earth for routing, laser inter-satellite links let these satellites talk directly to each other at blistering speeds. It’s like upgrading from 90s dial-up to fiber optics—but in the vacuum of space.

\

➡️ Onboard Compute

Rather than treating satellites as dumb data couriers, this network packs AI inference chips directly into orbit. That means tasks like image recognition, anomaly detection, or routing optimization happen right where the data is collected—no round-trip to Earth required.

\

➡️ Tokenized Economy

Bandwidth, storage, and compute aren’t free—and this is where a crypto-powered microtransaction layer comes in. Users or organizations pay tiny fractions of a token to borrow resources on demand. Maybe an Earth-observing startup rents extra compute from idle satellites over the Pacific, or a lunar mission buys bandwidth for a critical data dump. The P2P economy keeps the network decentralized and incentivizes participants to maintain and upgrade their nodes.

\

➡️ Governance via DAOs

Who decides which regions get better coverage, or whether to upgrade the network with quantum repeaters? Enter Decentralized Autonomous Organizations (DAOs). Stakeholders—ranging from hobbyist satellite operators to governments—can vote on proposals, allocate treasury funds, and enforce policies through smart contracts. This prevents gatekeeping by a single actor and ensures the AI internet in space evolves according to community-driven priorities.

\

➡️ Quantum-Safe Encryption

Tomorrow’s quantum computers could render today’s encryption obsolete. To prevent that nightmare scenario, the network bakes in quantum-safe encryption algorithms (e.g., lattice-based cryptography). That way, even if someone builds a quantum beast capable of breaking RSA keys, your orbital AI traffic stays secure.

\ Put it all together and you get a self-governing, decentralized AI mesh orbiting Earth (and eventually beyond), where satellites negotiate, process, and trade resources without centralized control.

\ \

The Big Obstacles

Let’s not overhype — there are big hurdles to cross:

- Launch Costs: Rockets aren’t cheap, even with SpaceX’s reusables.

- Hardware Complexity: Satellites with AI chips need radiation-hardening, efficiency, and stability.

- Spectrum Licensing: Governments tightly regulate space communication bands.

- Coordination: DAOs are cool in theory, messy in practice. Coordinating satellite launches via token votes isn’t exactly plug-and-play.

- Trust Bootstrapping: How do you ensure a decentralized AI satellite network isn’t hijacked or Sybil-attacked?

But hey, decentralization has always been messy. Bitcoin had its scaling wars. Ethereum had the DAO hack. Yet here we are.

\ \

Why All of It Matters…

This isn’t just about cool tech.

It’s about who controls intelligence. If the internet for AI is centralized, AI belongs to corporations and states. If it’s decentralized, AI belongs to everyone.

👍 Equity: Rural Africa gets the same AI access as Silicon Valley.

👍 Resilience: No more single-point-of-failure in wars or disasters.

👍 Freedom: No more kill-switches or censorship from governments.

👍 Innovation: Open ecosystems always outpace walled gardens.

\

…

\

The Sky Is Decentralized

AI is the next electricity. Yeah electricity needed a grid. For AI, that grid could be a mesh of satellites orbiting Earth, owned by the people, powering intelligence everywhere.

You May Also Like

PBOC sets USD/CNY reference rate at 6.9590 vs. 6.9570 previous

Trump has 'skeleton key to a dictatorship' — and it's turned him into a 'tyrant': analysis