Downtrend Test for Cardano (ADA): Will Selling Pressure Intensify for a Deeper Slide?

- Cardano is currently trading in $0.35 range.

- ADA’s trading volume has jumped by over 96%.

Following a brief spike in the crypto market, the majority of the digital assets are attempting to escape the bear hold, with some green on charts. The assets like Bitcoin (BTC) and Ethereum (ETH) are hovering at $89K and $2.9K, respectively. Among the altcoin pack, Cardano (ADA) has recorded a drop of over 1.05%.

The asset opened the day trading at a high of $0.3606, and with the bearish shift, the price has moved down to a bottom range of $0.342. If the downtrend continues to gain traction, the ADA price would see more losses. As per CMC data, at the time of writing, Cardano traded within the $0.3562 range.

ADA’s market cap is staying at $12.75 billion, and the daily trading volume has increased by over 96.76%, reaching the $677.71 million mark. Furthermore, the Coinglass data has reported that the market has witnessed a $2.20 million Cardano liquidation during the last 24 hours.

More Losses Ahead or a Trend Reversal Incoming for Cardano?

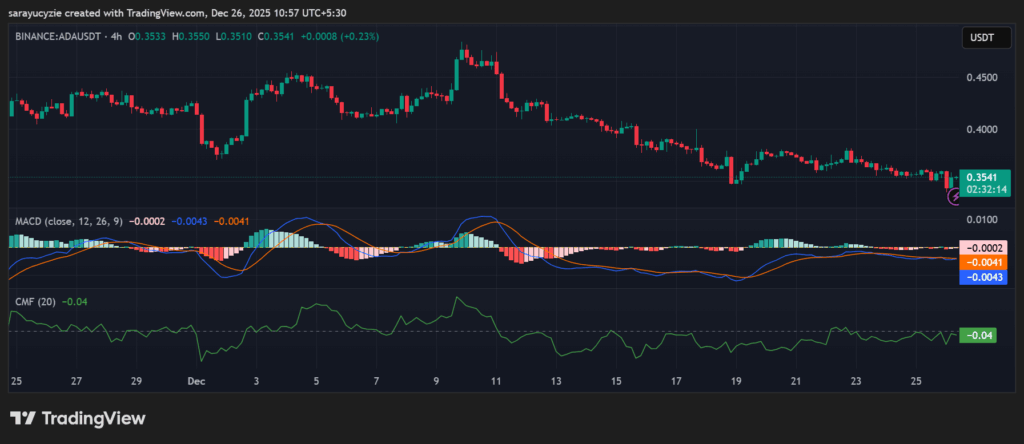

Cardano’s Moving Average Convergence Divergence (MACD) and signal lines are below the zero line, which shows bearish momentum. The trend is leaning downward. Unless the lines start crossing back above zero, the momentum may remain weak.

ADA chart (Source: TradingView)

ADA chart (Source: TradingView)

Besides, the Chaikin Money Flow (CMF) indicator is found at -0.04 hints at slight selling pressure in the ADA market. With this negative value, money is flowing out, and it may experience sideways or a slight downward movement unless buying interest comes in.

Moreover, the asset is in a neutral-to-slightly bearish territory, as the daily Relative Strength Index (RSI) is at 44.12. ADA is either strongly overbought or oversold, but could tip lower if bearish momentum continues. Cardano’s Bull Bear Power (BBP) value of -0.0049 suggests bearish sentiment in the market. The magnitude is very small, with a slight tilt toward sellers. The price could remain range-bound unless stronger buying or selling emerges.

The 4-hour price chart of the asset exhibits a negative outlook. If the downtrend strengthens, the Cardano price might slip and test the support at around $0.3542. Further loss could trigger the death cross to emerge and send the price below the $0.3520 range.

On the upside, assuming Cardano’s price reversal and the formation of a golden cross, the bulls might run toward the $0.3582 resistance. With a steady upside pressure of the asset, it could likely push the price up to its former highs above the $0.3610 level.

Top Updated Crypto News

Bitcoin ETFs Bleed $825M as US Sellers Dominate Holiday Trading

You May Also Like

Will US Banks Soon Accept Stablecoin Interest?

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse