Bitcoin Reclaims $111K After Strategy and Metaplanet Go Bargain Hunting

The two public firms bought more than half a billion dollars’ worth of bitcoin on Labor Day, likely contributing to Tuesday’s recovery.

Institutional Buying Spree Sends BTC Back Above $111K

While some bemoaned bitcoin’s drop below $108K over the holiday weekend, Michael Saylor’s Strategy and Simon Gerovich’s Metaplanet took advantage of the cryptocurrency’s discounted price and acquired 4,048 BTC and 1,009 BTC, respectively, on Labor Day, for a combined cost of roughly $562 million. Those two purchases alone may have restored market confidence, buoying bitcoin back above $111K on Tuesday.

(Strategy and Metaplanet bought more than half a billion dollars worth of bitcoin on Labor Day / Michael Saylor on X)

(Strategy and Metaplanet bought more than half a billion dollars worth of bitcoin on Labor Day / Michael Saylor on X)

Today’s recovery is more evidence for what appears to be the end of bitcoin’s so-called “four-year cycle.” The digital asset has a programmed halving of bitcoin rewards to miners every 210,000 blocks or roughly every four years. The last 50% reduction was in April 2024. Typically, bitcoin rallies as it approaches the halving event, peaking shortly afterwards, before crashing and entering the “crypto winter” doldrums.

But after the U.S. Securities and Exchange Commission (SEC) approved the first wave of bitcoin exchange-traded funds (ETFs) last year in January, the familiar four-year cycle was interrupted by the sudden inflow of institutional capital, with BTC peaking in March before April’s programmed reduction that year, then remaining on a relatively steady upward trajectory ever since.

And now, with the rise of bitcoin treasury firms, companies that acquire large amounts of the digital asset to boost stock price and hedge against obsolescence, it seems the four-year cycle is all but a relic of the past. And Monday’s purchases by Strategy and Metaplanet, which likely contributed to bitcoin’s recovery today, further reinforce that theory.

“This is why the bitcoin 4-year cycle is over,” said Jason A. Williams, co-founder and general partner at crypto investment firm Morgan Creek Digital Assets. “Top 100 bitcoin treasury companies hold almost 1 million bitcoin.”

