How to Trade Dogecoin (DOGE): Spot and Futures Trading Explained Step by Step on MEXC

Key Takeaways

- Dogecoin (DOGE) is a popular cryptocurrency with a loyal community and strong market presence.

- Spot trading allows you to directly buy and own DOGE at the market price, making it simple and ideal for beginners.

- Futures trading lets you speculate on the price movements of DOGE without owning the asset, providing the opportunity to profit from both rising and falling markets.

- Leverage in futures trading can significantly increase both your potential profits and risks.

- Risk management strategies, including using stop-loss orders and take-profit orders, are essential in both spot and futures trading.

Introduction

What Is Dogecoin (DOGE)?

A Brief History of Dogecoin

Spot Trading DOGE: How to Buy and Own the Asset

What Is Spot Trading?

How to Spot Trade Dogecoin on MEXC: Step-by-Step

Step 1: Create and Verify Your MEXC Account

Step 2: Deposit Funds

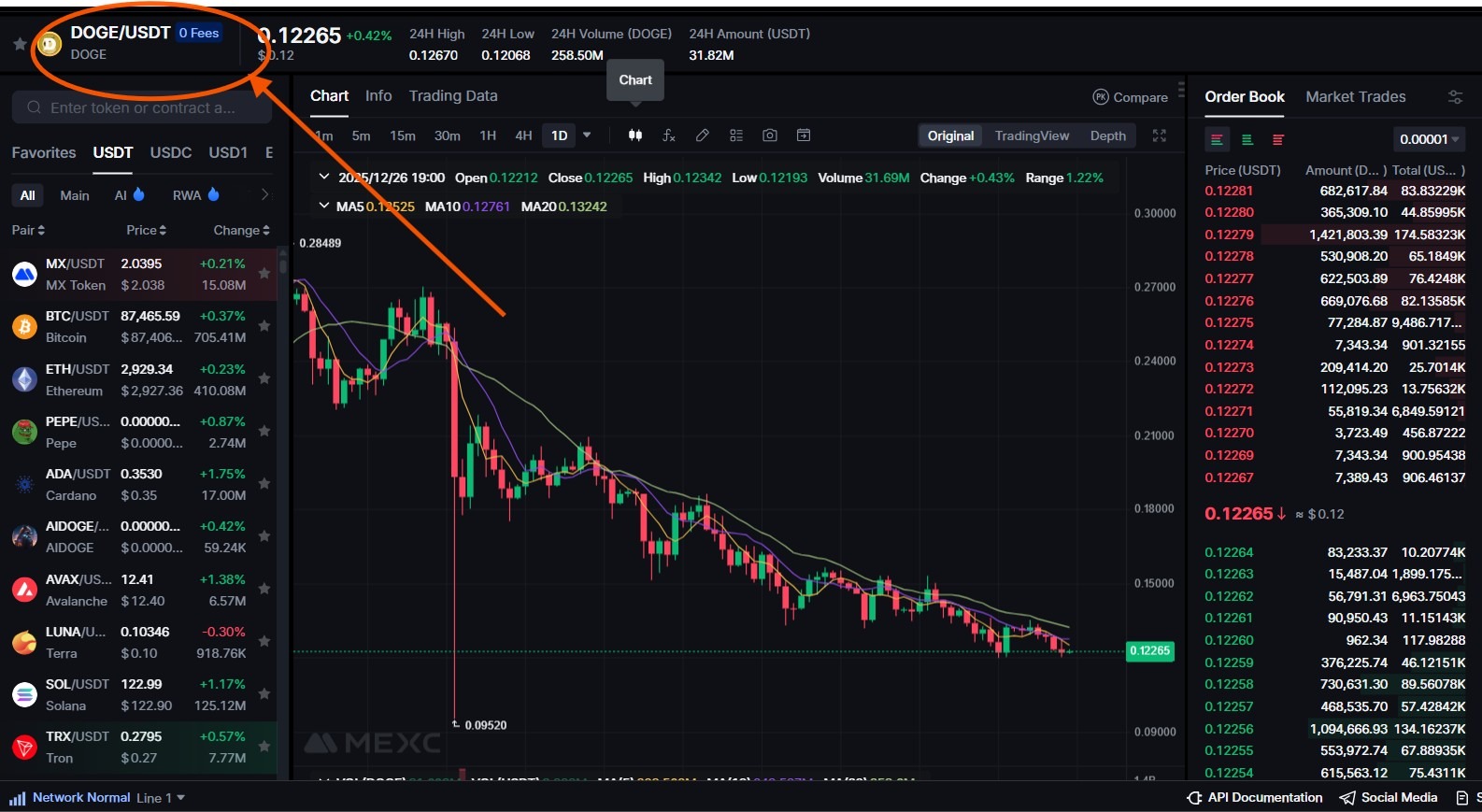

Step 3: Select the DOGE Market

Step 4: Place Your Order

- Market Order: This will buy or sell DOGE at the current market price. It is the quickest and most straightforward option for beginners.

- Limit Order: A limit order allows you to set a specific price at which you want to buy or sell DOGE. The order will only be executed when the market reaches your specified price.

Step 5: Confirm Your Transaction

Futures Trading DOGE: Speculating Without Ownership

What Are Futures Contracts?

