Here’s Cardano (ADA) Price If Bear Market Continues Throughout the Whole 2026

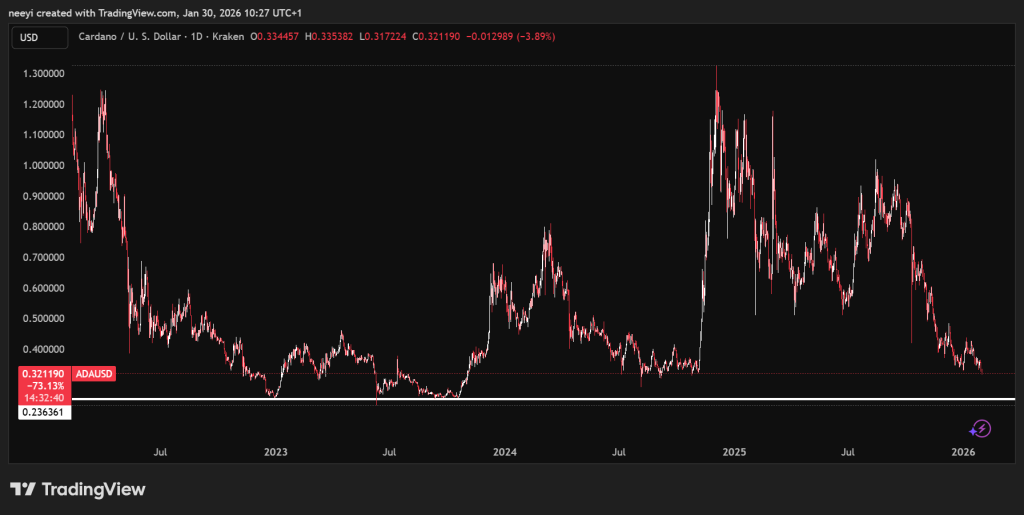

Cardano price has already endured a deep correction, and the current market structure leaves little room for optimism if bearish conditions persist. ADA price dropped more than 70% from the December 2024 peak near $1.3. That decline deepened when measured from the all-time high around $3.

Today, Cardano trades close to $0.3. That positioning matters because extended bear markets tend to pressure large Layer 1 assets longer than expected.

ADA Price Chart

ADA Price Chart

Bear markets rarely move in straight lines. Cardano price followed that pattern as volatility faded and directional conviction weakened. Large smart contract platforms often suffer during these phases due to reduced capital rotation and weaker demand for long-duration assets. ADA price now trades far below historical averages, which places it in a zone where patience replaces excitement. What could ADA be worth in 2026 if the bear market elongates?

Cardano Price Likely Tests Historical Support Near $0.2

A prolonged bearish environment often forces assets back toward prior cycle bases. Cardano price formed a significant low near $0.2 after the 2020 to 2021 rally. That zone remains one of the strongest technical reference points on the chart.

If ADA price revisits that region, consolidation could dominate for an extended period. Short dips below support may occur. Recoveries back above support could follow. This tug of war often defines late-stage bear markets as buyers and sellers contest long term value.

The current structure also shows that downside space looks smaller than upside potential. Cardano price already sits far below historical peaks. That imbalance supports the case for prolonged range trading instead of aggressive collapse.

Worst-Case Scenario: If Cardano Price Loses Long-Standing Support

A more severe outcome exists if the $0.2 level fails decisively. Under that condition, ADA price could fall toward regions last seen around 2020. A move into the $0.09 area becomes possible during extreme market stress.

ADA Price Chart

ADA Price Chart

Such a decline would depend on broader macro pressure and any Cardano-specific setbacks. Extended weakness across the crypto market could amplify that risk. Loss of confidence in large Layer 1 platforms would also add pressure.

Best Case Outcome If Cardano Narrative Gains Strength During 2026

Bear markets do not erase all upside potential. Certain narratives still experience sharp moves during difficult cycles. Cardano belongs to the research-driven smart contract blockchain narrative. That positioning can attract interest during periods where market focus shifts toward infrastructure and long-term development.

If narrative strength improves, ADA price could stage rallies even within a bearish environment. Moves toward $0.8 remain possible under favorable conditions. A sustained push above $1 would likely require broad positive sentiment across the crypto market.

Read Also: XRP Price at $100? David Schwartz Says the Market Doesn’t Buy That Story

Some other factors can also support an upward move; they include the project’s development plan for 2026. Cardano development plans for 2026 center on scalability, governance maturity, and expanded use cases. If they take proper shape, they can support price growth.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Here’s Cardano (ADA) Price If Bear Market Continues Throughout the Whole 2026 appeared first on CaptainAltcoin.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

US regulators move toward unified crypto oversight as sec project crypto gains CFTC support