Overview of Market Metrics

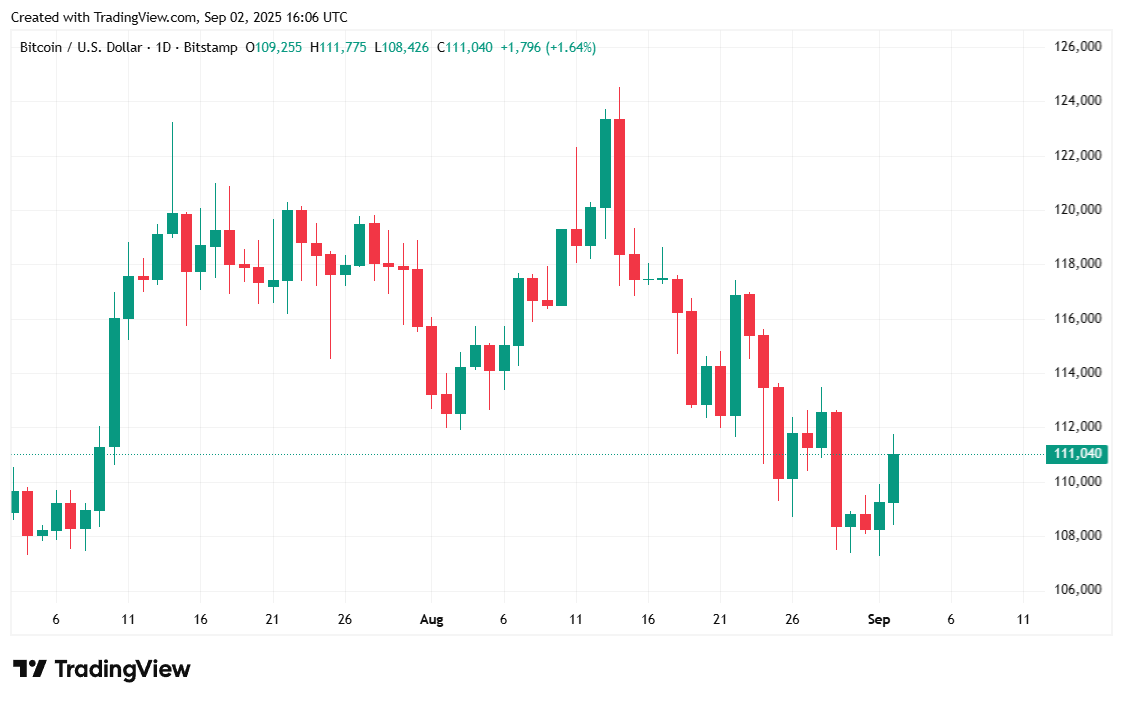

Bitcoin was priced at $111,035.88, up 2.06% for the day at the time of writing, according to Coinmarketcap. The cryptocurrency has been trading between $107,480.59 and $111,748.01 over the past 24 hours, and is also up 1.23% for the week.

( Bitcoin price / Trading View)

( Bitcoin price / Trading View)

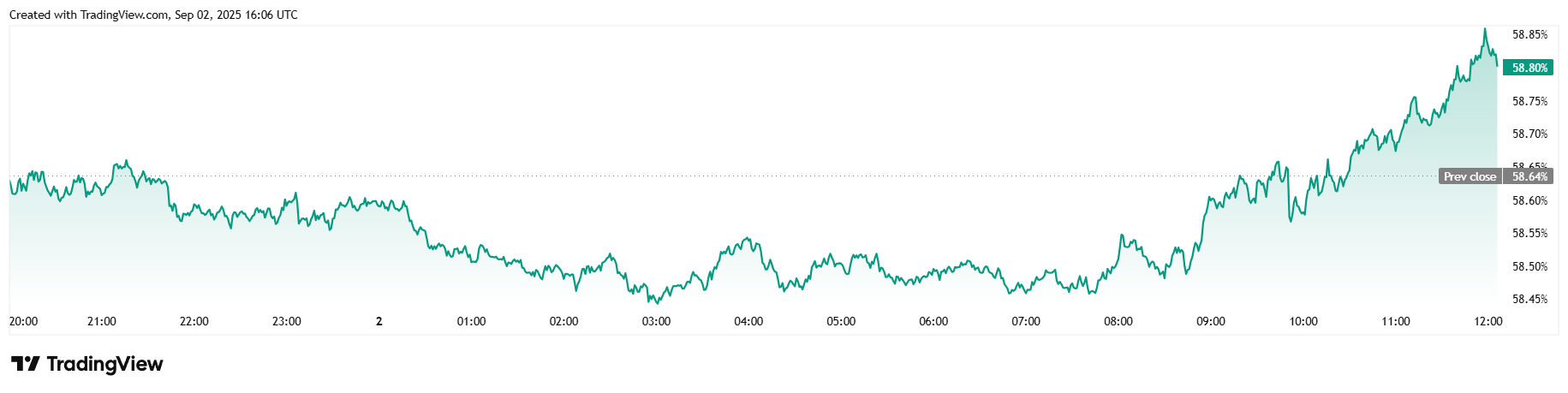

Trading volume reached $72.66 billion, up 16.88% since Labor Day. Market capitalization was also up 1.81% at $2.21 trillion. Bitcoin dominance climbed to 58.82%, up 0.30% over 24 hours.

( Bitcoin dominance / Trading View)

( Bitcoin dominance / Trading View)

Total bitcoin futures open interest for the day rose 2.35% to $81.92 billion, and bitcoin liquidations on Coinglass totaled $80.24 million over 24 hours. Liquidations were evenly split, with longs and shorts coming in at $39.50 million and $40.74 million, respectively. The split suggests a balanced sentiment among traders about the short-term future direction of bitcoin prices.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Memecoins drift lower as traders defend resistance zones