How to Trade Dogecoin Futures on MEXC: Step-by-Step

Step 1: Deposit Funds into Your Futures Wallet

Step 2: Select Your Futures Contract

Step 3: Set Leverage

Step 4: Open a Position

Step 5: Manage Your Position with Risk Controls

Step 6: Close Your Position

Spot vs. Futures Trading DOGE: Which Is Better for You

Feature | Spot Trading | Futures Trading |

Ownership of DOGE | Yes | No |

Leverage | None | Yes (e.g., 10x, 50x) |

Profit from Down Markets | No | Yes (via short selling) |

Risk Level | Lower | Higher |

Complexity | Simple | Advanced |

Risk Management in DOGE Trading

- Use Stop-Loss Orders: This is one of the most effective ways to limit potential losses. A stop-loss order automatically closes your position if the price moves against you by a predetermined amount.

- Start with Low Leverage: If you're new to futures trading, start with low leverage to minimize risk. As you gain experience, you can increase leverage if necessary.

- Diversify Your Portfolio: Don't focus all your funds on Dogecoin. Spread your risk across various assets to reduce the impact of volatility.

Frequently Asked Questions (FAQ)

Conclusion

Learn More

- How to Buy Dogecoin (DOGE) on MEXC: A Complete Guide for Beginners

- Dogecoin Wallet Guide: How to Store DOGE Safely

- Why Dogecoin Feels Easy to Buy — and Why That Can Be Misleading

Popular Articles

Dogecoin(DOGE) Trading Fees Explained: Spot vs Futures Costs on Crypto Exchanges

Dogecoin (DOGE) has become a household name in the world of cryptocurrencies. Originally created as a fun internet meme, it has since grown into a prominent asset within the cryptocurrency market. How

Why Is Dogecoin(DOGE) So Volatile? Price Swings, Liquidity, and Market Narratives

Dogecoin (DOGE), a cryptocurrency initially created as a joke, has grown into one of the most prominent and frequently traded digital assets in the cryptocurrency world. Its origins as a meme coin hav

What Are Dogecoin(DOGE) Futures? How DOGE Leverage Trading Works and Its Risks?

Unlikespot trading, where you directly purchase Dogecoin and hold it in your wallet, futures trading involves contracts that speculate on Dogecoin’s price at a future date. These contracts can be leve

Dogecoin(DOGE) Spot vs Futures Trading: Which Is Better for Different Risk Profiles?

Dogecoin has come a long way from the early days when it was created as an internet joke. What originally began as a light-hearted experiment eventually developed into one of the most recognizable dig

Hot Crypto Updates

What Is Futu Holdings Ltd. (FUTU)?

If you’re researching Futu Holdings Ltd. stock (FUTU), you’re researching a tech-driven brokerage and wealth management platform that serves investors through digital products, most notably moomoo and

What Is Meta Platforms (META)?

If you’re researching Meta Platforms stock (META), you’re looking at one of the most important US stocks in social media and digital advertising. Meta owns platforms used by billions of people globall

MEXC vs Binance 2026: Comprehensive Comparison Guide for Crypto Traders

Meta Description MEXC vs Binance 2026 in-depth comparison: Analyzing trading fees, coin listings, security, and user experience to help you choose the best cryptocurrency exchange for your trading nee

How to Purchase Dogecoin in Japan: A Complete Guide

Purchasing Dogecoin (DOGE) in Japan is straightforward when you use a regulated, user-friendly platform like MEXC and follow proper identity and funding procedures; this guide explains each step—from

Trending News

Botanix launches stBTC to deliver Bitcoin-native yield

The post Botanix launches stBTC to deliver Bitcoin-native yield appeared on BitcoinEthereumNews.com. Botanix Labs has launched stBTC, a liquid staking token designed to turn Bitcoin into a yield-beari

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

The post Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC appeared on BitcoinEthereumNews.com. Franklin Templeton CEO Jenny Johnson has weighed in on whether the Federal Reserve should make

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

The post A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release appeared on BitcoinEthereumNews.com. KPop Demon Hunters Netflix Everyone has wondered what may be the next step for KPop D

Uniswap Burns $596M UNI as Vote Changes Tokenomics

The post Uniswap Burns $596M UNI as Vote Changes Tokenomics appeared on BitcoinEthereumNews.com. Uniswap recently executed a 100 million UNI token burn, permanently

Related Articles

Dogecoin(DOGE) Spot vs Futures Trading: Which Is Better for Different Risk Profiles?

Dogecoin has come a long way from the early days when it was created as an internet joke. What originally began as a light-hearted experiment eventually developed into one of the most recognizable dig

What People Often Misunderstand About Dogecoin (DOGE)

Dogecoin is easy to dismiss because it looks like internet culture turned into money. But “meme origin” doesn’t automatically mean “fake asset,” and “serious technology” doesn’t automatically mean “go

What is Perceptron Network($PERC)? A Complete Guide to AI Incentives and Decentralized Data Pipelines

Key TakeawaysPerceptron Network is positioned as an agent-managed incentive framework, where AI agents can mint and distribute PERCs (composable mini-NFTs) to reward useful community behavior. The pro

Dogecoin ETF: What We Know So Far and Whether It Could Happen

Key Takeaways:REX-Osprey Dogecoin ETF (DOJE) launched in September 2025 as the first U.S. product offering DOGE exposure via a mix of holdings and derivatives.Grayscale Dogecoin Trust ETF (GDOG) debut