Ripple Seals Deal With Southeast Asia’s Largest Bank

Ripple has inked a three-way agreement with DBS and Franklin Templeton to bring tokenized money market funds and stablecoin-based liquidity onto DBS Digital Exchange (DDEx), in a move that squarely targets institutional demand for on-chain yield and credit.

Biggest Bank In Southeast Asia Taps Ripple Tech

Under a memorandum of understanding signed on September 18, DDEx will list Franklin Templeton’s sgBENJI—the token of the Franklin Onchain US Dollar Short-Term Money Market Fund—alongside Ripple’s US dollar stablecoin, RLUSD, enabling eligible clients to swap between a yield-bearing fund token and a stable unit of account around the clock. Ripple says the solution is being built on the public XRP Ledger, with repo-style lending to follow as the initiative expands.

DBS, Southeast Asia’s largest bank by assets (over $500 billion as of 2025), framed the tie-up as part of a broader institutional shift toward tokenized market infrastructure. “Digital asset investors need solutions that can meet the unique demands of a borderless 24/7 asset class,” said Lim Wee Kian, CEO of DBS Digital Exchange. The bank added that, in a next phase, it will explore allowing clients to post sgBENJI as collateral to obtain credit either directly from DBS via repurchase transactions (repos) or from third-party platforms where DBS acts as collateral agent—formally pulling a core money-markets use case on-chain.

Franklin Templeton, which has been at the vanguard of tokenized funds, will issue sgBENJI on the XRP Ledger to increase interoperability across networks. Roger Bayston, head of digital assets at Franklin Templeton, called the collaboration “a meaningful advancement in the utility of tokenized securities” and “a significant step forward in the growth of Asia’s digital asset ecosystem.” Ripple’s VP and global head of trading and markets, Nigel Khakoo, underscored the capital-markets angle, saying the link-up to “enable repo trades for a tokenized money market fund” with a regulated, liquid exchange medium like RLUSD “is truly a game-changer.”

Monica Long, Ripple’s president, situated the announcement in the larger tokenization debate, arguing that real-world assets must have both tradability and practical uses to fulfill their promise. “In order for tokenized financial assets to solve the problems they’ve been promised to solve, we need both 1/ liquid secondary markets and 2/ utility for these assets (such as with collateralization). That’s exactly what Ripple, DBS and FTI are working towards with this announcement,” she wrote via X.

The mechanics are designed for institutional portfolio management. By listing sgBENJI and RLUSD side by side, accredited investors on DDEx can quickly rebalance from volatile crypto exposures into a comparatively stable, yield-accruing fund token without leaving a single, bank-supervised ecosystem. Ripple and DBS say settlement finality within minutes and 24/7 market access are central to the design, with the XRP Ledger chosen for speed, low fees and throughput suitable for high-volume fund token transfers.

The choice of DBS as venue is notable on scale alone. The Singaporean lender is consistently cited as Southeast Asia’s largest bank by assets, and has been aggressive in building out regulated digital-asset rails through DDEx and bespoke custody. Ripple, for its part, has spent the past year positioning RLUSD as a compliance-first stablecoin for institutional payments and market operations, while Franklin Templeton continues to port money-market instruments onto public ledgers in pursuit of programmable liquidity.

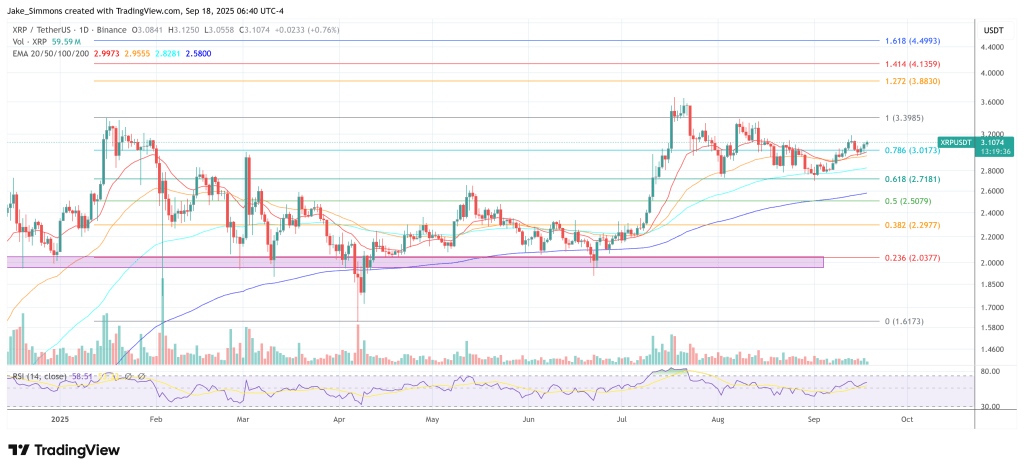

At press time, XRP traded at $3.10.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

XRPR and DOJE ETFs debut on American Cboe exchange