Mastering Discipline: How DAT Treasuries Can Survive Any Market Condition

Ensuring the sustainability of corporate crypto treasuries hinges on robust governance and disciplined management, according to Deng Chao, CEO of HashKey Capital. In an exclusive interview, Chao emphasized that digital asset treasuries (DATs) can be durable investments when managed properly, but warned that lack of risk frameworks or poor diversification often leads to their downfall during volatile market cycles.

“Resilience stems from discipline,” he explained. “Digital assets are not inherently unsustainable; it’s the way they are managed that determines their longevity.” These insights come shortly after HashKey announced the launch of its $500 million DAT fund in Hong Kong, aiming to support Bitcoin- and Ethereum-based corporate treasuries through strategic deployment across onchain infrastructure, custody, and ecosystem services. The fund is designed to help institutional investors leverage digital assets beyond mere holdings, seeking to benefit from the growth of blockchain-enabled infrastructure.

Related: Bitcoin as a corporate treasury: Why Meta, Amazon and Microsoft all declined

DATs Versus ETFs: Complementary Financial Tools

Chao distinguished between DATs and exchange-traded funds (ETFs), viewing them as complementary rather than competing. While ETFs provide broad exposure to retail and mainstream investors, DATs are tailored for corporations integrating crypto into their core operational strategies.

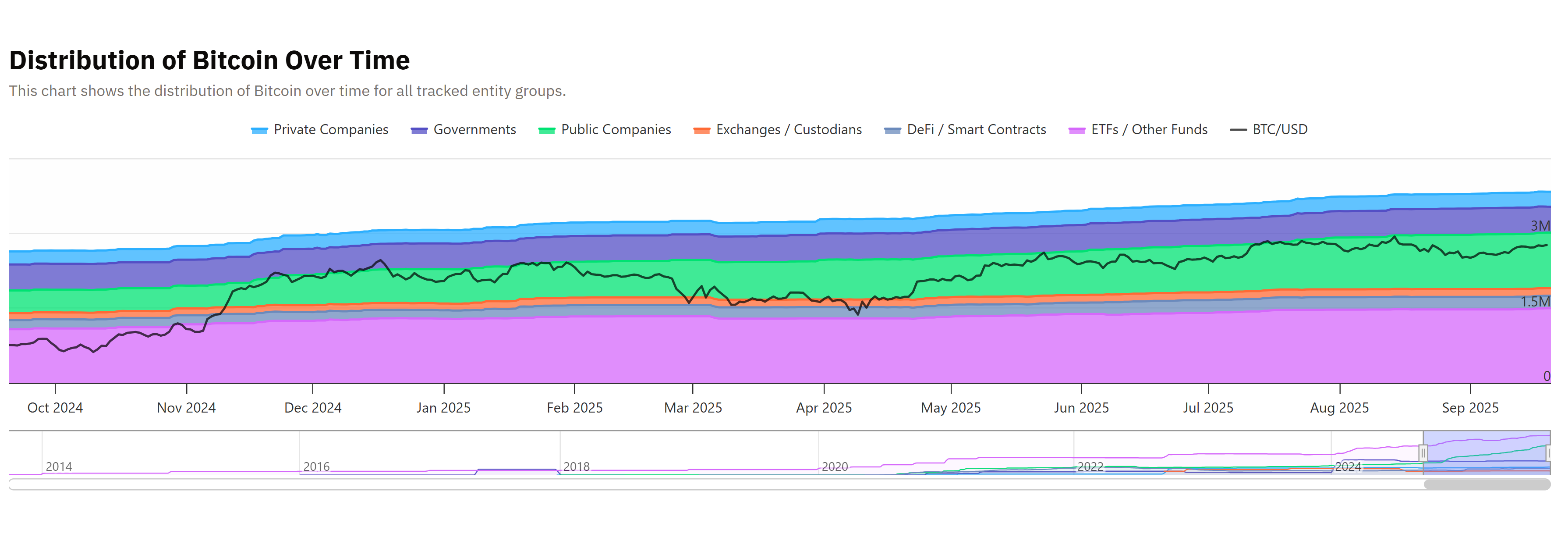

Data shows that spot Bitcoin ETFs hold a combined $152.31 billion—representing about 6.63% of Bitcoin’s total market cap—while public companies collectively hold over 1.1 million Bitcoin, worth approximately $128 billion, on their balance sheets.

All entities holding Bitcoin. Source: BitcoinTreasuries.NET

All entities holding Bitcoin. Source: BitcoinTreasuries.NET

Chao noted that many corporate treasuries have been burned by rigid investment structures or extreme volatility. HashKey’s DAT fund mitigates these issues by allowing regular subscriptions and redemptions, with diversified exposure to Bitcoin and Ethereum to curb concentration risks.

HashKey plans to focus on Bitcoin and Ethereum ecosystems—seen as central drivers of liquidity and innovation—covering areas like custody, payments, staking, and regulated stablecoin infrastructure. Although launched in Hong Kong, the firm intends to extend its reach to markets in the US, Japan, Korea, Southeast Asia, and the UK, emphasizing a truly global investment approach.

Addressing Institutional Skepticism in Crypto

Chao acknowledged the skepticism within traditional finance regarding digital assets, citing concerns over security, volatility, and accounting practices. He emphasized that misconceptions act as significant barriers to broader institutional adoption, despite the increasing interest in integrating cryptocurrencies into mainstream finance.

Looking forward, HashKey’s leadership is particularly optimistic about the growth of tokenized real-world assets (RWAs), institutional over-the-counter (OTC) markets, and the development of onchain financial products. He predicts that these innovations will expand the investment universe and facilitate the flow of capital at scale, signifying a shift from fragmented crypto activity toward a comprehensive digital financial ecosystem.

This article was originally published as Mastering Discipline: How DAT Treasuries Can Survive Any Market Condition on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

The Realistic Path To A $5 Milestone

Unveiling The Realistic Trajectory For BTC’s Remarkable Journey

Wormhole token soars following tokenomics overhaul, W reserve launch

Wormhole’s native token has had a tough time since launch, debuting at $1.66 before dropping significantly despite the general crypto market’s bull cycle. Wormhole, an interoperability protocol facilitating asset transfers between blockchains, announced updated tokenomics to its native Wormhole (W) token, including a token reserve and more yield for stakers. The changes could affect the protocol’s governance, as staked Wormhole tokens allocate voting power to delegates.According to a Wednesday announcement, three main changes are coming to the Wormhole token: a W reserve funded with protocol fees and revenue, a 4% base yield for staking with higher rewards for active ecosystem participants, and a change from bulk unlocks to biweekly unlocks.“The goal of Wormhole Contributors is to significantly expand the asset transfer and messaging volume that Wormhole facilitates over the next 1-2 years,” the protocol said. According to Wormhole, more tokens will be locked as adoption takes place and revenue filters back to the company.Read more