DePIN Isn’t Dead — It’s a $10B Revenue-Driven Market, Messari Says

- DePIN token prices remain depressed, with most projects launched between 2018 and 2022 still trading 94% to 99% below their all-time highs.

- On-chain revenue hit $72 million in 2025, signaling a shift toward sustainable business models with valuations now averaging a realistic 10–25x revenue.

- Top networks are proving real-world demand, with the sector’s $10 billion market cap increasingly driven by cost-efficient infrastructure rather than pure speculation.

The vast majority of DePIN token prices are still crushed, but some networks are starting to show real business traction.

Messari says most DePIN tokens launched in 2018–2022 remain 94%–99% below their all-time highs. That’s the speculative premium evaporating.

The Leading DePINs are now real, profitable, and growing onchain businesses, and they’re trading at prices that imply little chance of survival, let alone success. The best DePIN tokens today provide exposure to next-gen infrastructure businesses that have proven user demand, driven by cost and speed advantages.

Messari

Messari

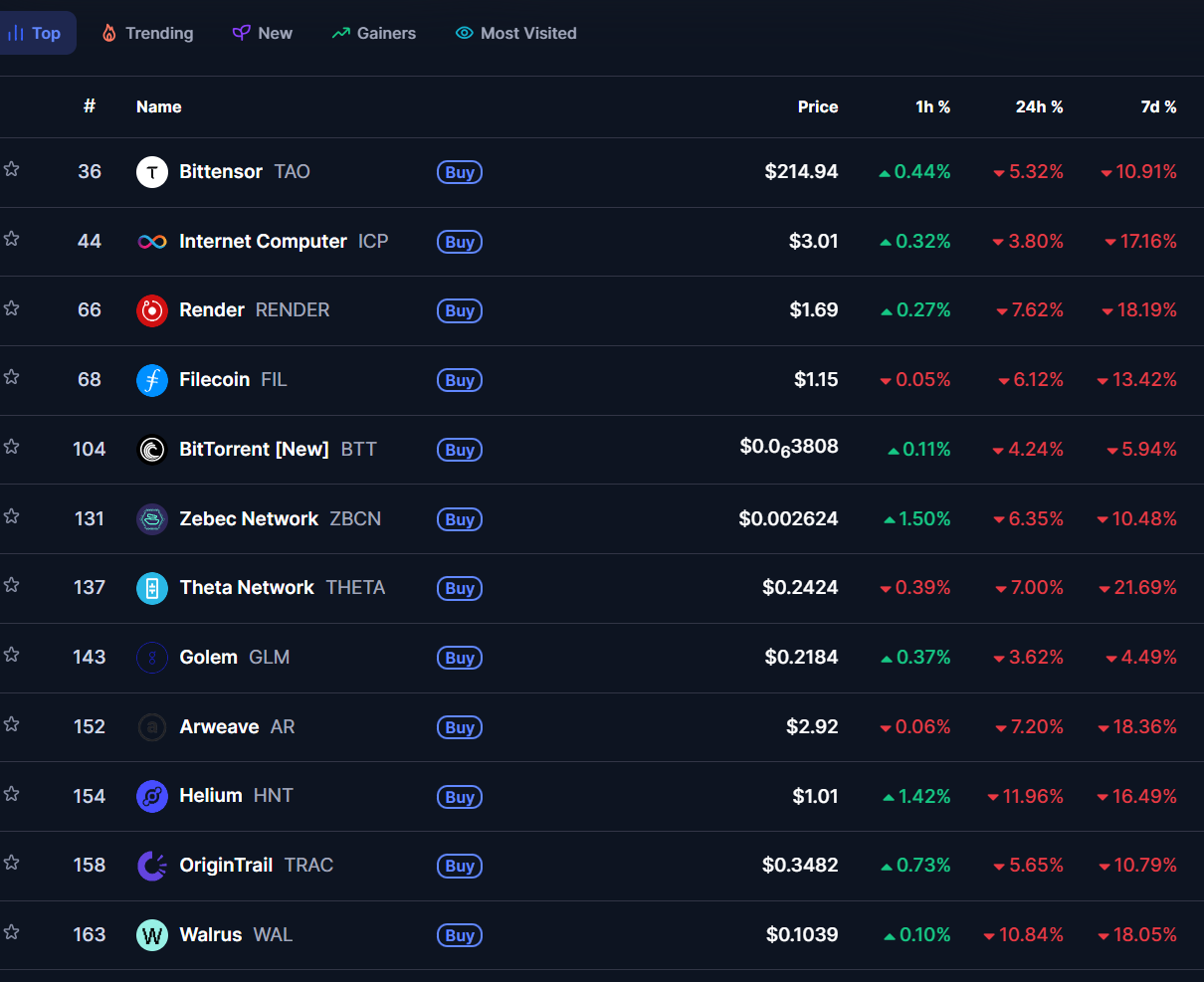

One simple look at the total market capitalisation of the DePIN sector on CoinMarketCap and they’re all pretty much in deep red, not just in the past seven days, but for several months now.

Top DePIN Tokens By Market Capitalization. Source: CoinMarketCap.

Top DePIN Tokens By Market Capitalization. Source: CoinMarketCap.

DePIN Sector Still Generating Revenue

Yet the sector is still producing measurable activity. About US$10 billion (AU$15.3 billion) in circulating market cap and roughly US$72 million (AU$110 million) in on-chain revenue in 2025.

DePIN (decentralised physical infrastructure networks) can be summarised as crypto-coordinated hardware. In them, networks pay users to deploy, operate and maintain real-world infrastructure.

Read more: Stablecoins Could Drain $500B From U.S. Banks, Standard Chartered Warns

But valuations have reset hard. In 2021, some DePIN projects traded at more than 1,000x revenue. Today, the top revenue-generating networks are closer to 10–25x revenue. That’s closer to how early-stage tech gets priced when investors care about business fundamentals and not just narratives.

Related: Australia’s Regulator Trains Its Sights on Crypto’s Regulatory Grey Zones

The post DePIN Isn’t Dead — It’s a $10B Revenue-Driven Market, Messari Says appeared first on Crypto News Australia.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

US regulators move toward unified crypto oversight as sec project crypto gains CFTC support