BNB News: FUD Continues For CZ As Remittix Tops Altcoin Charts In February

As BNB news remains dominated by fresh waves of FUD surrounding Changpeng Zhao, attention is shifting across the altcoin market. While uncertainty clouds sentiment around Binance, capital is quietly rotating elsewhere.

February’s charts tell a different story with Remittix emerging as a breakout performer. This contrast highlights how execution and utility are beginning to outweigh headlines in today’s crypto market.

Remittix

Remittix

BNB News Swirls As Binance Pushes Back Against Insolvency Claims

Fresh BNB news has reignited debate around Binance as speculation and counterclaims swirl following the October market flash crash. Binance swiftly denied rumors about a possible lawsuit against an X user who alleged that Binance was insolvent and responsible for the liquidation incident on October 10. Binance said the cease-and-desist letter circulating online was fake. The company warned users to be cautious of false documents. It also warned against misleading claims.

It became even worse when other influential commentators entered the fray. One widely followed account claimed to have verified a separate instance of Binance’s legal team contacting a user over posts tied to the “10/10” event. That contrast has kept Binance Coin news firmly in the spotlight, even as Changpeng “CZ” Zhao dismissed the allegations as coordinated FUD. Despite the noise, BNB price today has shown little reaction, reflecting a market that appears more focused on data than headlines.

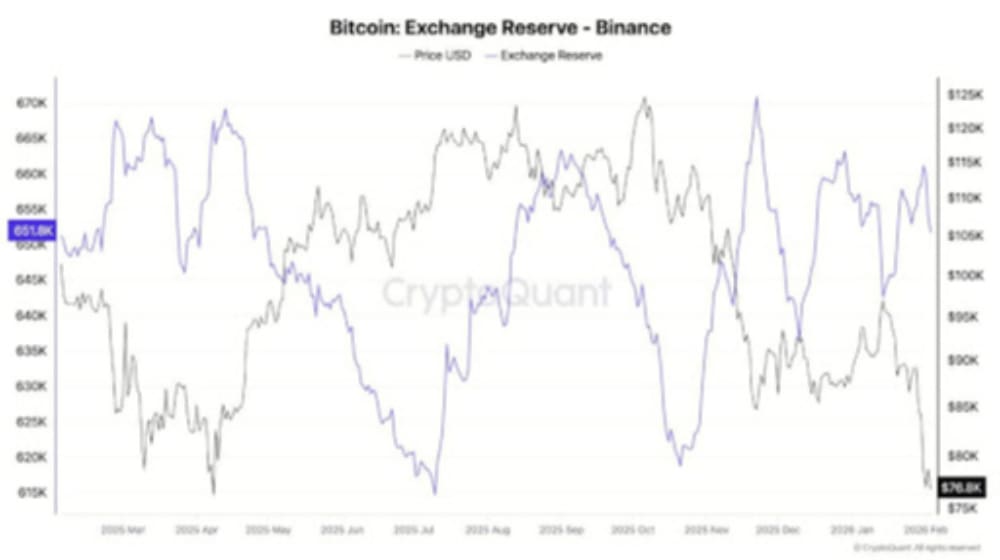

bitcoin Excchan ge reserve – Binance

bitcoin Excchan ge reserve – Binance

On-chain metrics paint a calmer picture. Blockchain analytics firm CryptoQuant reported no signs of stress, noting Binance holds roughly 659,000 BTC in reserves with minimal reserve movement. Data from DeFiLlama shows strong inflows, including over $586 million in a single day and $1.3 billion across the week. As the BNB price prediction models digest these numbers, analysts opine that the disconnect between sentiment and fundamentals is clear.

Binance has blamed the crash of October on macro pressure, leverage and congestion in the Ethereum network. However, critics still suspect internal systems. For now, Binance Coin price action suggests traders remain unconvinced by insolvency fears, even as FUD lingers and attention briefly shifts toward fast-rising names like Remittix at the edges of the altcoin charts.

February Altcoin Leaders Highlight Remittix Growth

As BNB news stays dominated by ongoing FUD around CZ and Binance, capital is quietly rotating toward projects showing real traction. One of the clearest beneficiaries of that shift is Remittix. While Binance Coin headlines focus on disputes and narratives, Remittix is climbing altcoin charts by executing on a PayFi vision built for everyday use. Investors scanning for the best crypto to buy now are paying attention to delivery, not noise.

Remittix is building a full crypto-to-fiat payments ecosystem that connects blockchain speed with real banking rails. Users are able to transfer value worldwide without additional costs, delays and complicated middlemen. The project targets a $19 trillion payments market.

Remttix will also address the needs of freelancers, businesses, and individuals who want simple, fast cross-border transfers. That utility-first approach explains why Remittix keeps gaining momentum as other large-cap tokens battle sentiment issues.

February has been especially strong. Remittix has crossed the $20M funding milestone, confirmed BitMart as its first centralized exchange listing, and pushed past $22M with LBank announcing an upcoming RTX listing.

The Remittix Wallet is already live on the Apple App Store with Android support underway. The full crypto-to-fiat platform is also set to launch on February 9th, 2026. CertiK has verified the team and ranked Remittix #1 among pre-launch tokens, reinforcing trust at a critical stage.

Why Remittix Is Gaining Traction

- BitMart confirmed as first CEX listing with LBank listing announced

- Live iOS wallet with crypto-to-fiat platform launching February 9th, 2026

- 15% referral rewards paid in USDT and claimable every 24 hours

- CertiK verified team and #1 ranked pre-launch token

- Limited-time 300% bonus extended based on popular demand

Momentum is accelerating as urgency builds. With exchange listings, a live wallet and a referral program that pays real USDT, Remittix is positioning itself as a February standout while larger names struggle with headlines. It’s execution like this that keeps Remittix near the top of altcoin watchlists.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

You May Also Like

What Does Market Cap Really Mean in Crypto — and Why Australians Care

The Manchester City Donnarumma Doubters Have Missed Something Huge