Ethereum Price is Overheated Due to New Holders Hitting 5-Month High

Ethereum continues to struggle near the $3,000 level as repeated recovery attempts lose momentum. ETH trades just below this psychological barrier, reflecting cautious sentiment.

While investor interest is rising, on-chain activity remains muted. This imbalance is raising concerns that Ethereum’s price may be overheating without sufficient network usage to sustain gains.

Ethereum Holders Are Rising

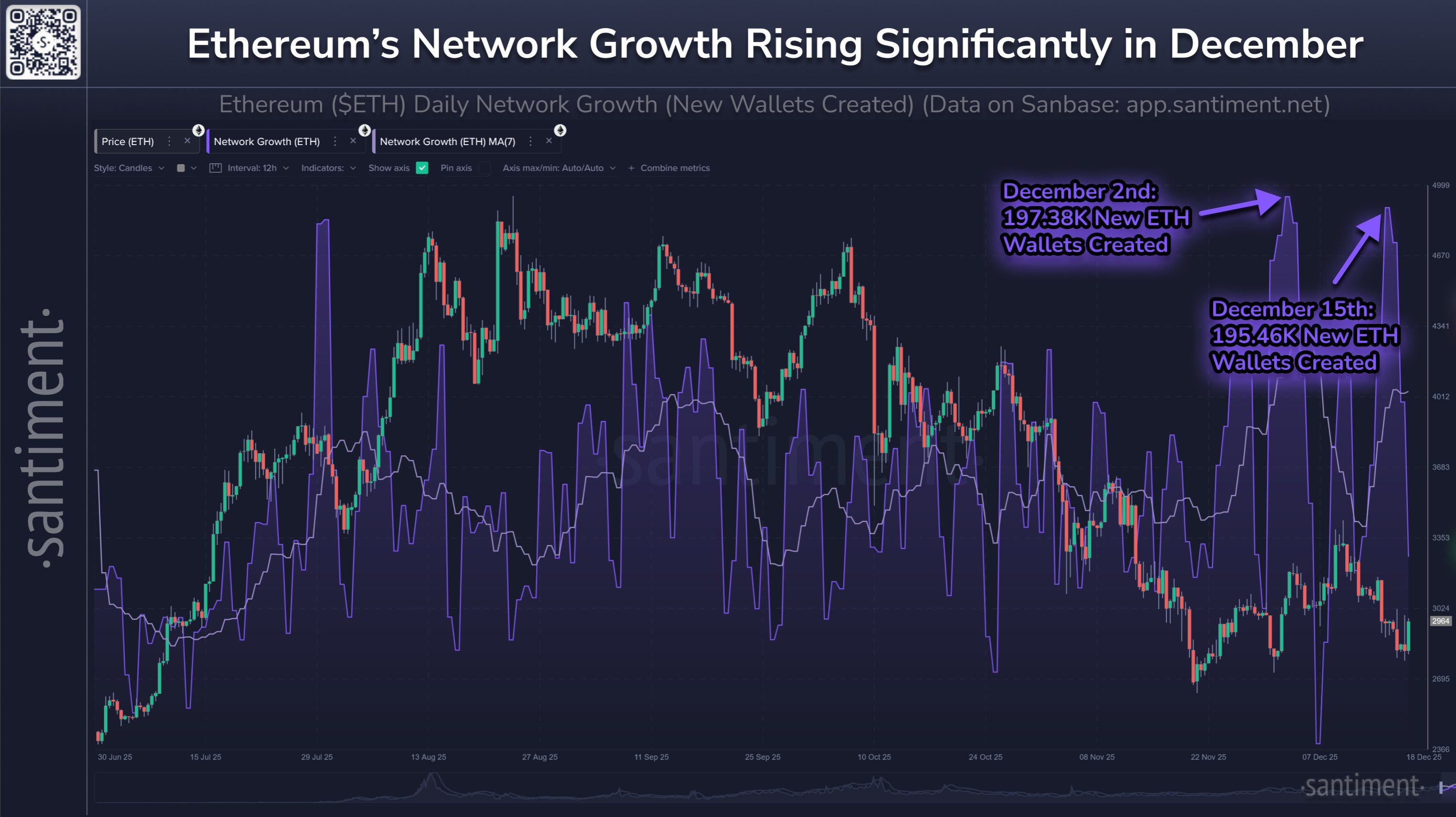

Ethereum is recording a steady rise in new wallet creation. The network now averages about 163,000 new addresses per day. This compares with roughly 124,000 daily additions during July, previously considered a peak period for network growth.

