Michael Saylor’s Strategy May Enter the S&P 500 as Early as Friday

Strategy (Nasdaq: MSTR) is one of the few high-performing equities shortlisted for inclusion in what many consider to be the top stock index.

Saylor’s Bitcoin Bet Could Land Strategy in the S&P 500 by Friday

The S&P 500, which tracks the performance of America’s top 500 companies, will be announcing new additions to its index on Friday, and Michael Saylor’s bitcoin treasury firm Strategy (Nasdaq: MSTR) is one of the leading favorites among a handful of companies eligible to be included in the prestigious cohort.

Every three months or so, a quarterly rebalancing of the S&P 500 takes place, and new firms are announced then added while others are removed; usually on a Friday. In July, Jack Dorsey’s Bitcoin technology company Block (NYSE: XYZ) was added to the index, and now other firms such as Strategy, Robinhood, and Applovin, are all vying for inclusion.

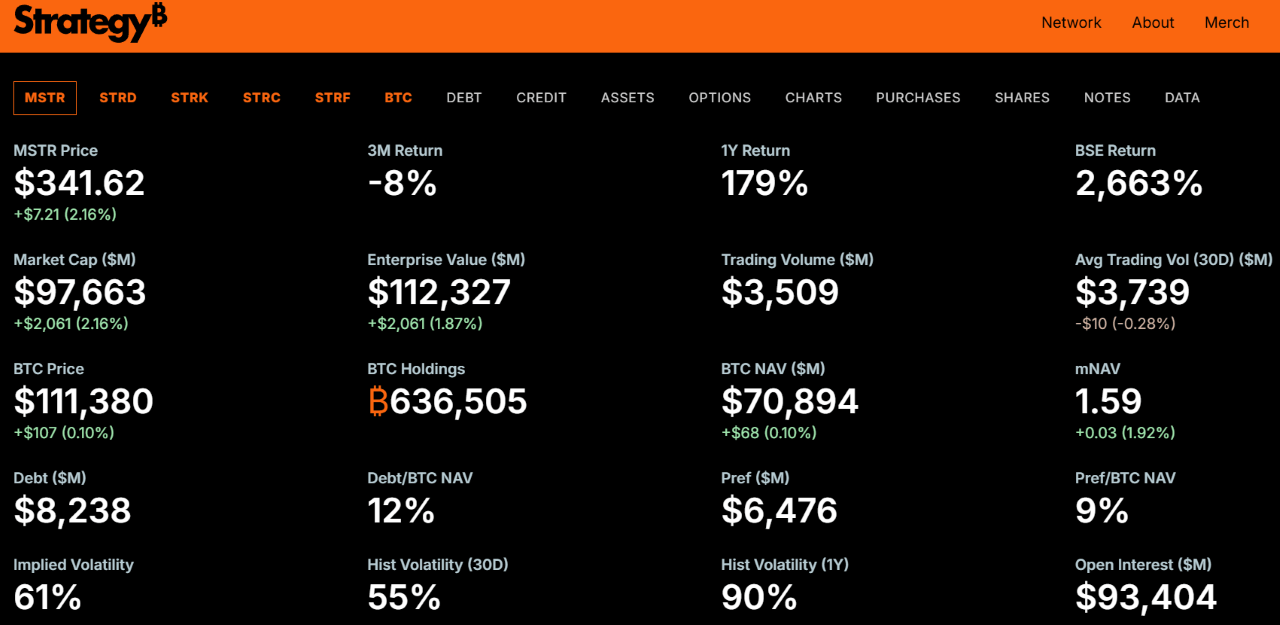

(MSTR was one of the best-performing stocks of 2024 and the company meets all of the eligibility requirements for inclusion in the S&P 500 / strategy.com)

(MSTR was one of the best-performing stocks of 2024 and the company meets all of the eligibility requirements for inclusion in the S&P 500 / strategy.com)

MSTR was one of the best-performing stocks in 2024. The company currently holds 636,505 BTC worth nearly $71 billion at the time of writing. The stock has a market capitalization of just under $98 billion. To be included in the S&P 500, a firm must meet the following criteria:

- The company must be domiciled in the U.S.

- Market capitalization must equal or exceed $22.7 billion

- Monthly trading volume must be equal to or greater than 250,000 shares for each of the six months leading up to the inclusion date

- Liquidity ratio must exceed 75%

- Shares must be listed on a stock exchange such as the NYSE or Nasdaq

- Shares must in an eligible form, such as common stock

Strategy meets all of these requirements, and some bitcoiners say MSTR’s inclusion on Friday is not only likely, but also paradigm-shifting. “This isn’t just another index shuffle,” said Adam Livingston, author of The Bitcoin Wizard. “It is the moment where every 401K, robo-advisor, and pension fund accidentally ends up hodling bitcoin.”

You May Also Like

Ethereum price enters a low-risk phase as open interest falls 50% since August

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!