XRP Price: Trade War Relief Sparks Recovery as Derivatives Flash Green

TLDR

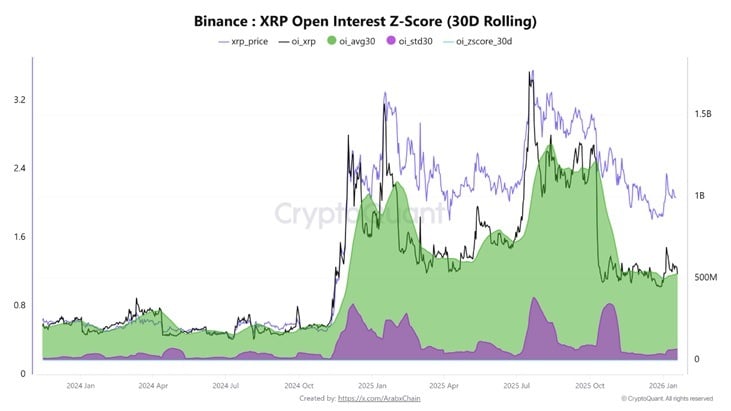

- XRP open interest on Binance climbed to $566.48 million, surpassing the 30-day average of $528.84 million, showing cautious accumulation among traders.

- The 30-day standard deviation of open interest reached $65.7 million, its highest level since November, indicating potential price expansion ahead.

- XRP snapped a seven-day losing streak after President Trump withdrew his 10% tariff threat on eight European NATO nations.

- Ripple CEO Brad Garlinghouse defended the Market Structure Bill at the World Economic Forum, calling for “clarity over chaos” in crypto regulation.

- Technical analysis shows XRP needs to break above $2.0 to confirm a bullish trend reversal, with medium-term targets at $3.0.

XRP price rebounded on January 21 after President Trump announced a framework agreement on Greenland, ending threats of tariffs against European NATO nations. The token gained 3.13% to close at $1.9463, reversing part of the previous day’s 4.86% decline.

The rally followed a seven-day losing streak that saw XRP drop 12% to $1.8489. Trump’s announcement removed immediate trade war concerns between the US and EU.

XRP Price

XRP Price

Trump stated the tariff framework represented “a great one for the United States of America, and all NATO Nations.” NATO Secretary General Mark Rutte indicated Europe would step up defense spending, easing tensions.

Blockchain data firm Cryptoquant released an analysis on January 20 examining XRP derivatives activity on Binance. The data showed open interest rose to approximately $566.48 million, exceeding the 30-day moving average of $528.84 million.

The analysis noted traders are taking “a cautious approach” rather than rushing into positions. This steady accumulation differs from the rapid leverage expansion seen in late 2024 and mid-2025.

Volatility Signals Potential Price Movement

The 30-day standard deviation of open interest increased to around $65.7 million, reaching its highest point since November. This expansion in volatility often precedes price movements as traders position for future changes.

Source: CryptoQuant

Source: CryptoQuant

Despite increased open interest, leverage remains balanced. The Z-score stands at approximately 0.57, indicating the market has not entered extreme leverage territory. Cryptoquant characterized the current phase as “cautious accumulation with a gradual increase in risk.”

Ripple CEO Brad Garlinghouse addressed crypto regulation at the World Economic Forum. He pushed back against critics of the Market Structure Bill, arguing that no legislation is better than waiting for perfect legislation.

The US Senate Agriculture Committee plans to release its draft text on January 23, with a markup vote scheduled for January 27. The Senate Banking Committee previously postponed its markup vote after Coinbase withdrew support.

Technical Levels and Market Structure

XRP remains below its 50-day and 200-day exponential moving averages, currently at $2.0537 and $2.3035 respectively. The token needs to break above $2.0 to signal a near-term bullish trend reversal.

Support levels sit at $1.85, $1.75, and $1.50. A sustained drop below $1.85 would invalidate the bullish structure and signal a bearish reversal.

Analysts project a medium-term price target of $3.0 over four to eight weeks if current conditions hold. A longer-term target of $3.66 applies to an eight to twelve week timeframe.

XRP-spot ETF demand continues to support price action. The resolution of the SEC vs. Ripple case in 2025 enabled increased XRP adoption across traditional finance applications.

The Bank of Japan’s monetary policy decision on January 23 and US economic data releases will influence near-term price action. XRP-spot ETF flows and progress on the Market Structure Bill remain key factors for the token’s trajectory.

The post XRP Price: Trade War Relief Sparks Recovery as Derivatives Flash Green appeared first on CoinCentral.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

XAG/USD retreats toward $113.00 on profit-taking pressure