The increase highlights strong investor curiosity around Ethereum despite weak price performance. Growing wallet creation suggests demand for exposure remains intact. However, new addresses alone do not guarantee price strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Network Growth. Source: Santiment

Ethereum Network Growth. Source: Santiment

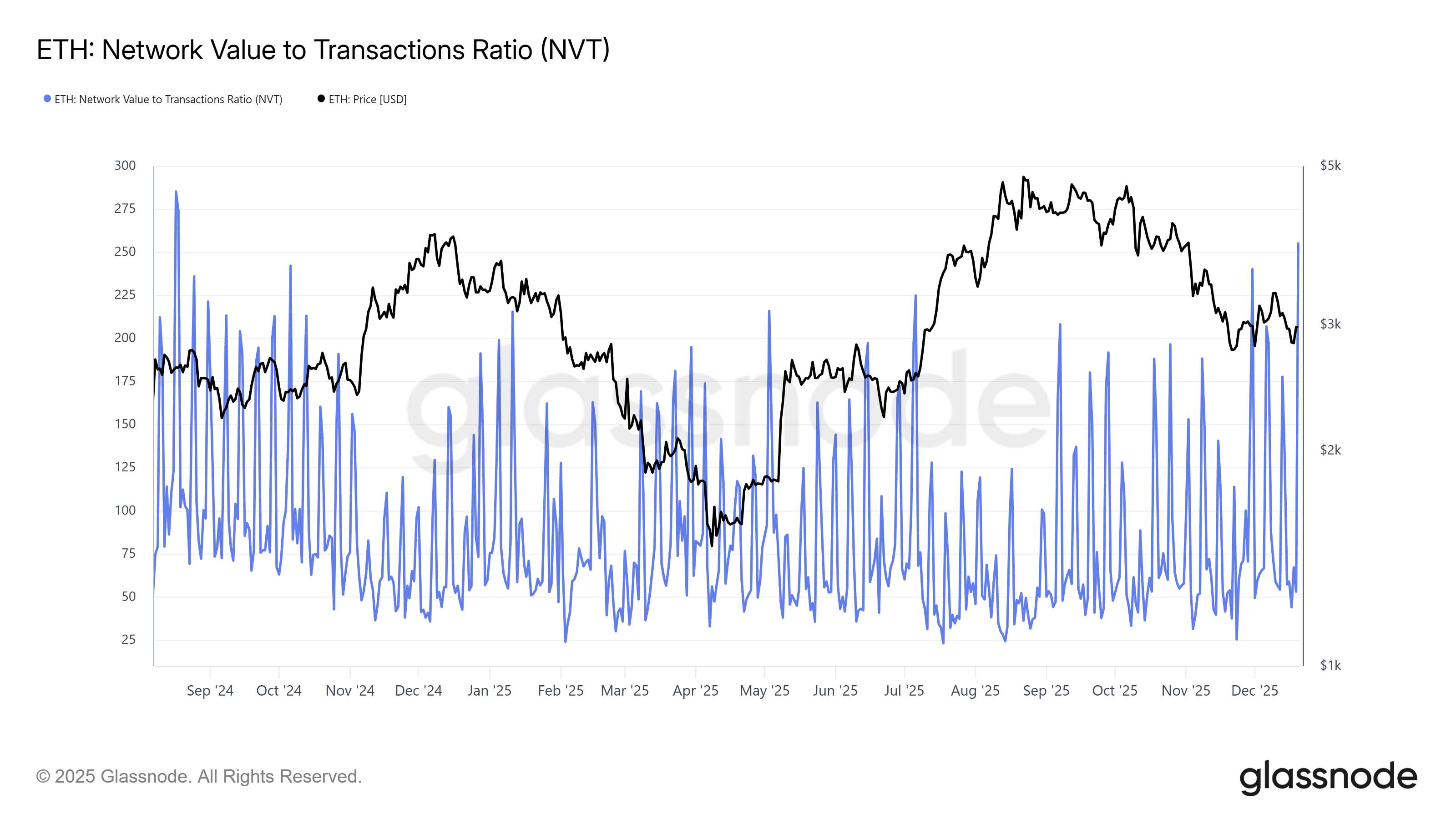

Macro indicators present a mixed picture. Ethereum’s network value-to-transactions ratio is rising sharply. The indicator currently sits at a 16-month high, signaling potential overheating conditions.

A high NVT ratio suggests market valuation is growing faster than transaction activity. Optimism around recovery appears to be driving interest, but real usage has yet to follow. Without increased on-chain activity, price advances risk stalling as valuation outpaces fundamentals.

