Bitcoin Cash (BCH) Price Breaks 17-Month High: Is $719 the Next Target?

The post Bitcoin Cash (BCH) Price Breaks 17-Month High: Is $719 the Next Target? appeared first on Coinpedia Fintech News

Bitcoin Cash (BCH), the cryptocurrency born from a Bitcoin fork, has shocked traders by climbing to a 17-month high of $647. Just weeks ago, social media was filled with bearish talk about BCH’s future.

But Santiment data shows that such extreme negativity often sets the stage for a sharp rebound shows how quickly market sentiment can change.

Bitcoin Cash Hits a Yearly High

Bitcoin Cash (BCH) has reached a new yearly high of $647, gaining strong momentum after the U.S. Federal Reserve announced a 25 basis point rate cut. The decision boosted risk appetite, and crypto markets reacted with fresh buying interest.

Apart from it, on-chain numbers also back this rally. BCH’s trading volume jumped 155%, climbing to $1.38 billion, the highest level since December 2024. This sharp rise in activity shows that more traders are actively moving into the asset.

Another positive sign comes from Coinglass data. The BCH long-to-short ratio now stands at 1.28, the strongest in more than a month. A ratio above one means more traders are betting on the price to rise than fall.

BCH Outpacing Bitcoin in the Short Term

What makes the move even more notable is BCH’s strength against Bitcoin itself. The asset jumped 7% compared to BTC, showing relative strength in a market where Bitcoin usually dominates.

This outperformance suggests that traders looking for short-term opportunities are rotating into altcoins like BCH whenever retail sentiment becomes too one-sided.

Bearish Chatter Triggers BCH Rally

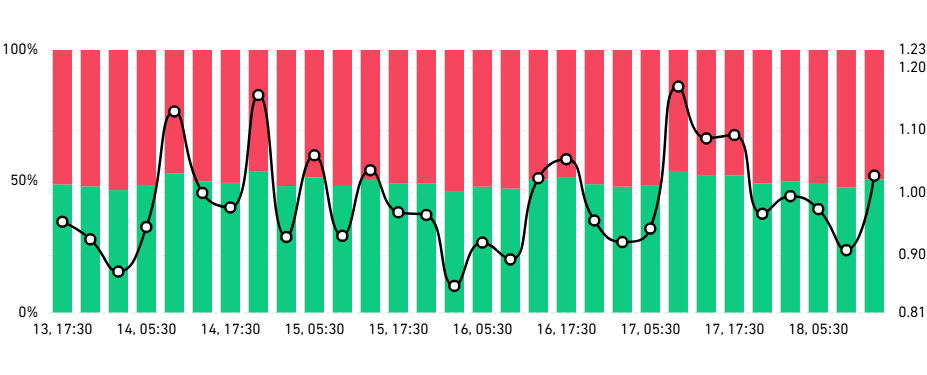

Bitcoin Cash (BCH) recently surged after weeks of heavy bearish talk on social media about BCH’s future. Santiment’s data shows that such extreme negativity often signals a market rebound.

History proves that when most people are too pessimistic, it can create strong buying opportunities.

The sentiment chart makes this clear, when positive comments drop below 0.13 per bearish remark, it usually hints at buying opportunities. Conversely, very high optimism often warns of corrections.

What Next For Bitcoin Cash?

Meanwhile, Bitcoin cash recent rally shows a clear lesson that buying when fear is strongest and selling when optimism is too high often works best in crypto. And for Bitcoin Cash, this idea played out perfectly, lifting the coin to its highest level since early 2024.

As of now, Bitcoin Cash is holding strong, climbing to a new yearly peak of $647. If the momentum stays alive, the next target could be retesting last year’s high near $719.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Skanska divests two office buildings in Copenhagen, Denmark, for DKK 1.0 billion, about SEK 1.5 billion