Ethereum NVT Ratio. Source: Glassnode

Ethereum NVT Ratio. Source: Glassnode

ETH Price Is Yet To Find Strength To Escape

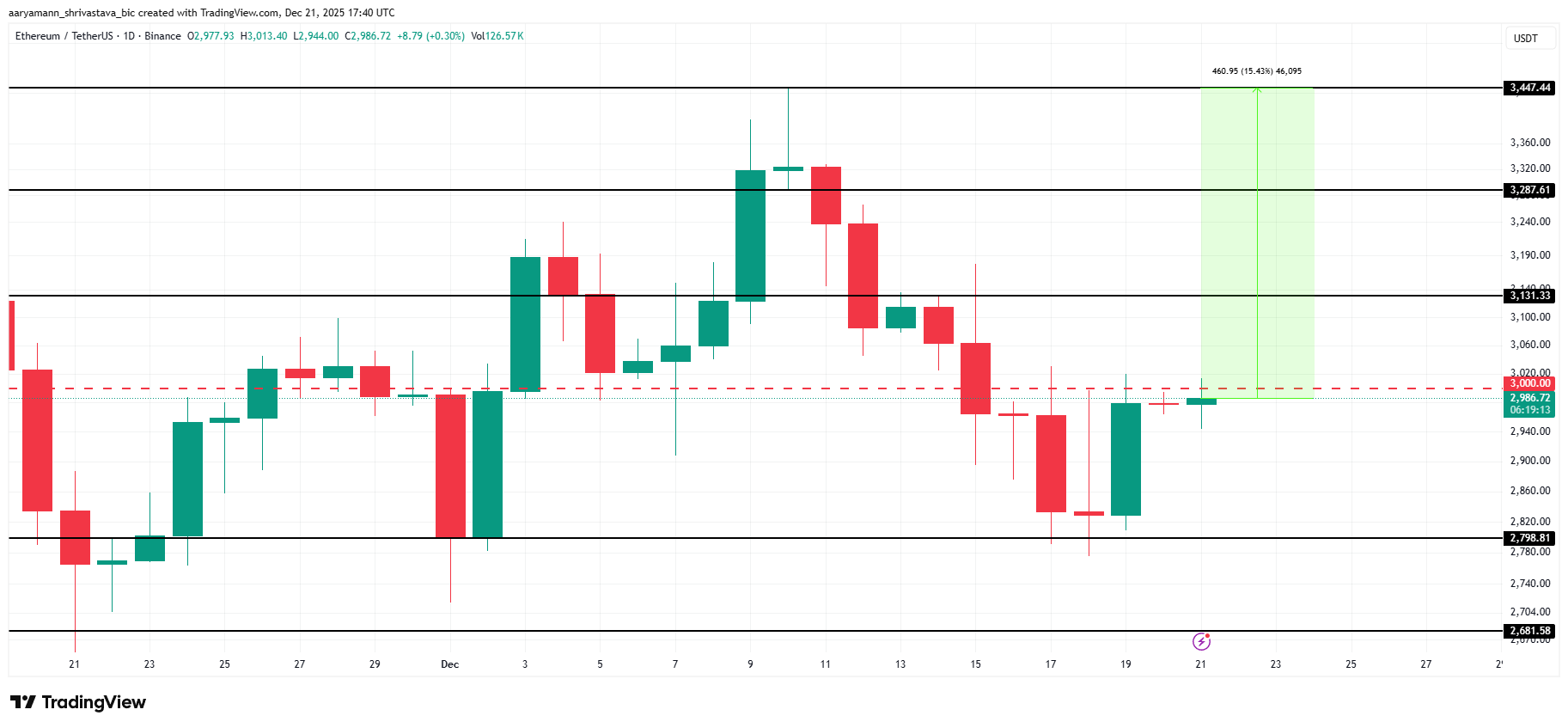

Ethereum trades near $2,986 at the time of writing, sitting just below the $3,000 resistance. This level has been tested repeatedly in recent sessions. Failure to break above it has reinforced caution among traders watching for confirmation.

ETH may continue consolidating below $3,000 or briefly breach it without holding support. If transaction activity remains weak, downside pressure could return. In that case, the $2,798 support may be tested again, reflecting unresolved macro imbalances.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

Improving conditions could shift the outlook. A rise in transaction volume would help Ethereum secure $3,000 as support. Holding that level could open a path toward $3,131. A sustained break beyond this barrier would invalidate the bearish thesis and allow ETH to target $3,287, restoring confidence.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Kalshi BNB Deposits: A Game-Changer for Crypto Prediction Markets